Introduction

I’ve heard plenty of property professionals use this line:

This area will always be in high demand

And plenty of so-called investment experts will try to tell you to pick locations where everyone wants to live. But it’s all wrong. If you’re after capital growth you need to get one concept straight:

Prices go up when demand exceeds supply

It actually has very little to do with whether the location is “nice” or not. And there are no areas where demand is always high and supply is always low.

Ferraris

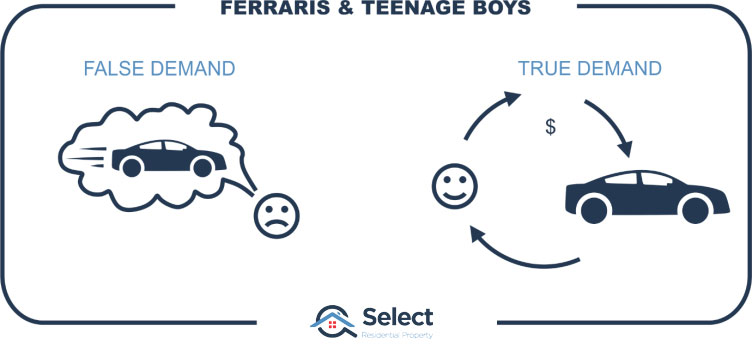

Firstly, we need to draw a distinction between “desire” and “demand”. As investors, we’re after capital growth. So, the kind of demand we’re interested in is the kind that pushes prices up.

A teenage boy may want a Ferrari. But that kind of demand won’t affect the price of Ferraris because teenage boys don’t have the financial capacity to purchase them. (They also probably don’t have a driver’s licence. Or if they do, not for long once they get behind the wheel of a Ferrari).

“Both millionaires and teenage boys want Ferraris. But only the demand from one will influence prices”

That’s the demand we want to monitor in the property market. Not the wishful thinking kind of “desire”, but the hand-up-at-auction kind of demand.

Always being an appealing location to live simply isn’t good enough. It needs to be affordable to appeal to enough buyers to scramble over each other creating the kind of demand that pushes prices up.

Exclusive areas

It’s no good looking around for lovely places to invest if nobody can afford to buy there. The most affluent property markets in the country may not have many genuine buyers. Sometimes they will and other times they will not. Just because all year round they continue to be appealing places to live, doesn’t mean the demand to buy there is high all year round.

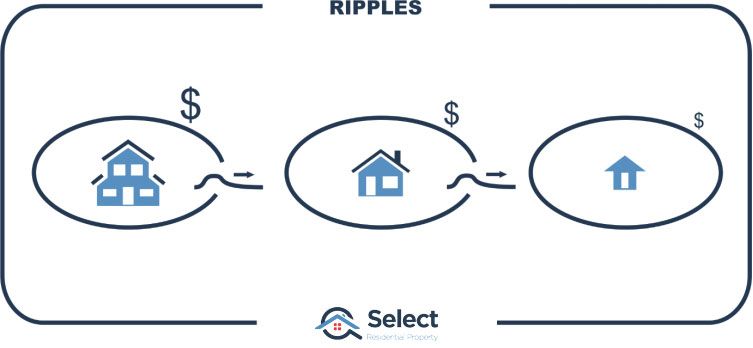

In fact, there’s sufficient evidence to suggest that at the start of a new growth cycle for a city, the affluent areas start to take off first and then that growth subdues and ripples outwards to neighbouring suburbs.

After a few years of rapid growth, buyers eventually consider the properties in those affluent areas to be too expensive. They start looking for the next best alternative. That reduces demand for the affluent area and increases demand for its neighbour.

“Affluent areas will not always outperform the less affluent suburbs in the same city”

There will be periods of accelerated growth and periods of reduced growth.

Corrections

I’ve conducted research in the past to examine the fortunes of affluent areas versus lower socio-economic areas during periods of national price falls. Interestingly, the more expensive suburbs closer to the CBD fell more sharply than the cheaper areas further from it. You can check out this presentation for more details.

Expensive markets fall more than cheapies

As the evidence clearly shows, it is not true that these upper-class markets will always be in high demand. Quite the reverse: demand for them drops more noticeably in tough times.

Mansions & Millionaires

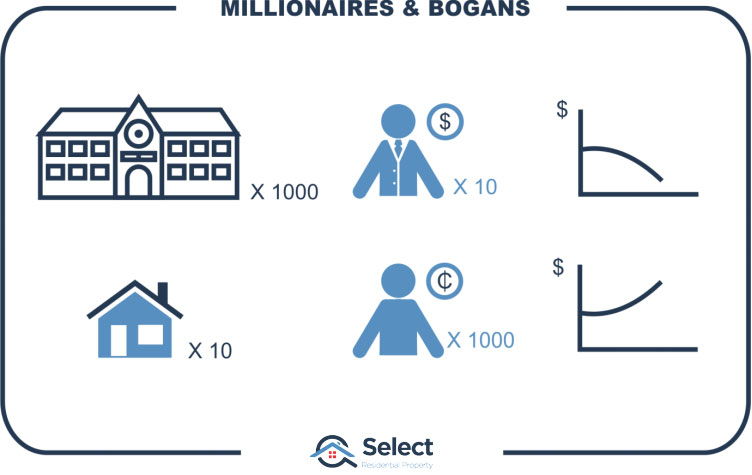

If there are too many mansions and not enough millionaires, then ritzy area prices can fall. If there are a thousand mansions and only 100 millionaires, the price of mansions will drop.

Conversely,

“If there are a thousand bogans and only 100 dog boxes, the price of dog boxes will rise”

It’s got nothing to do with whether it’s a nice property or a nice area. It’s all about supply & demand.

Conclusion

If you’re after capital growth, you must pay heed to supply and demand. These are the only two factors affecting price growth.

Remember that you don’t live in your investment property, your tenant does. It doesn’t matter whether it’s a nice area to you or not. It matters if demand outweighs supply.

For a more comprehensive view of this topic check out: