Introduction

There are loads of expenses involved in buying and hanging on to an investment property. But one thing that trumps all those negatives is capital growth.

“Capital growth is what makes investing all worthwhile”

Too many investors and investment advisors suggest avoiding property markets known to have certain extra-ordinary expenses, above average. The suggestion is that these expenses will have a big impact on your success. The truth is, they’ll have very little impact in most cases and the advice is quite often biased by a hidden agenda.

One of the markets that pops up frequently I’ll mention later. But what’s important is keeping your analysis of any property market in perspective. In this presentation I’m going to lay out the sort of analysis investors should do and dispel some of the myths about certain markets.

Entry costs

Let’s start off with an analysis of the expenses incurred when entering the market, that is, when buying. The biggest expense is stamp duty. It’s usually in the tens of thousands of dollars. As a rough gauge, I estimate stamp duty at 4% of the property’s value

- Stamp duty (~4% e.g. $20k for a $500k property)

- Legal fees

- Building inspection

- Pest inspection

- ————————-

- TOTAL = 5%

For example, for a $500,000 property, you’d pay roughly $20,000 in stamp duty.

But there’s also a stack of smaller costs like legal fees and inspections. These combined will come close to 1% of the property’s value. So, in total you’re looking at about 5% of the property’s value being spent on entry costs.

Holding costs

The biggest expense when holding property is of course the interest to be paid on the mortgage.

- Mortgage interest

- Property management

- Insurance

- Council rates

- Repairs & maintenance

- Land tax – maybe

- ————————-

- TOTAL = 5.5%

Assuming your bank is charging you a 5% interest rate and you have an 80% loan-to-value ratio, you’ll be forking out about 4% of the property’s value each year in interest (80% of 5% = 4%).

Then there’s a whole bunch of trivial expenses like: management fees, insurance, council rates, blah.

As a rough guestimate, plan for about another 1.5% of the property’s value blown away in holding costs on top of the mortgage interest. The total with an 80% LVR is about 5% to 6% of the property’s value based on interest rates at the time of writing.

So, unless you have a yield of 5 to 6% of the property’s value, you’re probably running at a loss. That’s assuming you have no capital growth. And that’s where the pay-dirt lands – in the capital growth. It makes all the other costs look insignificant.

Body corporate

I’m amazed at the number of times I’ve heard an investor say, “The body corporate is killing me”. Body corporate fees, also known as strata fees are charged by the manager of unit complexes to maintain the common grounds: like the lift, the foyer, gardens, pool, etc.

But it’s not the body corporate fees that are the killer. It’s the lack of growth.

“High growth trivialises almost every expense. Low growth exaggerates them all.”

I’ve heard of investors selling a property simply because they’re paying high strata fees. Admittedly, sometimes it’s been more than double what I would have expected as “normal”, but in percentage terms, it’s trivial.

- $500,000 property

- Body corporate $1,000/quarter above“normal”

- $4,000 p.a. wasted

- 8% = $4k / $500k

- 1-year growth of 6% = $30,000

If you’re paying a thousand dollars a quarter more than normal, you may not think it’s trivial. But if you own a $500,000 property, then $4,000 is only 0.8% of its value.

If the property’s value rises by 6% over the next year, you stand to make $30,000 in capital growth. That makes the $4,000 look trivial.

Imagine if you sold that property and bought an alternative that had strata fees at literally half the rate of your first property.

- $500,000 property

- $4,000 p.a. saved

- 1-year growth of next property is 2% lower than your previous

- Capital growth of only 4% = $20,000 not $30,000

- $10,000 capital growth lost

- Net worse off by $6,000

Instead of getting $30,000 in capital growth, you’re now only getting $20,000. You’ve saved yourself $4,000 in cash-flow but you’re worse off by $6,000.

This example shows how important capital growth is. It is way more important than strata fees. A slight decrease in capital growth of minus 2% completely overwhelms a massive improvement in strata fees.

I had a friend who was considering selling their investment unit because of this exact problem of high strata fees. They felt they had been duped into a poor investment based on this one expense. They felt miserable, to the point of deciding to sell.

But I told them to hold onto the property. I knew that market at that point in time had pretty good growth prospects. I knew they’d fork out heaps in agent’s commission and they’d miss out on literally tens of thousands of dollars’ worth of growth in only the next few years.

No idea

I can understand their position though. They had no idea what any market was going to grow by. If the growth in their current suburb was just as likely to match one in another, then why not change to cheaper expenses?

They didn’t know how to predict growth. They didn’t know how to estimate or research for growth. All they knew was that there’s a big bill each quarter, one that is a lot more than what they’ve seen for other buildings or in other suburbs. They didn’t know if there’d be any growth to counter that expense.

If it’s the only expertise you have with which to make a decision, then it makes perfect sense to cut costs and go with what you know. If, however, you have the expertise to predict capital growth, then it revolutionises your decision-making. You’re literally investing at multiple times the power of a less-informed investor.

Now, some property investment advisors lack this ability to pick growth locations. And so, their advice falls back onto what they do know. For them, expenses might become an important consideration. Shopping around for the cheapest interest rate might be the best allocation of their time.

Keep your analysis in perspective. Don’t get distracted.

“Get growth right and it will cover over a multitude of ineptitude in other less important areas.”

Canberra

A while ago I read a blog where the author, who titled themselves as “senior property strategist”, explained the reasons why they don’t recommend their clients invest in Canberra. The reasons they gave were:

- High rates; and

- Land tax.

In the ACT you pay land tax as a property investor regardless of the amount of land you own. In other states there is normally a threshold which needs to be exceeded before you start paying land tax. So usually owning one property won’t trigger a land tax liability. But in the ACT, you start paying from dollar one worth of land.

However, the ACT has quite cheap stamp duty rates compared to many other states – depending on the price range.

- ACT $500k prop, tot state fees = $12,600

- VIC $500k prop, tot state fees = $26,500

A typical property in Canberra right now will cost less than half the stamp duty for the same priced property in Victoria. But with the higher council rates and land tax in the ACT, it will take around 4 years to undo the advantage of the cheaper stamp duty compared to buying in Victoria for example.

But if you compare Canberra yields with Melbourne yields, it might not be clawed back at all.

- Canberra – Queanbeyan yields 4.6%

- Sydney yields 3.3%

- Melbourne yields 3.3%

- 6% – 3.3% = 1.3% difference

- 3% of $500k = $6,500

At the time of writing, the Canberra – Queanbeyan region has yields of about 4.6% while Sydney and Melbourne have yields around 3.3%. So, the extra you pay in rates and land tax in the ACT are balanced by the extra yield you’re more likely to get.

If you plan to hold for the long-term there’s no real reason to avoid Canberra for the cash-flow reasons the expert stated.

Growth

Now some advisors suggest that places like Canberra won’t have good growth long-term. But I’ve seen nothing anywhere near convincing in their arguments. Some have even been silly enough to suggest it has never managed to keep up with the likes of Sydney and Melbourne.

Actually, according to Core Logic data over the last 28 years since 1990, there’s virtually nothing in it between Canberra, Sydney & Melbourne.

- Sydney 445% growth

- Melbourne 443% growth

- Brisbane 349% growth

- Perth 417% growth

- Adelaide 342% growth

- Gold Coast – Tweed Heads 327% growth

- Newcastle – Maitland 522% growth

- Canberra – Queanbeyan 442% growth

And Canberra has outperformed many of the larger significant urban areas such as Brisbane, Adelaide, Perth and the Gold Coast.

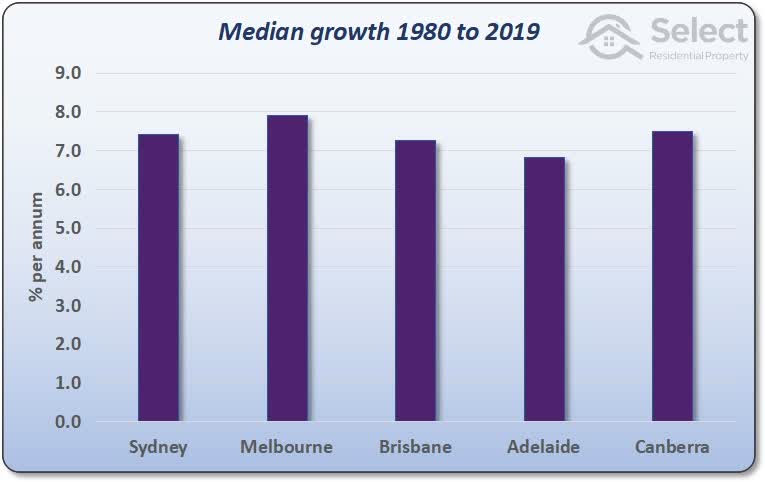

Using median data from the Real Estate Institute of Australia…

…dating back 40 years, Canberra has actually outperformed Sydney, Brisbane, & Adelaide. Data dating back that far wasn’t available for Perth.

There’s no historical evidence to support the theory that Sydney, Melbourne & Brisbane will outperform other state capitals over the long term.

And why should an investor hold long-term anyway? If you think this is a sensible strategy, you really need to view other presentations in this series:

- “You shouldn’t focus on long-term growth”

- “Never say never sell”

- “Why timing is better than time-in”

So, you can see how investing in Canberra could easily be just as profitable as investing in one of the major capitals over both the short and long-term. But if you were a professional unsure of the growth potential of any city, if you knew your expertise wouldn’t cover that so well, what would you fall back on? You’d focus on the expenses wouldn’t you – because they’re easier to predict.

Conclusion

What’s heaps more important than finding a property with lower expenses, is finding a property with higher capital growth. Growth trumps every other aspect of property investing.

The reason so many professionals bang on about other aspects, is because they simply don’t know growth. Make sure your investment advisor has a growth focus.

Oh, and if you want to invest in Canberra, there’s nothing wrong with it – even over the long-term.