Introduction

If you’ve paid any attention to blogs, articles, podcasts and property investment books by the high-profile experts from the investment industry, you’ve no doubt heard about this concept of an “investment grade” property. There are all sorts of properties you can buy in a suburb and not all of them are considered by the experts to be “investment grade”. They take it a step further and suggest that not all suburbs are investment grade.

Every expert has a slightly different idea of what features a property or suburb must have in order to qualify as investment grade. But it doesn’t matter. Because in this presentation I’ll show why pretty much every feature they mention is almost entirely irrelevant to good investing.

The data says that these sort of “investment grade” properties don’t outperform over the long-term.

Definition

To clarify what is often referred to as investment grade, I’ve taken a few of the terms I’ve heard over the years. This is a stereo-typical definition from a range of commentators:

- Lifestyle location

- Safe & friendly

- Special

- Appeals to a wide range

- Affluent owners

- Short walk to amenities

- Cafes, parks

- Street appeal

- Views

- Natural light

- Privacy

- Attractive style

- Sound structure

- Above avg. historical growth

But a good investment has very little to do with those qualities. I’m not saying those features are bad. I’m just saying that the advice is misleading because investors will go looking for properties with those specific features, missing the fundamentals about investing.

A true investment grade property

A true investment grade property is one that delivers on the following 3 aspects:

- Low risk

- High growth

- High income

In fact, these aspects apply to any good investment, not just property.

But you can’t easily look at a property and see whether it is low risk or whether it will have high growth. You can however, easily see if it’s a short walk to lifestyle amenities or is of an attractive style.

The assumption is that the 3 aspects of a true good investment should come along naturally if you buy a property that has the features mentioned by the experts. That is: close to amenities, has street appeal, with an attractive architectural style, safety, blah, blah, blah.

But if that was true, then we wouldn’t see properties that have none of those features outperforming properties that have all of those features. But the truth is, it happens all the time.

Mt Druitt vs Cottesloe

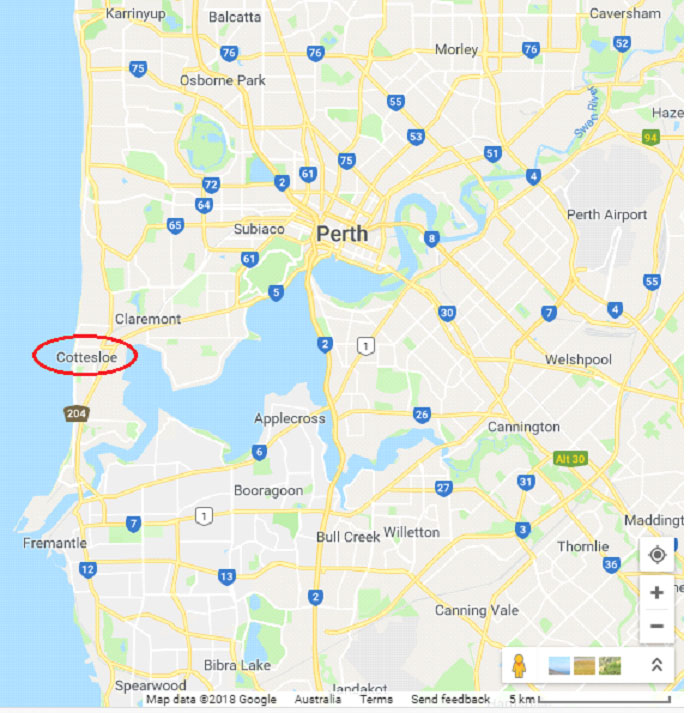

Cottesloe is a suburb of Perth. Here’s where it is on the map.

River one side, ocean the other. It’s an absolutely beautiful suburb of Perth. Here are some photos of Cottesloe.

There are loads of properties throughout Cottesloe that fit the description of an investment grade property – as defined by the experts.

Nice view from the balcony. Looks like a few trendy cafés might be across the road.

Nice shops.

Imagine looking down your street and seeing that. Out of the thousands of homes across Australia, surely this street would have to be in the top 0.1%

Could there be a better amenity for lifestyle than a beautiful beach?

Houses look well maintained, don’t they?

Gorgeous.

The median price for a house in Cottesloe at the time of writing is over $2mil. Here are some nice ones that would fit the bill for investment grade:

Neat as a pin.

A little dated and perhaps not architecturally pleasing. But keep watching.

There’s nothing spectacular here by the way. These are just run of the mill.

Trust me I’m not picking out anything flash here by Cottesloe standards.

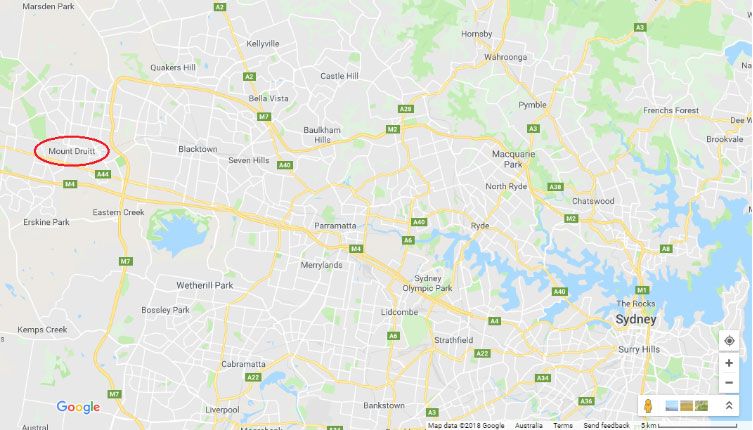

Now, let’s contrast those happy snaps with a market that has none of the attributes the experts believe make for an investment grade property – Mt Druitt in Sydney’s western suburbs.

Mt Druitt is a good hour’s drive west of the Sydney CBD. The median house price at the moment is around $675,000.

I grew up in this area so I know it pretty well. There used to be a sign up as you come over the Bridge on Carlisle Avenue over the railway line. It read, “Mt Druitt does not support domestic violence”.

That’s a photo just down from CentreLink.

Shops.

Streets.

Nice little bogan village.

This is one of the best-looking houses I could find online at the time.

The backyard of another. Plenty of room at least.

Outdoor toilets are back in vogue, but now they’re in the front yard with an open plan genre to encapsulate street views.

Simple, but serves a purpose.

Performance comparison

Let’s imagine the year is 2013 and you have a lot of money to invest in property. Which would you choose: Cottesloe, full of investment grade properties; or Mt Druitt, with none?

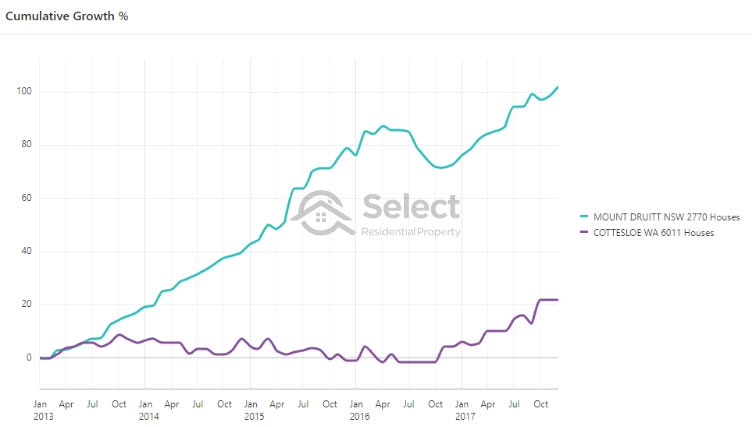

Here’s a chart plotting the 5-year growth in medians for houses in both Mt Druitt and Cottesloe.

Mount Druitt houses doubled in value in these 5 years. Cottesloe houses grew by about 20%. The opportunity cost in just 5 years was 80%. For a $2m portfolio, that’s $1.6m.

Some might argue that over the long-term, Cottesloe will outperform Mount Druitt. But that changes nothing. An investor who bought a mil of Mount Druitt at the start of 2013 would have well over $1.5m after selling at the end of 2017. They could transplant that equity and buy more Cottesloe in 2017 than they could have in 2013. It doesn’t matter how well Cottesloe grows from then on, they’re better off having started in Mount Druitt.

There’s more detail on that in this topic:

Focus on long term growth – WRONG!

Given the extraordinary difference in price growth between these two markets, it would have been very hard to find a single property in Cottesloe that outperformed any in Mt Druitt. How is this possible given they are at complete polar opposite ends of the investment grade spectrum?

It’s because the investment grade attributes, completely miss the point.

Risk

One measure of risk used in the share market is price volatility. It’s a measure of how radically price changes for a particular stock. The same measure can be used for property.

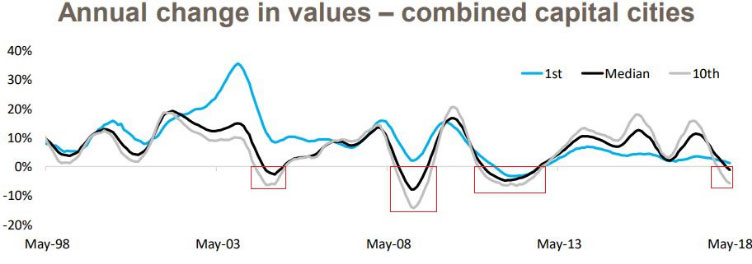

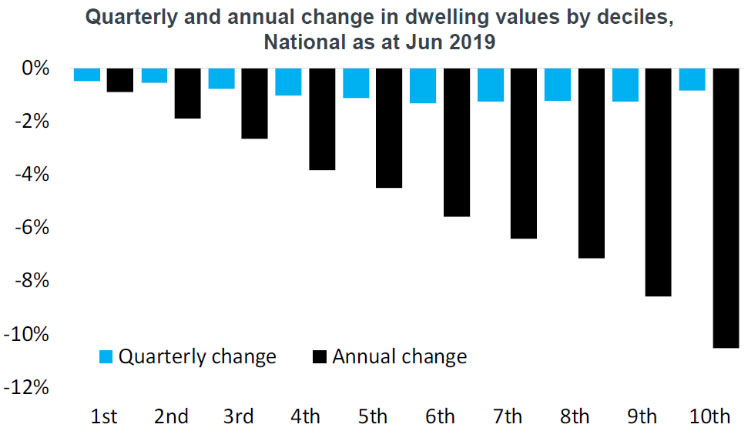

This chart comes from Core Logic. Time and again they produce these charts that show higher priced suburbs are generally more volatile than lower priced suburbs. Expensive suburbs have larger gains and larger falls, in percentage terms than cheaper suburbs.

The sections I’ve boxed in red are when the Australian property market went backwards. The higher priced markets suffered more than the lower priced ones.

Here’s another view of the same sort of thing.

This chart shows the performance of property markets split by price range into ten groups. The cheapest group is on the left. The most expensive is on the right. The biggest falls in values were in the most expensive suburbs.

So, from this measure of risk, Mount Druitt might be considered less risky than Cottesloe. And given the price difference between these two markets, it’s possible investors could diversify more easily having properties spread across multiple cheaper suburbs rather than having all their eggs in one expensive suburb.

Yield

The yield in Mount Druitt has been significantly higher than that in Cottesloe for a very long time too. So, on all 3 points of risk, growth and yield, Mount Druitt has been the investment grade property market, not Cottesloe despite Cottesloe having all the features of an investment grade suburb and Mount Druitt having pretty much none.

Long-term

Most of the price difference between Cottesloe and Mount Druitt happened during a single boom in Perth property prices in a small 5-year period from about 2003 to 2008. Every suburb will have a boom one day. But…

“No suburb can outperform over the true long-term”

Another presentation in this series explains why that’s not possible. Check out the Apples & Oranges presentation:

That presentation explains why it is unlikely for one property to outperform another over the long-term. Here’s another example.

Corio is a lower socio-economic suburb of Geelong while Toorak is one of the priciest suburbs in Victoria. The two markets have been trading blows for the last 30 years in terms of their growth rates. At the time of putting together data for this presentation, Corio was on top. But in 10 years, it could be a different story.

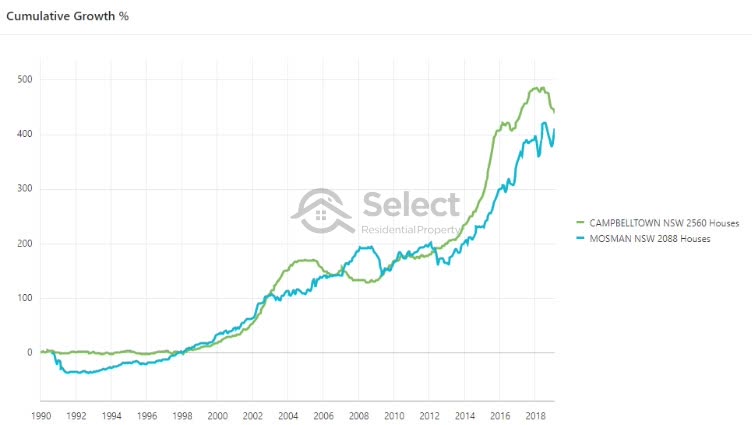

Here’s a comparison of Campbelltown in Sydney’s far south west and Mosman in the pricey lower north shore.

Again, this is over a 30-year period. And again, they each have had their time winning the race.

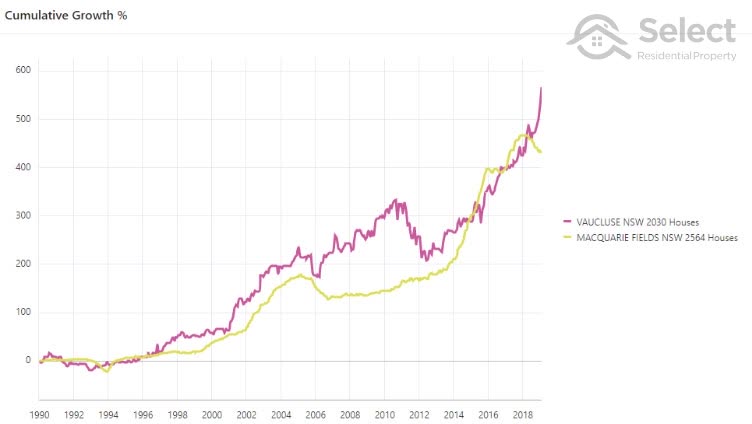

Here’s another example.

There are plenty of examples of affluent areas beating the cheaper areas and vice-versa. Every suburb will have its time to shine.

Averages

But these are just a few examples. You can cherry pick isolated cases to support almost any argument you like. It’s not until you calculate averages that you realise what the norm really is. That’s when the general trend starts to emerge. And the trend is that:

“Long-term, all property markets perform pretty much the same”

Now, on the subject of averages: there’s no doubt that a lot of the suburbs closer to the CBD have more of the features most experts call “investment grade”. But if that’s true, it should mean that suburbs closer to the CBD outperform those further away. However, analysis of data over the last 40 years suggests there’s no significant difference.

For more on that topic check out this presentation in the series:

Why there’s no need to buy near the CBD

Price variability

There’s another test we can perform against the data to see if the theory of investment grade properties the experts recommend holds true. They’ll often say that certain streets and certain properties will outperform the average streets and average properties in the same suburb.

Now that may be true for short periods of time like a few years. But eventually, whatever benefit one street or property has over other streets or properties will be factored into the price of properties. From then on, the growth will be even amongst all of them since the difference has now been factored into the price.

For more on that topic, check out this presentation in the series:

Schools shops transport etc are overrated

If certain properties do outperform others in the same suburbs, over the long-term, the price difference between good and bad properties in a suburb would expand in percentage terms.

For example, if 40 years ago a good property in suburb ‘A’ was worth $50,000 while a bad one was worth $25,000 then if they both ended up 40 years later at $500,000 and $250,000 respectively, then they had the same performance over 40 years. Both had roughly 6% capital growth.

- Year 1

- Good property $50,000

- 100% more expensive

- Bad property $25,000

- 50% cheaper

- Good property $50,000

- Year 40

- Good property $500,000 (6% pa)

- Still 100% more expensive

- Bad property $250,000 (6% pa)

- Still 50% cheaper

- Good property $500,000 (6% pa)

Even though the dollar gap widened as prices got larger, the percentage difference didn’t change – good properties were still only double the price of bad properties. If this happened, you’d be no better off buying a cheap or an expensive property.

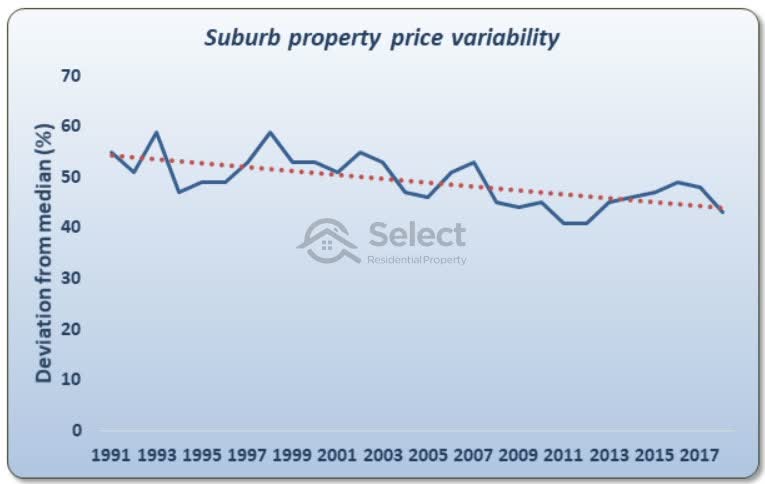

But if it’s true what the experts say, that good properties in good streets will outperform the average for the suburb over the long-term, then we’d expect the percentage difference between good and bad properties to grow over time. In other words, we’d see more variability in prices across the suburbs in percentage terms. But instead, we see this…

This chart shows the change in price variability per suburb across Australian suburbs from 1991 to 2018. Nearly a million property sales were considered. It’s not uncommon to see prices vary by as much as 50%. However, over the years, that variation has narrowed.

The orange dotted line shows the general trend. If the experts are right, the trend line should be heading upwards to the right, but instead, it’s heading downwards. In other words, the variation away from the norm over the last 30 years has been narrowing, not widening.

This means that long-term there is tendency for properties to perform the same.

“Investment grade properties do not outperform over the long-term”

Nothing does. It’s the same for suburbs and cities too. The data shows there is a tendency to have similar rates of performance over the long-term. The longer the term of examination, the more closely the performance of properties, suburbs and cities becomes.

Supply & demand

The key concept every investor should focus on is not the specific features of the suburb or the property within it, but the demand for them and the supply of them. Prices are driven by supply and demand. Not by proximity to cafés or appealing architecture. Not by layout or finish. What you really need to look for is a property that is in high demand and low supply. That may not necessarily mean what these experts refer to as investment grade.

And yes, it is true that most people will want to live in nice suburbs. But do they have the financial capacity to buy there? Will they put in a strong offer to buy a property and push prices up?

“Most teenage boys would like to own a Ferrari, but do they influence the price of Ferraris?”

You need to distinguish between wishful desire and genuine demand.

Millionaires & Bogans

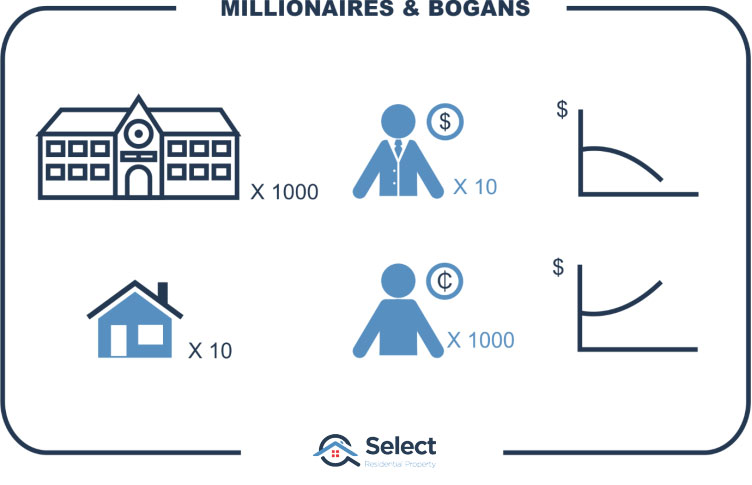

Imagine there were 1000 mansions for sale in Cottesloe and only 10 millionaires looking to buy one. If that was the case, then supply would exceed demand by 100-fold. According to the age-old law of supply and demand, prices for mansions would tumble.

Now imagine a completely different market in which 1000 Bogans are fighting over 10 dog-boxes. Demand exceeds supply by 100-fold. In this kind of environment prices would start tearing upwards for dog-boxes.

It has nothing to do with lifestyle, street appeal, views, proximity to amenities, architecture, etc. Those things might make a location or property more appealing. But supply and demand operate independently of those features.

Now just a word of caution: don’t go out purposefully looking for a dog-box. If you do, you’re missing the point. I’m not saying that cheap and nasty outperforms ritzy. I’m saying that those qualities are irrelevant. The only qualities relevant are supply & demand.

True investment grade

“A true investment grade property is one in high demand and low supply”

If that means it has a toilet in the front-yard, then so be it.

Note that according to my definition of investment grade, a property will never be investment grade all its life, even if it never changes. That’s because supply and demand for property change all the time. There’s a continual tug-o-war. The market is continually moving in and out of a supply and demand balance.

There’s nothing wrong with Cottesloe. It will have more booms and more flat periods. And there’s nothing inherently good about Mount Druitt either. It will have its flat growth periods too and more booms.

And BTW, for more on that topic of how long a property market is likely to boom for, check out this presentation:

Why timing is better than time-in

Conclusion

The lesson to be learnt here is that supply and demand dictate price change, not property features. You shouldn’t look for specific property attributes without first knowing what demand there is for them and also what supply there is of them.