What is Infill Risk?

Infill risk is the risk of an area being heavily developed in the future.

Supply is the enemy of capital growth. So, to maximise future growth from your property, you need to choose a location that will have minimal new supply in the future.

It’s almost impossible to find safe locations for unit investment, since they can be built higher and higher just about anywhere. But with houses it’s relatively trivial.

Avoiding Oversupply

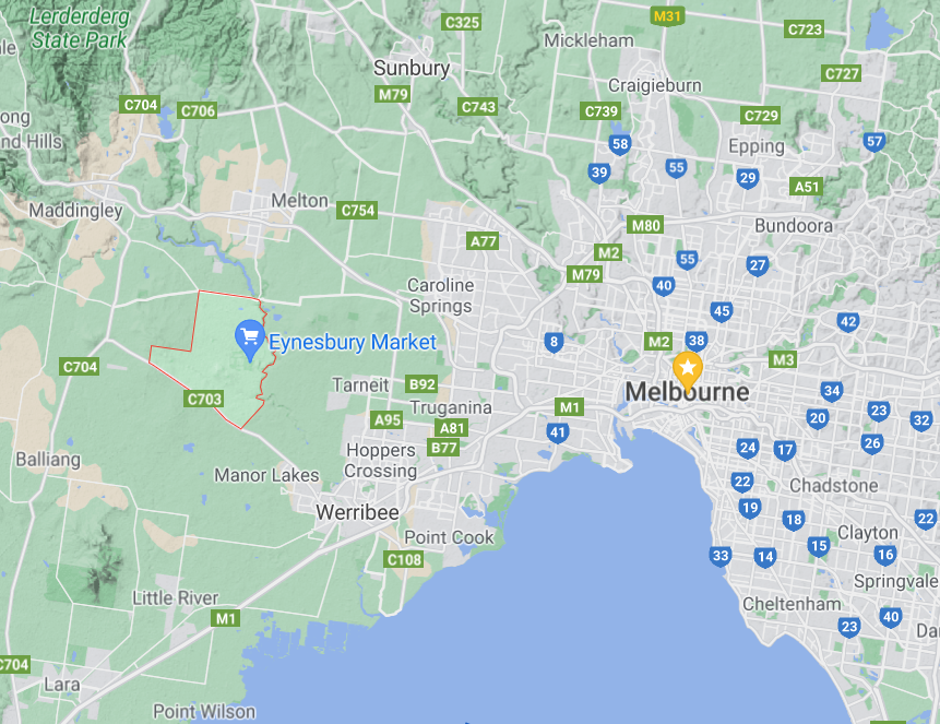

If you’re hunting for a house, to avoid oversupply, all you have to do is avoid large tracts of vacant land like in the image below to the west of Melbourne…

The above image shows built-up areas in grey and vacant land in green.

The suburb to the west of Melbourne highlighted in red is Eynesbury. It’s a classic no-go zone – house and land packages in the middle of vacant land that can be developed for decades to come.

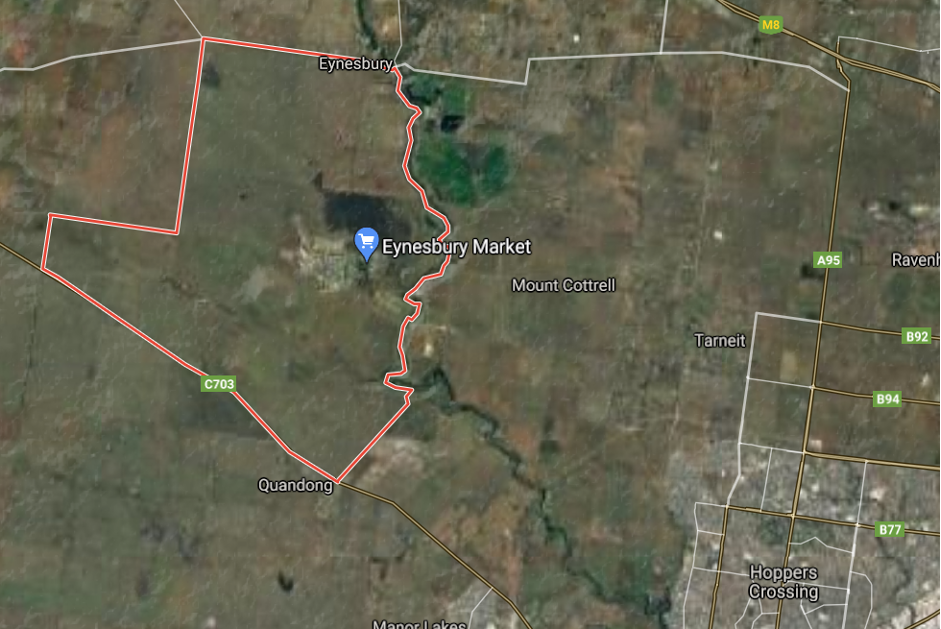

Switching between street and satellite view and zooming in can help identify the problem…

Even if there’s no development proposed right now, there could be next year.

Right now, house and land packages are in high enough demand for this not to be a big deal for most locations. The level of interest from buyers might be sufficient to exceed the ability of local government and developers to supply the infrastructure and new lots. But why take the risk?

A Safer Bet

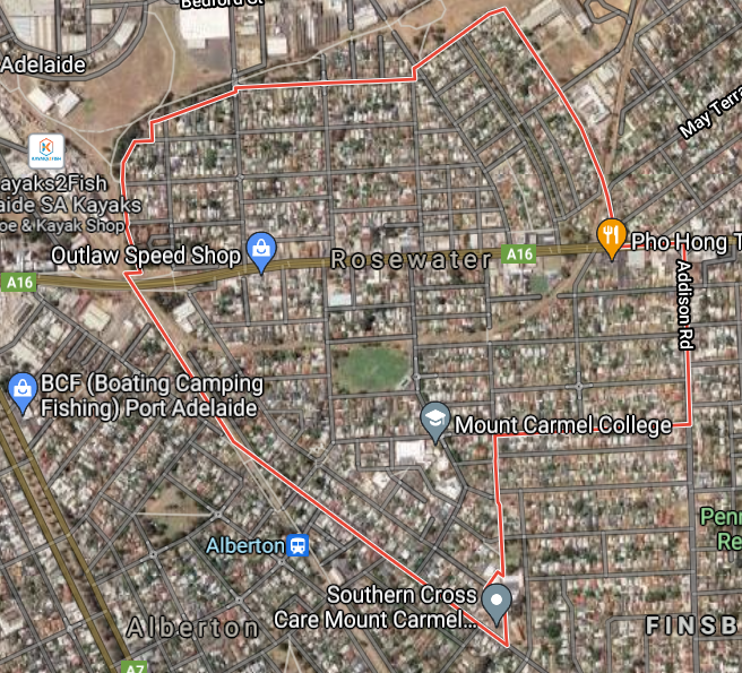

A safer bet would be a fully built-out area as shown following…

This is a suburb to the north west of Adelaide’s CBD. You can see there’s no more vacant land within the suburb, or in its immediate neighbours either. So long as you buy a house in this suburb, it’s a much safer investment over the long-term than a unit or a house near vacant land.

Infill Example

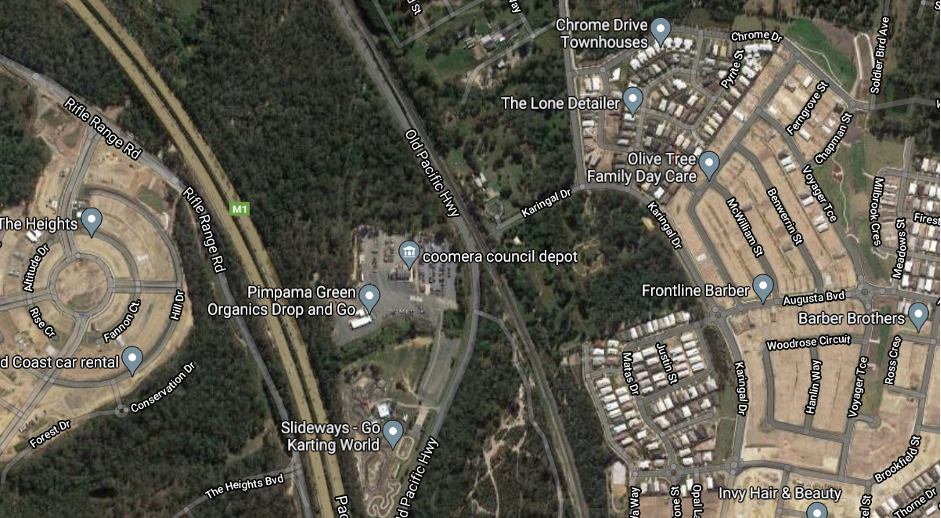

Here’s an aerial view of a spot between Brisbane and the Gold Coast that has been the target of heavy infill for quite a few years now…

The brown scars are where vegetation has been cleared for new houses…

Some streets have been planned, but vegetation not cleared yet, you can see the streets pencilled in…

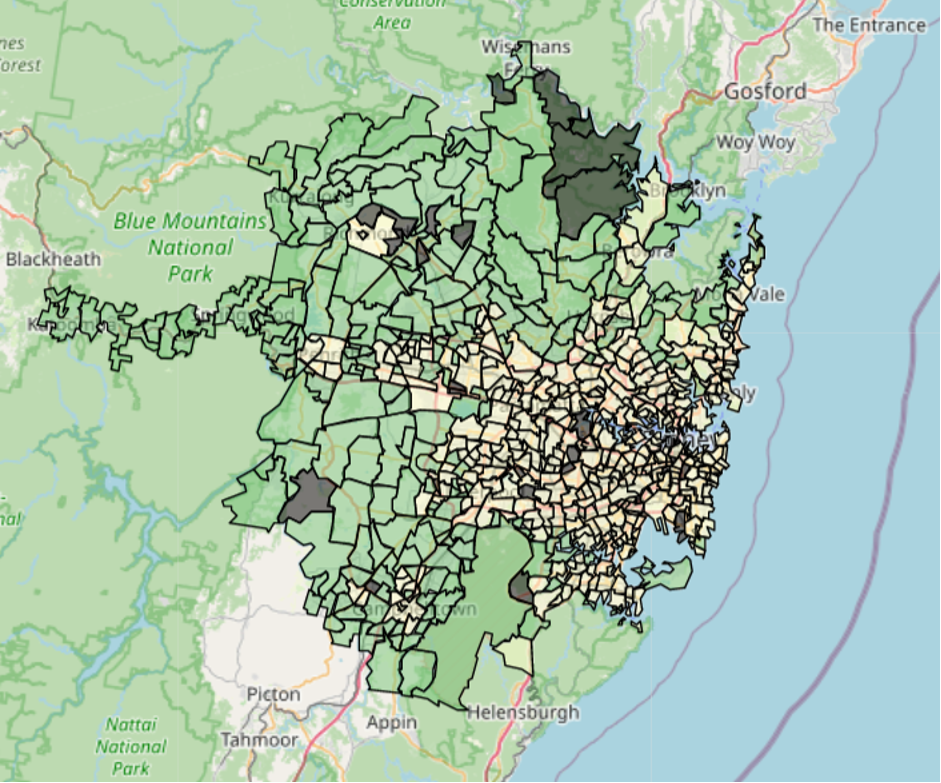

The following map is of Sydney. It shows suburbs with low risk of infill in yellow. These are fully built-out. The areas in green are suburbs deemed to have “some” risk of infill

As you can see, there’s quite a fair bit of vacant land around Sydney. The most likely risk in the majority of these green suburbs is fairly mild though.

The suburbs in dark grey were not “assessable”.

Summary

Include infill risk in your research. Online maps are your friend.

Be careful not to confuse vacant land with national parks, reserves, golf courses, ovals, etc. And don’t worry about a few vacant lots if you zoom right in.

If you plan to hold long-term, don’t buy a unit and avoid the greenfield estates with house & land packages.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data