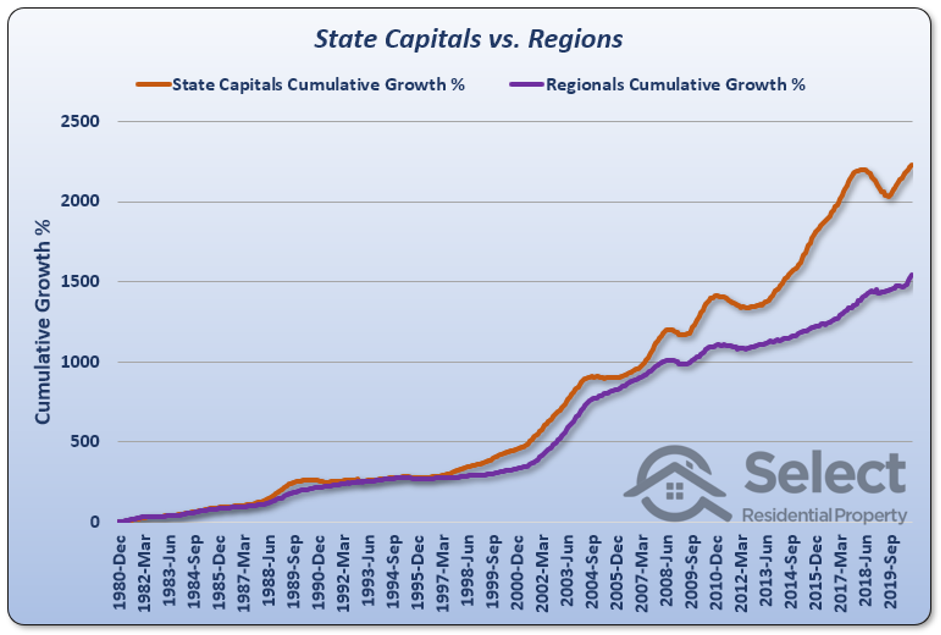

State Capitals vs. Regionals

Over the last 40 years, state capitals have outperformed regional markets.

However, whenever I look at a long-term growth chart like this, comparing two markets, I almost always see pinch-points.

The longer the time-frame, the more frequent are these pinch-points. Quite often one market will take the lead and the other will not only catch up, but overtake. And then the next decade they trade places again.

Trading Places

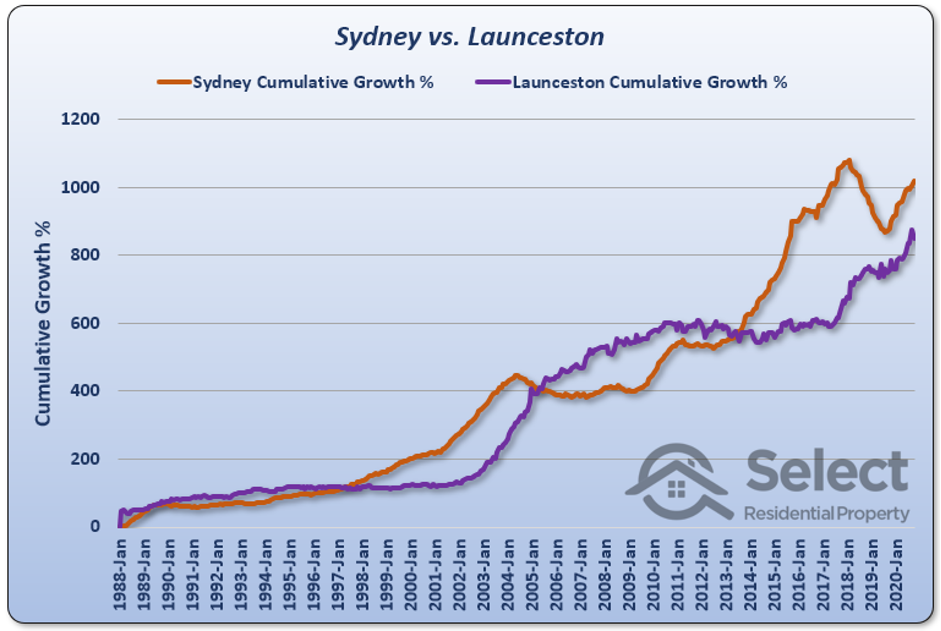

The following example compares Sydney against Launceston from 1988 (earliest records).

You’ll notice that Launceston gets off to a flyer, but then Sydney catches up and overtakes. The lead changes 3 times in 32 years.

Ripple Effect

This repeating pattern of divergence and convergence is due to the ripple effect. You can read more about that concept here:

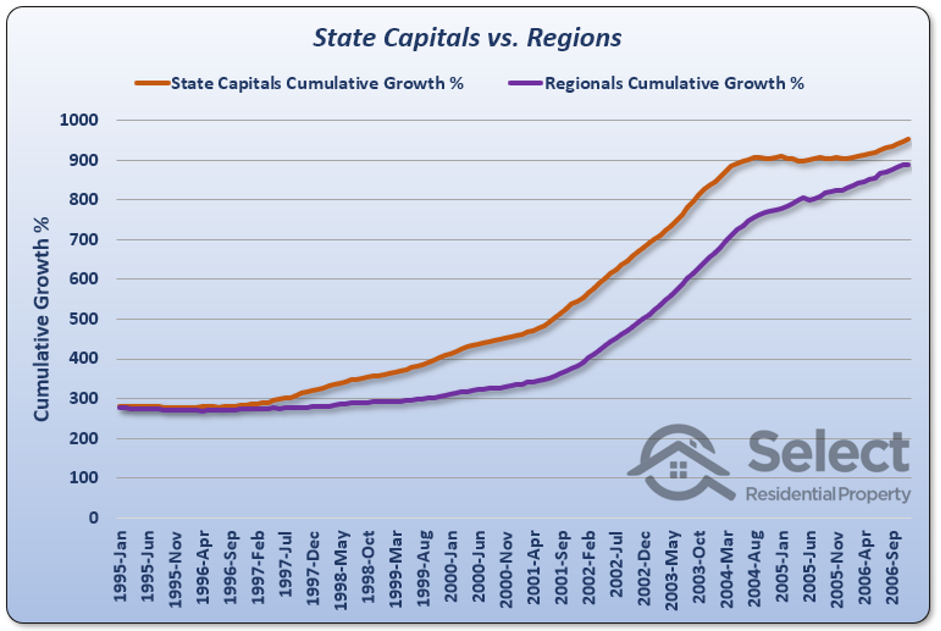

In a nutshell, no two property markets can continue to diverge indefinitely. One cannot continue to draw away from the other forever. After a while, the cheaper market appears as much better value to buyers. They can justify the massive price difference. Due to this ripple effect, there’s a tendency for all markets to eventually have very similar growth rates.

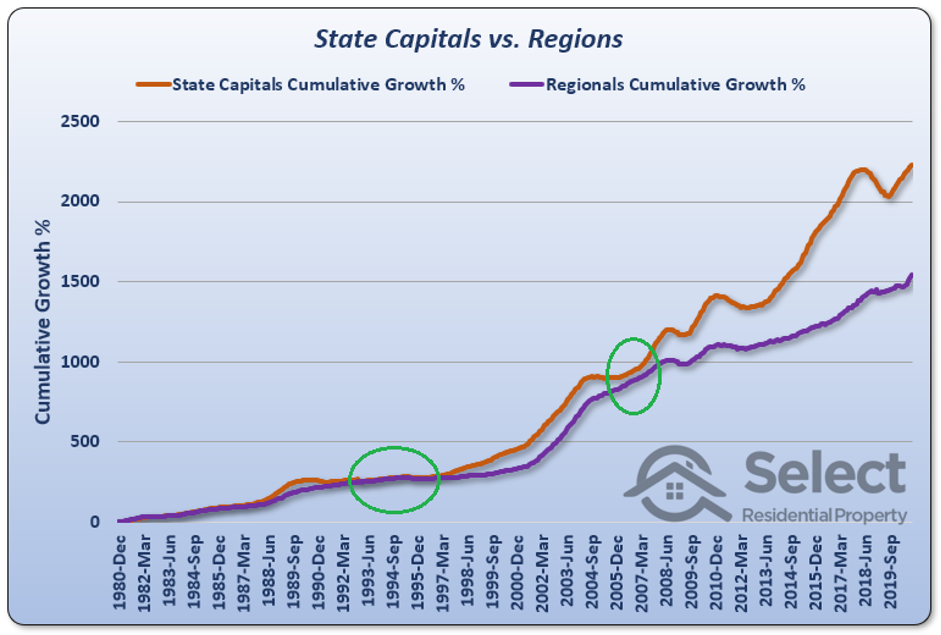

However, over the short-term we get these divergences. They look pretty small to the left of the chart. But that’s just an illusion due to the nature of compound growth. Back in the day, these divergences were significant. Here’s the same chart zoomed in to a portion in the middle.

Conclusion

We can’t conclude that state capitals will always outperform regional markets. History shows this has not always been the case.

And we can’t say that in the long-run, state capitals will continue to distance themselves above regional markets. The ripple effect suggests that won’t happen – or at least not significantly.

We also can’t assume that regional markets will catch right up to state capitals. They may close the gap but never meet the state capitals.

A relatively safe assumption is that regional markets are under-valued relative to state capitals right now. Although the gap could widen, that seems unlikely given the demand to supply ratio for many regional markets around Australia has risen strongly in recent times.

On top of this, there’s been a growing trend towards work-from-home and online businesses that don’t need a shop-front or office in the CBD. The pandemic may have accelerated that trend.

If Australians start leaning more towards lifestyle than career and if the affordability differences widen further, regional markets may be a great option for investors right now and for a good while to follow.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data