Introduction

Just about every property investment expert will tell you they always look to buy under market value with every purchase they make. But I’ve learnt that if you chase after bargains you run away from capital growth. And capital growth is the fly’s eyes of property investing – nothing is more important.

If you make buying under market value a priority, you’ll be making capital growth harder to obtain. These strategies are polar opposites. I’ll explain why soon. But firstly:

Define terms

We need to define some terms:

- Cheap

- Discounted

- Under valued

Cheap is just that – a low price. It might be low for very good reasons: a lower socio-economic demographic, a troublesome street, structural problems, poor condition, noisy neighbors, etc. Just because it’s cheap doesn’t mean it’s under market value.

A discounted property is any property sold below the original asking price, which is most of them. Real estate agents routinely add an extra amount to the expected sale price. This is so that buyers like us can feel better about ourselves after a successfully haggling the seller down to the price they were going to sell at anyway!

“It’s possible to buy at a discount and still pay above market value”

I’m talking about buying under market value, not buying cheap properties, not bargains, not buying at a discount to the asking price. I’m talking about buying under intrinsic value.

What investors think they should be pursuing, is a property under market value. In other words, they think they can buy a property worth $400k for only $380k.

Valuing

But, how do we know what a property is worth? Well, the true value for a property is the price someone is willing to pay for it – it’s as simple as that. But that someone could be a poor negotiator or the opposite, they could suffer from hepa-tight-arse. So, who’s to say what the property is worth?

How does a professional property valuer do it?

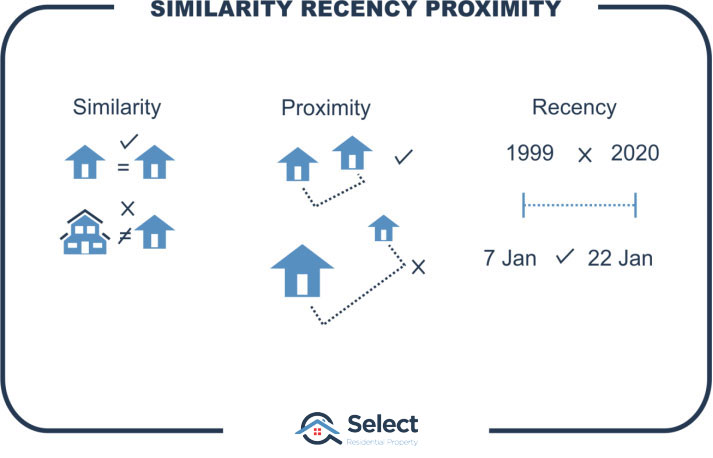

Valuers compare recently sold properties in close proximity of similar nature and condition. Real estate agents will do the same thing. Potential buyers will do the same thing.

However, everyone has a different opinion despite using the same technique. Why? Because everyone is biased:

- Seller is biased up

- Buyer is biased down

- Valuer is biased down

- RE agent is biased towards turnover

The buyer doesn’t want to pay too much – they want the property to value lower.

The valuer is motivated by the risk of losing their job – they don’t want to over-value the property and get in trouble with the lender that hired them, so they tend to be conservative.

And the real estate agent is motivated by speed, so they try to get the buyer to believe it’s worth more and the seller to believe it’s worth less and hope to high heaven the valuer picks a price somewhere in the middle and they want all this to happen as quickly as possible.

Who’s right?

There’s no one person who is right. In the end, the property’s true value is what someone was willing to pay for it at that point in time. And since that is subject to opinion, you will never really know. That brings us to the 1st problem with the approach of buying under market value – nobody really knows what market value is until the property has sold and then we know precisely.

New value – what you paid for it

And that’s the second issue with hunting down properties under market value. The new value of the property is what you just paid for it.

You’ve heard of the reno-flip right? You buy a property, renovate it and sell it really quickly. There’s no such thing as the under-market-value-flip or the discount-flip.

You can’t buy a property for under market value and then sell it for market value in the next couple of months. The record of the sale of that property will be available to valuers, real estate agents, buyers and buyer’s advocates. You’re not fooling anyone. Its new value is the price you just paid for it.

Re-vals

And you can’t refinance on the “new” value either. Your bank will probably refuse to get a valuation done on your newly purchased property. They’ll usually only entertain a new valuation at least 6 months after purchase and probably only if you tell them you’ve renovated.

But if you ordered your own independent valuation, the valuer would have an extremely accurate and confident estimate – based on recent sales of similar properties close by. What could be closer, than the same address? What could be more similar, than exactly the same? And what could be more recent than last week?

VALUER: “Mr Sheppard I’m confident I can give you a very accurate estimate. A property exactly the same as yours at the same address sold recently. I’m surprised you don’t know about this since you bought it”!

ME: [embarrassed smirk] Oh … I remember that one now.

The Discount-Flip

There’s no such strategy as the discount-flip. The theory goes like this:

You spend a lot of time researching a market intimately so you recognize the good value for money once it pops up.

You make tons of low-ball offers hoping one day someone will bite.

Eventually, you snag a deal and then you wait until that sale figure is no longer recent and is forgotten by agents, buyers and valuers.

Then you put the property back on the market for the “proper” price and wait for a buyer willing to pay that much who doesn’t notice the prior sale price.

Then the property settles, your money is back in your hands, hopefully along with a small profit.

The whole process is painfully slow. And with all the entry and exit costs, you’re much more likely to have been better off with a simple “buy and hold for growth” strategy.

“Under market value is a strategy for novice investors who can’t find growth”

Discount flip fails

There are some experts who offer a service to find these under market value properties. I received some marketing from them containing about a dozen examples of their past successes. They claimed discounts were around $60,000 on average.

But after analysing these specific properties, I realised they weren’t successful at all. In fact, for one of them, looking at current values, the buyer probably paid $50,000 too much!

On average the biggest discounts were in the worst markets. The negative growth countered any benefit from a discount.

And that’s not all. In markets that experienced good growth, the discount wasn’t a discount. In some cases, the property was the same value 9 months later despite the whole suburb having positive growth. So, either the property was overvalued or under-performed the growth of the suburb around it.

- Average discount claimed = 12.3%

- Analysed 9 months after sale, on average

- True discount calculated = 2.7%

- Average suburb growth = -1.0%

- On average, better off after 9 months by 1.7%

Now keep in mind, if you’re a business marketing your success stories, you’d pick out the best from the rest. So, if these dozen were examples of best cases, I can’t imagine the horror stories there’d be with a sample size of 100.

The strategy doesn’t work.

Not impossible

Now, having said all that, I don’t believe it’s impossible to buy a property for under market value. However, relying purely on that as a strategy is unprofitable. You need something else like capital growth or renovation potential to make it worthwhile. And this leads us to the next problem with this approach…

Bad focus

If you’re focussing on buying under market value, you’ll be drawn to more negotiable sellers. You’ll discredit markets in which sellers are arrogant and staunchly reject your hepa-tight-arse offers. You’ll be drawn to markets where agents give you time and sellers carefully consider your offer.

The thing is,

“The best property markets for capital growth have the least negotiable sellers. The markets you’ll find negotiable sellers are the ones you want to avoid.”

Ironically, a seller’s market is the best one to buy in for an investor. A seller’s market is one in which selling is easy. You plonk your property on the market and suddenly every buyer and their cus’ turns up at the 1st open inspection. There’s a flurry of visits, some ridiculous offers, and it’s gone.

A seller’s market is one in which demand exceeds supply. Those are the markets investors should be interested in.

Conversely, a “buyer’s” market is one in which it’s easy to buy. You can take your pick from a huge range of stock. Agents greet you like they’ve been ship-wrecked on a deserted island.

Falling prices

Imagine you do negotiate a seller into lowering the price below market value. And imagine it wasn’t that hard either. In fact, everybody is doing it – a discount paradise!

You’ve just bought into a declining market.

The bargain you thought you got $20,000 below market value could be $20,000 above market value just 6 months later.

Think about it, if everyone pays below market value, prices are dropping with every sale. Every single property that sells under market value is a nail in the coffin of your hopes for capital growth.

“The easier it is to get a bargain, the lower the demand is with respect to supply”

The worst markets for capital growth are the markets you’re most likely to negotiate a huge discount. For every buyer who pays below market value, there is a blight on that market’s supply and demand equation.

The best markets for growth

It’s not until the majority of buyers are paying above market value, that you’ve found a market experiencing some capital growth. The more buyers there are paying above market value, the more capital growth is occurring.

“The best market to invest in, is the one where it’s impossible to buy under market value”

If you decide to apply a buy-under-market-value strategy to hot markets, you’ll miss out on a lot of deals. For every month you waste trying to find the ultimate deal, prices creep up that little bit more.

Some data

This is all theory, but what really sticks is evidence. I’ll use the Average Vendor Discount to compare markets with more potential for bargains against those with low potential for bargains.

The Average Vendor Discount is a metric we use to measure demand in property markets. We look at the price that property was originally advertised for sale. Then we compare that price to the eventual sale price of the same property. We measure the difference in percentage terms which is called the Discount. We then calculate an average for all properties that sold in a suburb for a month.

Context

At the time of making calculations, the average vendor discount Australia-wide was around 3%. The vast majority of property markets around the country had a discount of less than 7%. Anything above 10% was considered quite worrying. Anything less than 2% is excellent.

The higher the discount is, the lower the demand will be, but the more likelihood of finding a negotiable vendor. Keep in mind that a discount does not equal a bargain or a saving. Also, keep in mind that using a single metric to gauge demand and supply is extremely inaccurate.

Analysis

Despite all this, an analysis of discounts over the 10 years from 2010 to 2020 hints at how bad it might be to chase a bargain:

- High discount cases are suburbs with at least a discount of 10%

- Average discount for all suburbs in the analysis was 11.9%

- They experienced 8.8% total capital growth on average over the next 3 years

- Low discount cases are suburbs with a maximum discount of 2%

- Average discount for these suburbs was 0.7%

- They had 22.5% total capital growth on average over the next 3 years

- Totals

- Average saving gained buying in a high discount suburb instead of a low discount suburb was 11.2% (assumed)

- Capital growth lost buying in high discount suburb instead of a low discount suburb was 13.7%

- Therefore worse off by 2.5%

Within 3 years, bargain hunters would be worse off by 2.5% of their property’s value. The discount saved was overwhelmed by the inferior capital growth.

However, this is assuming the property was advertised at fair market value. But they never are. So, the discount savings in the calculations are greatly exaggerated. Bargain buyers would have been much worse off.

The data clearly shows that this strategy is a poor choice for investors to focus on.

Experts

I’ve heard property investment “experts” & “educators,” say you should avoid markets in which buyers are paying “too” much. You should never pay above market value.

Following that advice will steer investors away from the right type of markets. Investors should be aiming to find suburbs where it’s impossible to buy – unless you pay above market value.

Distressed sales

Now, I just want to touch briefly on this concept of distressed sales.

A distressed sale is for example, a mortgagee repossession where someone has been unable to keep up loan repayments. Or it’s a divorce where the couple just want to get away from each other. Perhaps the owner has died and their heirs are selling it off. Maybe the owners have bought a replacement property elsewhere and they need this one to sell first and they’re running out of time.

- Mortgagee repossession

- Divorce settlement

- Deceased estate

- Bought elsewhere

You might be thinking you’ll find one of these opportunities. But there’s a few things you should be aware of:

Uncommon

Mortgagee repossessions are typically around the 1% mark. If they’re higher, you might want to avoid those areas. In fact, an ideal market to buy in for growth won’t have any mortgagee repos.

Competition

Secondly, every investor is looking for one of these opportunities. If you’ve picked a good market, there’ll be loads of competition already.

Not in Hot markets

And thirdly and most importantly:

“There’s no such thing as a distressed sale in a hot market”

In a hot market, if you have to sell in a hurry, you can. There’s no hold-up. In a hot market, buyers are scrambling over each other. Ironically, if you think you’ve found one of these “opportunities” you may have actually found a bad investment location.

Ethics

Fourthly, it’s easy to kick someone in the teeth when they’re on their knees. But I don’t want that to be the basis for my successful portfolio. It’s not something that would make my mum proud. Should you be taking advantage of someone in a tough spot, or should you pay fair market value? Up to you.

Summary

- They’re uncommon

- There’s competition

- There are no distressed sales in hot markets

- It might challenge your ethics

Oh, and BTW, not all distressed sales are actually distressed. Sometimes it can be a marketing ploy to garner further interest. The seller might actually be licking their lips right from your first offer.

Seller & buyer attitudes

And here’s a little more “heads-up” about attitude. To get into the best markets, you actually need a fair dose of humility. The sellers are allowed to be arrogant. In the right type of markets, they hold the power. If you try your “low-ball” tricks, they’ll tell you to play in the garden with the other children while the grown-ups talk money. Pull your head in, grovel if you have to, and get into that market any which way you can.

If you need your ego inflated, then aim for the trouble-spots where you can easily buy under market value and feel like a tough-nut negotiator. But if it’s your bank balance that needs bolstering, then target markets that will be a character-building fight to get into.

Conclusion

Finding properties under market value is a lot harder than you think. There are legitimate success stories. But the general strategy opposes success, making it more difficult to achieve than most investors realise.

“Every under-market opportunity is actually a kick in the capital growth groin”

The best markets for growth are the worst markets for buying under-valued properties.

What little you might gain from buying under value is nothing compared to what you’re likely to lose with inferior capital growth. Focus on growth, don’t focus on bargains. Capital growth trumps everything else.