Introduction

Everyone has heard of the rental crisis by now. It has been looming for a few years. But how bad is it really and where is it going to get even worse?

Balance

The sign of a balanced market is where demand from renters matches supply from landlords. This is reflected in a vacancy rate of 2%. How do I know it is 2%?

I analysed historical data and calculated the vacancy rate when rents grow in line with inflation.

I noticed that when vacancies drop below 2%, rents rise faster than inflation. And when vacancy rates are above 2%, rents grow slower than the rate of inflation.

Here is a link to that research…

We can therefore say that any area with a vacancy rate under 2% is a headache for renters and is good for landlords.

The national vacancy rate is currently a bit over 0.7% – very low.

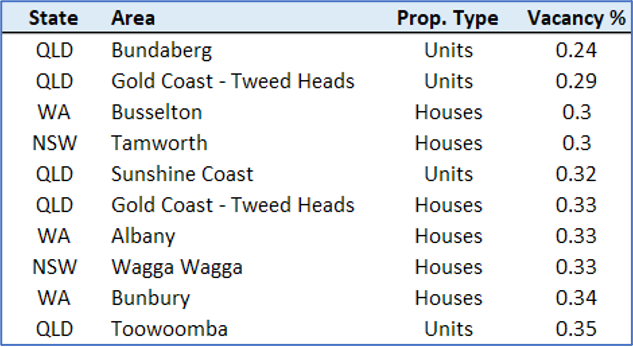

Worst Place to be a Renter

The following areas are some of the worst places in the country to be a renter looking for new digs.

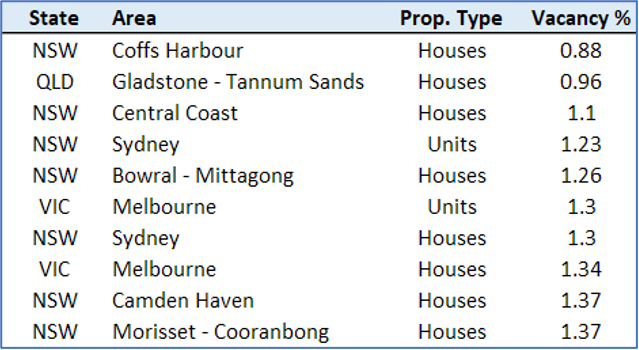

Best Places to be a Renter

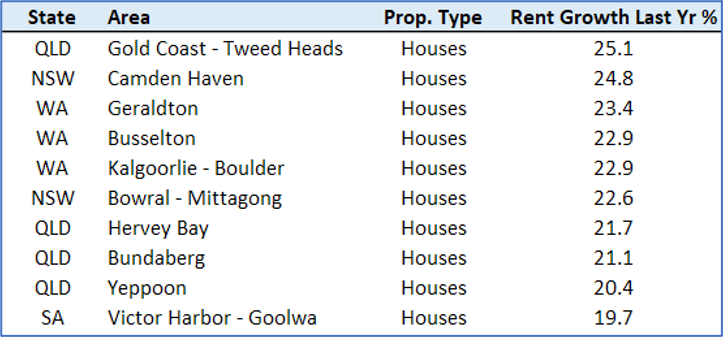

Recent Rental Growth

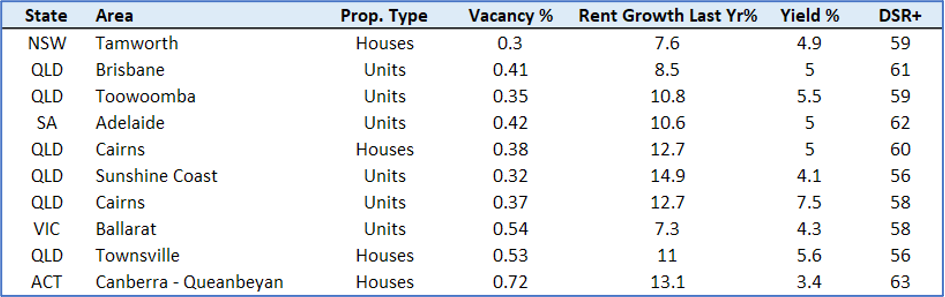

Future Rental Growth

More than half are in QLD.

They were chosen for:

· Low vacancy

· Less than average recent rent growth

· Respectable demand relative to supply (DSR+)

I expect 12-month rental growth in these areas between 15% and 25%.

Note that these are not the best investment areas for investors. Some have poor growth prospects, and some have low yields.

Brisbane

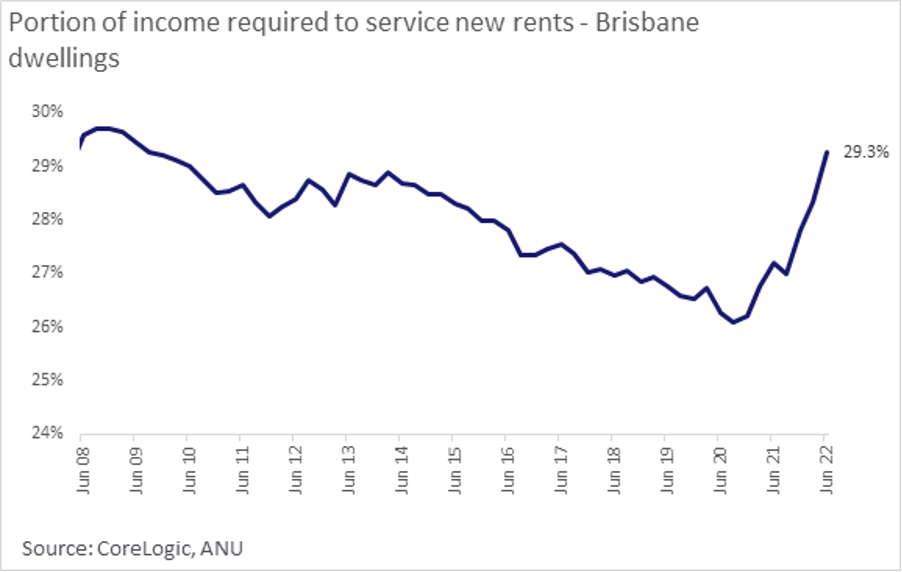

There is not much we can point to in Australian property that has become more affordable every year for over a decade.

Core Logic and the Australian National University put that chart together. You can read Eliza’s full article here…

The Brisbane Rental Crisis in 5 Charts

The rapid rise in Brisbane rents recently is not a sudden problem that needs fixing. It is a sudden fix to a problem that had been building for over a decade.

What is it to come?

Brisbane’s rent affordability has only just got back to where it was in 2008. On top of that, vacancy rates are still way below 2%. So, there is plenty more rent growth to come. And not just in Brisbane.

But do not worry, eventually:

1. Investors will enter the market, lured by higher yields

2. And renters may find it more feasible to own than rent

3. So, buyer demand increases

4. Developers respond, supplying to the demand

5. The extra supply cools the market and restores balance

6. Then there is a period of low growth before the cycle repeats

Conclusion

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data