Introduction

Does the data support the “sky-falling” media headlines regarding interest rate rises?

What does the data show that the media might not be considering?

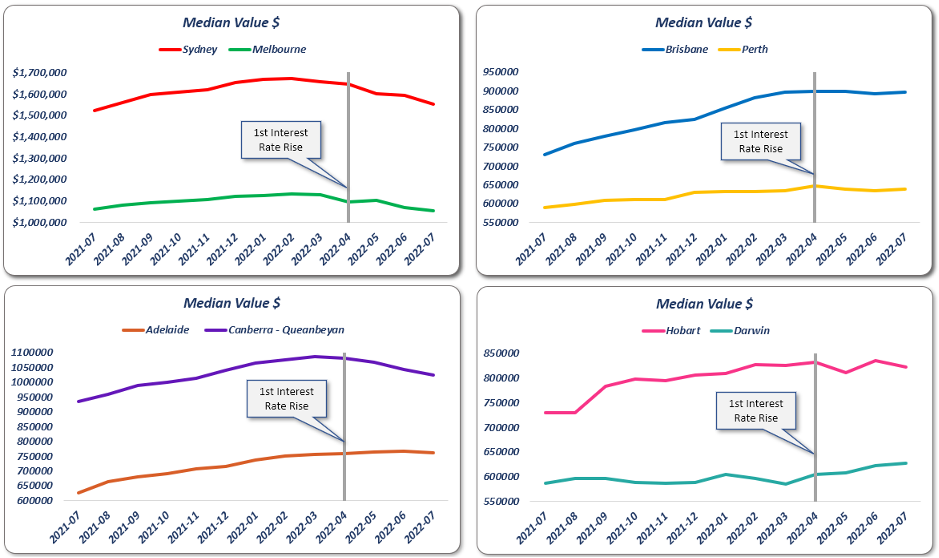

Value Changes

Here’s how the state capital median values have changed over the last 12 months.

Interest rates have risen every month since April. Notice how the tide started turning in Sydney, Melbourne and Canberra before interest rates started rising. This retraction in prices or levelling off is normal behaviour at the end of a boom.

Also, notice how the remaining state capitals don’t appear to be heading south, just levelling off.

Other points of interest:

- Hobart has continued to embarrass commentators who suggested its boom, which started in 2017, would be short-lived

- Darwin is finally showing some green shoots

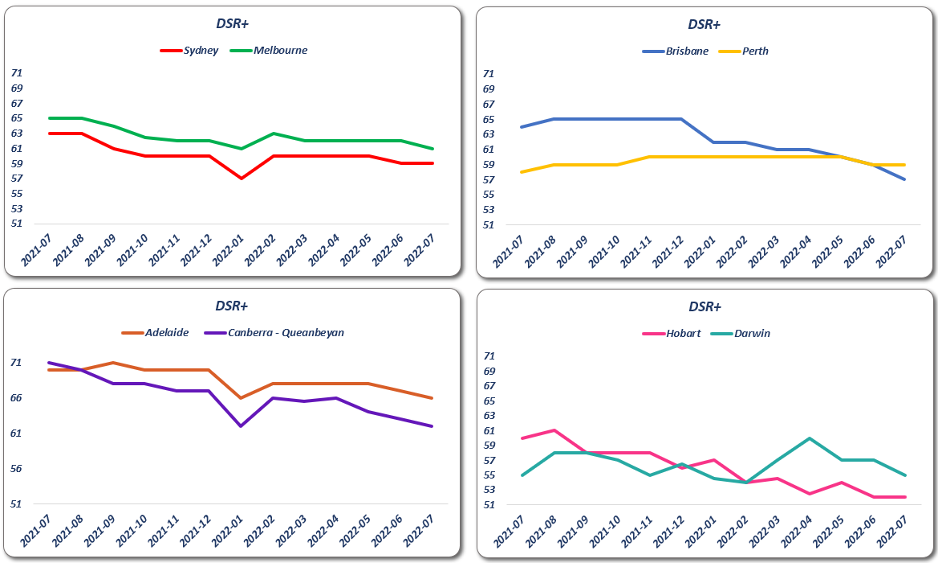

Supply & Demand

Changes in supply and demand trigger changes in capital growth rates. Are rising interest rates the real cause of reduced demand?

The following charts show the demand to supply ratio (DSR+) of the state capitals over the last 12 months.

Every market has been showing declines in demand relative to supply apart from Perth (yellow) and Darwin (teal).

And those declines started well before the 1st interest rate rise could reduce demand among buyers.

But it does look like the interest rate rises have accelerated the decline in demand in some cities: Brisbane, Canberra and Darwin.

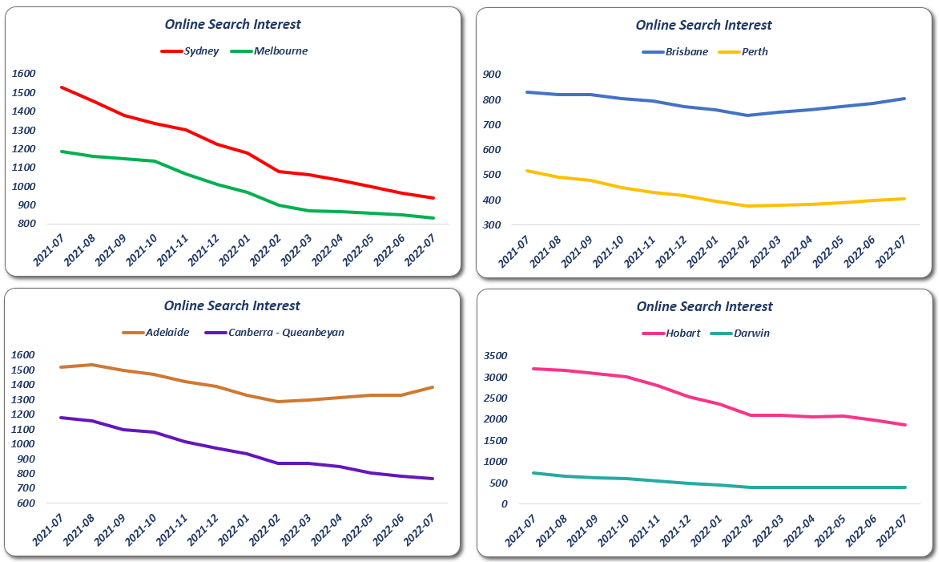

Search Interest

How keen are property seekers now compared to a year ago? The following charts show the number of online property searches in each state capital versus the number of properties available.

The drop in interest from buyers is most evident in: Sydney, Melbourne, Canberra and Hobart.

Interest appears to have increased over the last 6 months in Brisbane, Adelaide and Perth.

Note again how hard it is to see any correlation between rising interest rates and changes in demand.

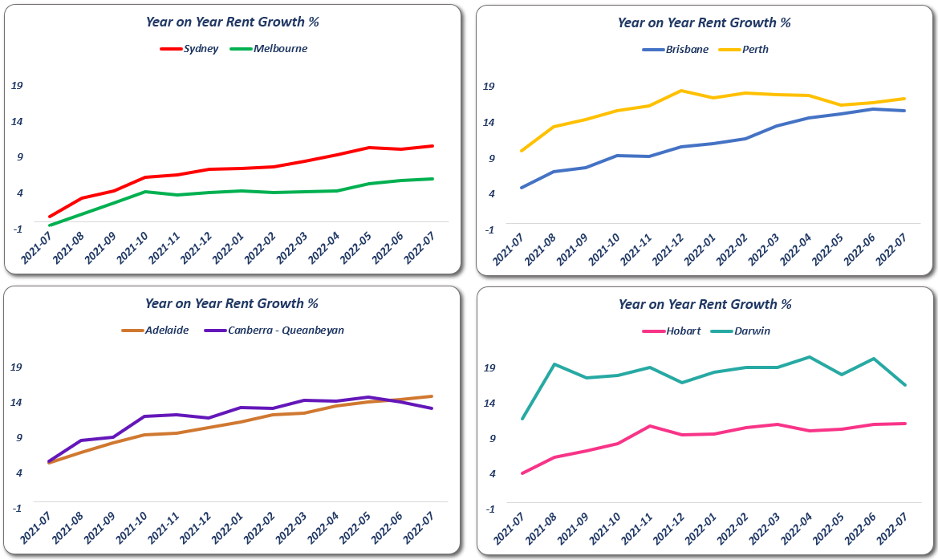

Rent

One thing the media have got right is the desperately tight vacancies and growing rents. The rate of growth in rents has accelerated across the country.

This is due to a prolonged period of historically low vacancy rates.

Perth and Darwin rents have been growing at double-digit rates for the last year – touching on 20% in some cases.

Conclusion

Although interest rates do play a role in capital growth, the slow-down was happening before rates started rising. Probably due to buyer pockets running dry.

A period of rising rents doesn’t necessarily follow immediately after a growth spurt. But this appears to be the case this time through the cycle.

The charts show how diverse the Australian property market is. There’s always an opportunity for investors – somewhere.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data