Introduction

We all know that growth is the ant’s pants of property investing and yield plays 2nd fiddle. But how easy is it to get both high yield AND high growth?

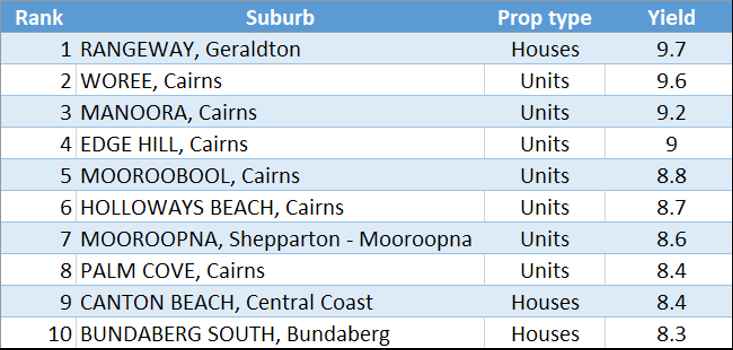

High Yielders - 3 Years Ago

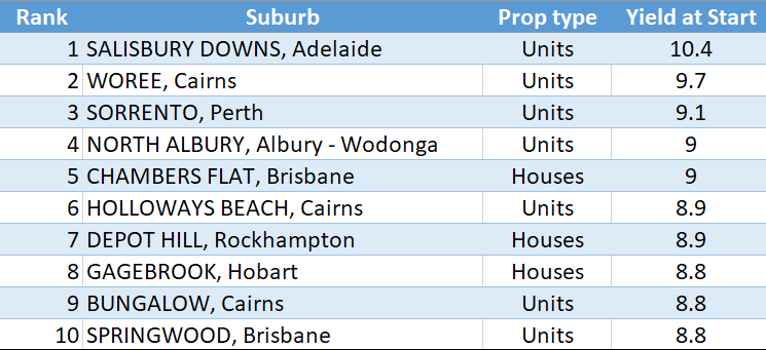

The following table shows a list of the top 10 suburbs in the country by yield, from 3 years ago.

Yields fluctuate from month to month, so as it turns out, over the 3-year period, the best cash-flow actually came from Edge Hill units in Cairns – not Rangeway houses. Investors were paid rent equal to 30% of the original price they paid over the following 3 years (minus management costs of course).

The growth in unit “values” in Edge Hill over those 3 years was pretty good too at 39%. Growth and yield together paid back an investor 69% of their investment in just 3 years.

But the best result was actually Canton Beach houses in the Central Coast. Although the rent over 3 years was only 26% of the property’s value, the growth in value was a staggering 224%, nearly 10x more growth than rent.

But these were exceptional cases. Looking at the top 100 provides a more realistic sample of what to expect. The top “100” highest yielding suburbs had a median combined rent and growth of 57%.

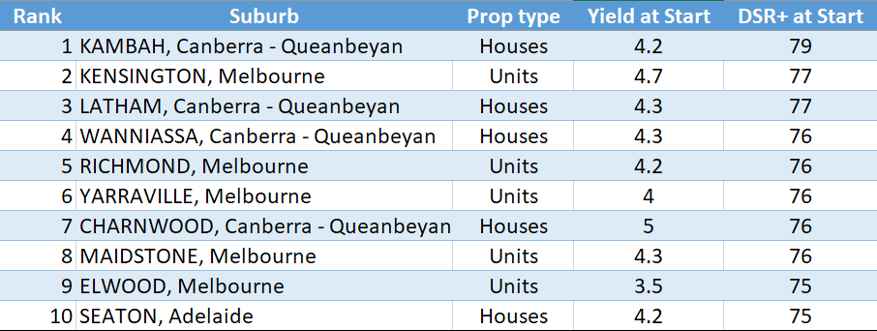

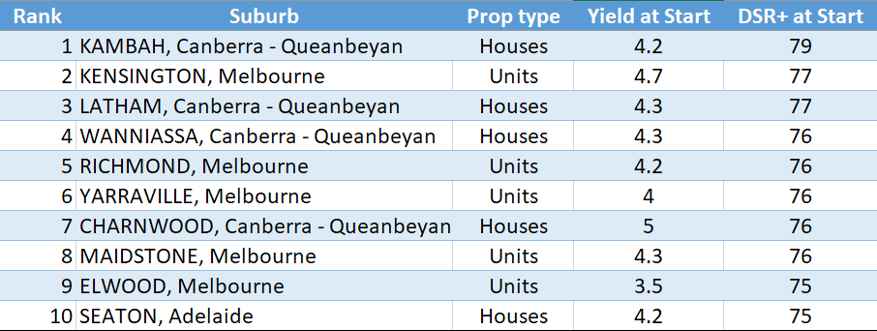

High Growers – 3 Years Ago

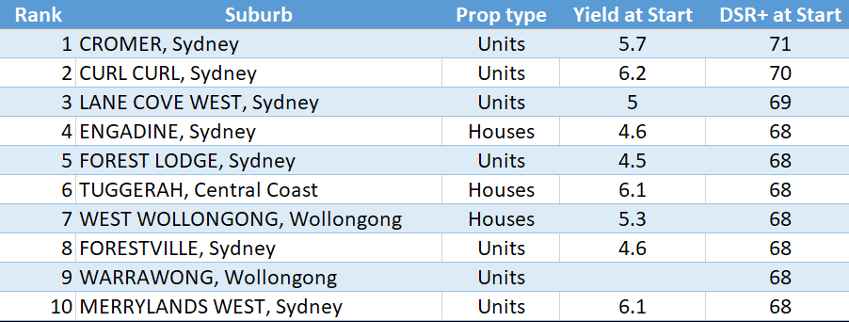

The following table shows the top suburbs for growth potential from 3 years ago as ordered by the demand to supply ratio (DSR+). Note that these aren’t the top capital growth markets over that 3-year period looking back at growth. They’re the top 10 if you were looking forward from that time, hoping or aiming for growth into the future.

Note the yields are only half as good as the prior list. The best was Charnwood houses, which delivered 17% of its original value in rental income in 3 years. It also delivered the best growth of 60% for a total of 77%.

The median combined growth and rent for the top 100 DSR+ markets over the 3 years was 55%. Remember, it was 57% for the high yielders. But it’s a bit misleading.

Firstly, the high yielders are quite often those suburbs where there’s an anomaly in the median. It’s usually a lot higher in reality. This exaggerates the yield and the capital growth too.

Secondly, the higher the gross yield, the lower the net yield is as a proportion. In other words, if the gross yield is only 2.5%, the net yield won’t be too much lower, maybe 2.0%. But if the gross yield is high (e.g., 9%), the net yield will be a lot lower (e.g., 5%).

So, although it looks like the top yielders edged out the top growers, it’s more likely the other way around.

Let’s stretch out the timeframe to something a little more practical – 5 years.

High Yielders - 5 Years Ago

The best rental income over the 5 years came from Clarendon Vale houses in Hobart. The rental income equalled 63% of the property’s original value 5 years ago.

But it was the growth, not the yield, that changed an investors life in this suburb – an amazing, 251%.

Again, this is a rare case, and not easily replicated into the future. A more accurate assessment requires a larger sample size. The combined growth and rent over 5 years for the top “100” had a median of about 75%

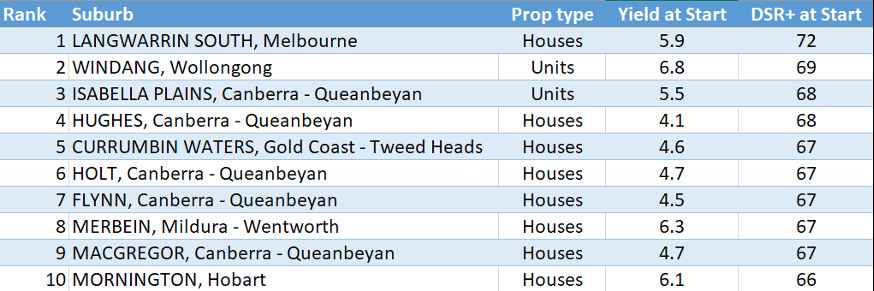

High Growers – 5 Years Ago

Again, this table does not show the best capital growth suburbs, just the best suburbs with “potential” for capital growth as assessed 5 years ago using the demand to supply ratio

The average growth from these top 10 was 80% in total over the 5-year period. Some of the yields weren’t so bad either. Adding in the yield totalled 107%.

The median growth and rent for the top 100 DSR+ markets over the 5 years was 88%.

High Yielders - 8 Years Ago

Houses in Gagebrook in Hobart had the best rental income over the 8-year period, racking up a total of 99% of the median value from 8 years ago. Remember though, gross rent does not equal net rent.

Gagebrook also took out top spot for growth with 196%.

Interesting how often it is that the best total rent came from a suburb that also had the best capital growth. This is because supply and demand dictate changes in both the values of properties and rents.

The median combined 8-year growth and rent from the top 100 yielders was 106%.

High Growers – 8 Years Ago

The best rent gain was 60% from Curl Curl units in Sydney. They came 2nd in capital growth too with 173%. Warrawong in Wollongong came 1st with 179%.

The median combined 8-year growth and rent from the top 100 DSR+ markets was 158%.

CONCLUSION

Capital growth is still the ant’s pants of property investing, easily trumping yield in overall net wealth creation over any period. But sometimes yield is more important to cash-strapped investors or retirees.

Anyway, it doesn’t look like it’s hard to find both – search for suburbs in which demand exceeds supply and you’ll probably find rents rising as well as property prices for the same reasons.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data