Introduction

A large number of investors chase after infrastructure projects around the country expecting prices to boom in areas where infrastructure spending is high. But many investors end up disappointed years later when the price gains they expected were a little lack-lustre at best and sometimes even non-existent.

The research of infrastructure markets is one of the biggest sink-holes of time and energy a property investor can pursue. It is extremely difficult to get the research right and to accurately gauge the impact the project will have on prices. In the majority of cases I’ve researched the impact is somewhere between negligible and zilch.

The idea

There are only two ways in which an infrastructure project can push prices up:

- Increased demand

- Decreased supply

A suburb receiving some new amenity like a train station, shopping centre or business park; may become more appealing, increasing the demand for property nearby and thus placing pressure on prices to rise.

Housing workers

The thing is, many infrastructure projects will be staffed by locals unless:

- It’s a truly remote location

- There’s extremely low unemployment

- The a local skill shortage

People are prepared to travel a long way to get to work in the morning. They’re not in the habit of moving their life for a temporary project. So, most infrastructure projects can pool workers from a very wide area.

Commute unless:

- > 80 mins

- 18+ month project

- High paying

Extreme cases are required to entice workers to transplant their lives just for one project. Without workers moving into the area, there is no pressure on accommodation for the duration of the project.

An example

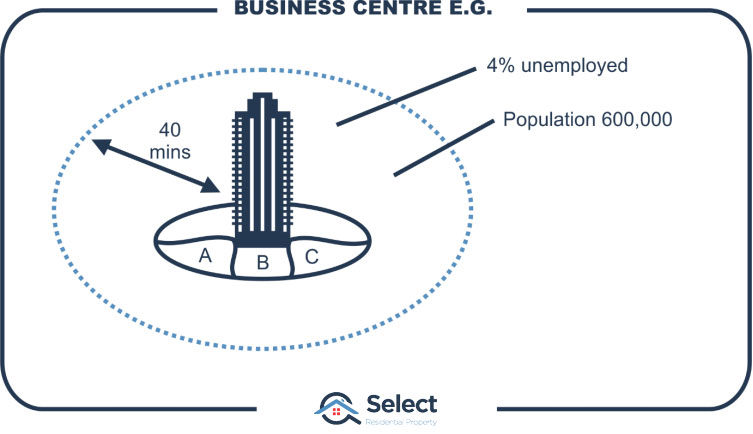

I had a client who planned to buy in an area of Brisbane that he believed was set for a price surge. His reasons were the completion of a new business centre that would bring 500 new jobs to the area.

I calculated the population within a 40-minute commute of the business centre. I then estimated the unemployment rate for this geography. There were literally thousands of potential job applicants who had no incentive to move one inch. And if they did move, they had a choice of at least half a dozen suburbs right next door to this new business centre. Not to mention a dozen more that were “close enough”.

The estimated pressure placed on housing would be unmeasurably small. I anticipated the vacancy rate wouldn’t budge. And this was the entire basis for the investor’s choice of suburb.

No news is good news

Over the years of publishing supply and demand data in magazines, newspapers and on TV & radio, I’m continually asked to provide some commentary about the hot growth markets I’ve picked. “What’s going on there? Is there some infrastructure project? What makes it so appealing?”

“I’ve found that the best markets are ones in which there’s nothing going on”

There’s no news. No news is good news for investors because it means developers aren’t interested. I’ve noticed that a great many hot markets become that way from a gradual shortage of supply which eventually becomes chronic, rather than from a sudden infrastructure project that pushes demand along.

Later I’ll show a tragic example of how big news blew any hopes of growth away for a town with a huge infrastructure future. But firstly…

Assessing dollar values

Another problem with infrastructure projects is trying to assess the impact on prices. You have to convert everything to an estimate of increased demand or limited supply. In most cases, it’s a best guess. You can’t simply relate the project’s budget to price rises.

Some projects have incredible budgets because of technical challenges. Like a harbour tunnel. But their impact on property prices might not reflect the multi-billion-dollar size of the project.

Massive infrastructure

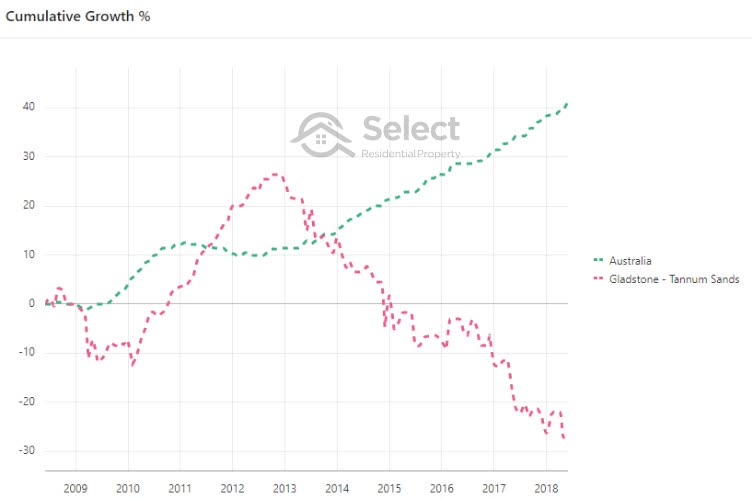

Gladstone in Queensland, back in 2008, had billions of dollars’ worth of projects lined up.

- $90b projects

- 30,000 residents

- $3m per person

- Prices fell

There were more than $3 million dollars’ worth of infrastructure projects per resident in the city. With all that wealth flowing into the economy, you’d expect prices to skyrocket. But as I’ll show you in a minute, prices actually went down, not up.

Miniscule infrastructure

At the other end of the spectrum I’ve heard one developer promote their project as a “growth market” because the local council had allocated 3 million dollars to road upgrades. $3million is nothing. That might get you a feasibility study for a decent sized project. It was probably just repainting the lines and filling in a few pot-holes. How is that going to draw in the crowds of buyers scrambling over each other to get a slice?

Aside

But that’s not the worst piece of developer spruiking I’ve heard. One developer was so desperate for investor attention his project’s claim to fame was that a celebrity went swimming nearby. I had to laugh. It’s not often you see cheap guff like that. Most developer project marketing is diabolically clever.

More appeal

The most likely positive impact an infrastructure project will have on a market is increasing the appeal of the location due to the convenience provided by some new amenity.

- Transport (road, rail, etc.)

- Business precinct

- Shopping centre

- Hospital

- University

Transport infrastructure is one of the biggest, since it makes other locations closer in terms of travel time. Business centres or other jobs nodes are another big drawcard. A new hospital, shopping centre or university or the expansion of current ones. All these are supposed to increase the demand for nearby accommodation.

But keep in mind that people prefer to travel rather than move. It takes a highly influential project, a really big one, to move the market by a significant amount. And even then, within a few years growth rates may have balanced out anyway. For more on that, check out this topic:

Schools shops transport etc are overrated

Big infrastructure – big news

The biggest infrastructure projects make the news headlines. And that means everyone finds out about them, including developers. Some of the biggest infrastructure projects in recent history have resulted in a property market that became a disaster area due to heavy developer activity.

Gladstone in QLD is a prime example. Around 2008, in the heat of the resources boom, there was about 90 billion dollars’ worth of infrastructure projects earmarked for Gladstone. But every developer and his cous’ new about these projects and started building something to house this massive influx of workers that was expected to pour into the city.

There was such a tremendous over-supply of property that flooded the market, the increased demand for housing was completely overwhelmed and property prices actually dropped.

It was made even worse in 2015 when the resources boom ended.

“It’s been more than 10 years and Gladstone prices still haven’t recovered”

Big infrastructure attracts the wrong crowd

Big infrastructure projects attract developers like manure attracts flies. Developers are the enemy of property investors. Developers create additional supply which thwarts capital growth. Supply needs to be constrained to have any chance of growth. At the same time there needs to be high demand to push prices higher.

I remember one hot-spot picking expert back in 2008 made very strong recommendations for investors to buy in Gladstone. Around the same time, he also picked Morwell, Sale & Traralgon in the Gippsland region of Victoria.

House prices in these suburbs have averaged less than 3% per annum growth – well below the national average growth rate for the 10 years since the recommendations were made.

Another one of this expert’s picks was Geraldton in Western Australia

The Geraldton property market was never any good to begin with and more recently has turned into an absolute disaster. I pity investors who paid for one of his reports and acted on it.

Another location he picked around the same time was Christies Beach in Adelaide.

It has also underperformed tragically. 4 massively different geographies and 4 massive failures. Now admittedly, he only picked one of those locations purely for its infrastructure projects. But the point is, you need to…

“Be very careful researching infrastructure projects, even the experts get it horribly wrong”

Timing

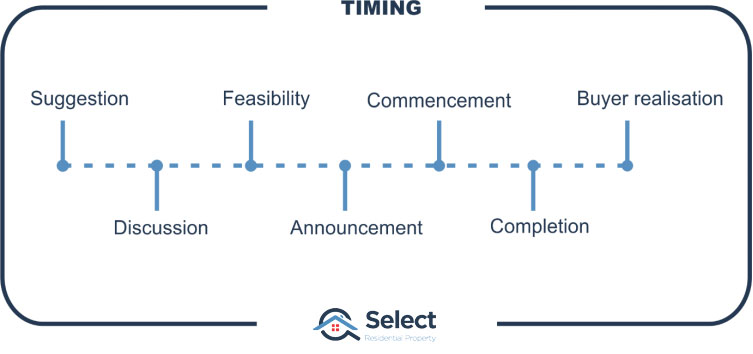

Infrastructure projects can sometimes take a long time to effect prices. Home buyers are slow to realise what the infrastructure means to life in the area.

Home buyers like to see it once it’s built and operational. They want to pay a visit and get a feel for it. They don’t speculate like investors do.

By the time buyers are aware of the benefits of the new infrastructure and start pushing up demand for property, the infrastructure project could already be a couple of years old.

I would recommend investors wait until the project is already influencing supply & demand rather than assume it will. This way you avoid getting caught out if the project is scrapped or takes years more to complete than you expected.

The growth phases triggered by infrastructure projects are not flash-in-the-pan. If they do start to influence supply & demand, you’ll have plenty of time to enter the market before the growth rate starts to diminish.

Over-rated

Many infrastructure projects are over-rated in their influence on prices. For example, a new train line that runs through a suburb may give a major boost for the suburb’s appeal. But without adequate parking, it might not have wide influence across the entire suburb. It might be limited only to properties within walking distance.

Most new infrastructure has little impact on prices. That’s because most buyers have a lot of requirements on their list:

- Close to work

- Shops

- Good school

- Appropriate housing

- Family

- Parks

- Affordable

- Safe

- Cafes

- Quiet

- Public transport

- Lifestyle/entertainment

- Place of worship

- Fitness facilities

- Restaurants

- Beach

- etc.

If public transport was improved, that’s great, but it might only be one item on a potential resident’s list of “wants”.

Less appeal

And not all properties in the area will benefit from new infrastructure. A new shopping centre for example could wreak havoc with limited parking and traffic jams. It could disturb the atmosphere in nearby streets that were once considered peaceful and charming.

A new train line will probably have to run past houses, increasing their exposure to noise – same for a new motorway. But an airport is the big noise bringer. Jet engines can be heard for many kilometres.

The Queensland University of Technology and the Air Transport Innovation Centre performed a joint study around 2016. It examined how the opening of Brisbane’s new “international” airport in 1988 affected property prices under the flight path.

The report found that price growth suffered for about the next 4 years. But from then on, for the next 20+ years, growth of affected suburbs actually caught up with suburbs that were not affected by aircraft noise.

In other words, the infrastructure’s introduction affected growth rates negatively, but only for a few years. And over the long-term it made no difference.

Alternatives

A better approach to chasing infrastructure project is to wait and see if they are actually having an impact on the supply and demand of property and to accurately gauge by how much. There are better metrics to gauge supply & demand than the number of dollars spent on a project or the number of jobs it created.

Conclusion

In summary, it’s hard to research an infrastructure project and objectively calculate the impact on demand for property. Most researchers are really only guessing. And most research reports are merely marketing from developers.

It’s also hard to know what additional supply a project will trigger among developers.

Most projects only add one new amenity/convenience to an area. But residents want several before committing to a move.

And lastly, the measure of supply and demand for a market is much easier to gauge using metrics other than the size of the project or how many jobs it’s supposed to create.

- Hard to objectively gauge

- Triggers development

- Over-rated growth influence

- Better alt. measures of supply & demand

You might like to check out some of the other topics in this series, there are more over-rated indicators you need to be aware of: