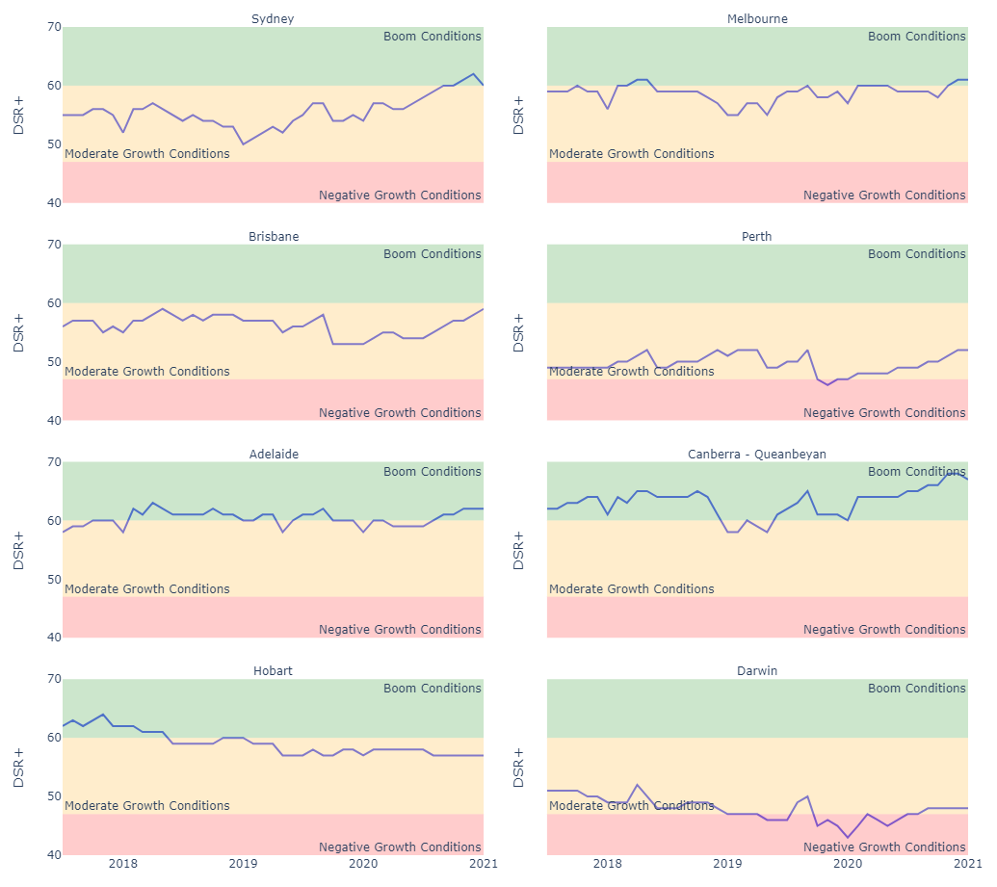

The charts show the change in the Demand to Supply Ratio (DSR+) for the last few years for our state capitals. Boom conditions are already present in half of the cities. Key takeaways:

- Sydney and Melbourne have returned to seller markets

- Brisbane has shown a dramatic rise in the last 6 months

- Canberra has the most solid growth prospects

- Hobart’s boom days are over – moderate growth from here on

- Perth’s worst is behind it, but that doesn’t mean a boom is nigh

Sydney’s last boom started around 2012 and had pretty much finished by 2017. The peak Demand to Supply Ratio was reached at the start of 2015. The DSR+ was 61 back then. So, when a city’s average DSR+ rises above 60, it’s a good sign of growth potential.

The charts show the change in the Demand to Supply Ratio (DSR+) for the last few years for our state capitals. Boom conditions are already present in half of the cities. Key takeaways:

- Sydney and Melbourne have returned to seller markets

- Brisbane has shown a dramatic rise in the last 6 months

- Canberra has the most solid growth prospects

- Hobart’s boom days are over – moderate growth from here on

- Perth’s worst is behind it, but that doesn’t mean a boom is nigh

Sydney’s last boom started around 2012 and had pretty much finished by 2017. The peak Demand to Supply Ratio was reached at the start of 2015. The DSR+ was 61 back then. So, when a city’s average DSR+ rises above 60, it’s a good sign of growth potential.

The longer the time-frame, the more frequent are these pinch-points. Quite often one market will take the lead and the other will not only catch up, but overtake. And then the next decade they trade places again.

Regions

Looking at regional areas, plenty of the larger ones look pretty good too as the following charts show.

These are the biggest 8 significant urban areas that aren’t state capitals. Large coastal satellite cities are showing great potential. In particular, those within a reasonable drive immediately north or south of Sydney and Brisbane.

Conclusion:

With all the public commentary of heat in regional markets, you’d think investors should only seek out a regional market for the best growth. But there are plenty of strong state capitals to pick from. According to the data, there’s no reason to single-mindedly pursue a regional market – good news if they worry you.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data