Introduction

Is there always a place an investor can buy to get double-digit growth, 10% or more per annum?

Technically, yes. There has never been a time in the last 30 years where no suburb had double-digit growth.

Significant Urban Areas (SUA's)

But growth calculations are misleading for small markets like suburbs. SUAs are more reliable and help narrow down the search.

The Australian Bureau of Statistics lists about 100 SUAs. Sydney is the largest. Kingaroy in QLD is the smallest, with a population around 10,000.

SUA Double-Digit Growth

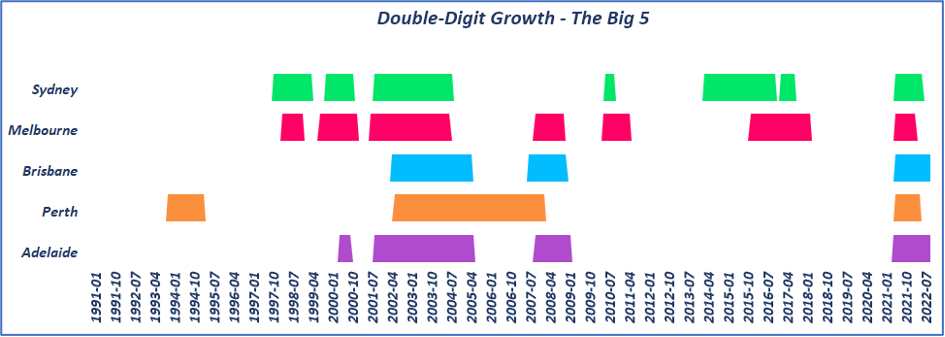

The following chart shows the periods over the last 30 years when there was double-digit growth in the 5 largest SUAs.

All bars have the same height if the SUA had 10% pa growth or more. If the SUA had less than 10% growth, the chart shows white space. It is all or nothing.

This suggests that if investors are restricted to the big smoke, there may be times of slim pickings.

Regions

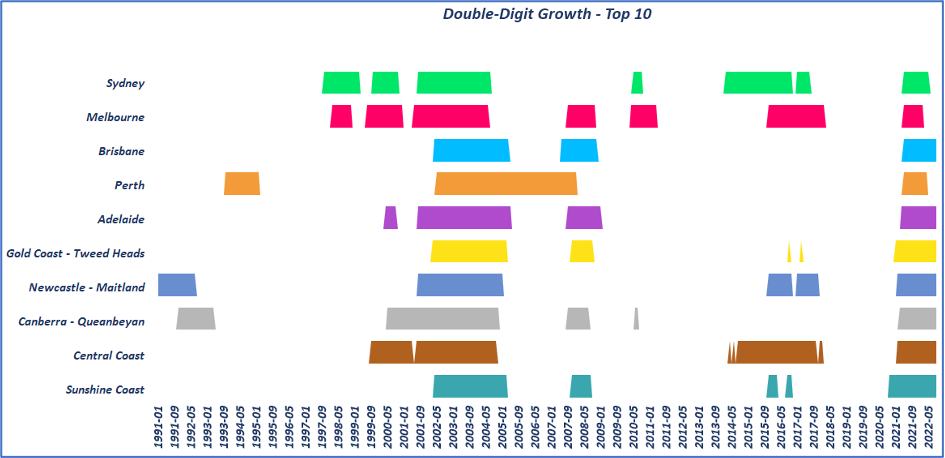

What if we are comfortable choosing from a broader range of cities…

It is clear from this chart when the “national” growth surges happened:

· 2002-2005

· 2021-2022

It highlights how special the time was that we have just gone through.

But there are still some gaps where none of these 10 SUAs had double-digit growth.

Top 20

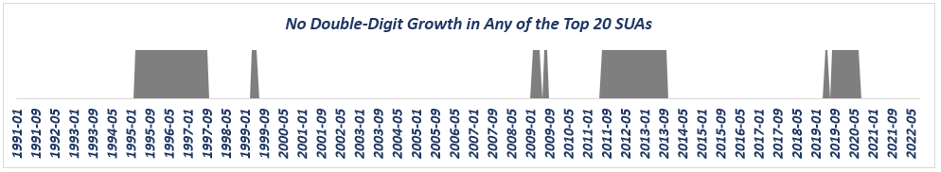

When viewing 20 SUAs, it is easier if the perspective is flipped. This next chart only shows periods in which there was no double-digit growth in any SUA.

80% of the time, there is at least one of the top 20 SUAs booming. But there are still a handful of periods without double-digit growth in any of the top 20 SUAs.

All SUA's

I could not find a single month in which no SUA recorded double-digit growth. Expanding the analysis to include all 101 SUAs, filled in all the gaps.

Conclusion

There is only 30 years of historical data analysed, but it does suggest there is always a “great” time to invest – somewhere.

The next question is, how can you pick the next SUA for double-digit growth? That will be next month’s article.

BTW, allocating money to an investment property that grows at only 5% pa is still better than leaving that money in the bank.

“Do yourself a favour and provide a renter somewhere to live”

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data