Introduction

The “Ripple Effect” is a phenomenon often witnessed in the growth cycle of a city. Capital growth typically starts near the city centre in the more expensive suburbs. It then spreads towards the fringe suburbs like ripples on a pond.

At SRP we have a calculation to measure it. The metric is called the REP (Ripple Effect Potential).

You can read more about it here https://dsrdata.com.au/stats/rep

Sydney’s Prior Growth Cycle

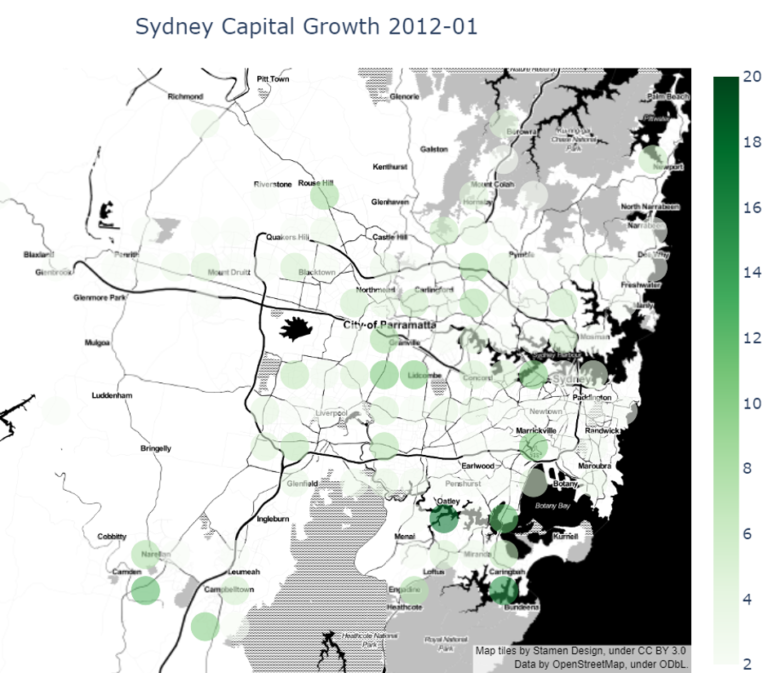

Sydney had a pretty good boom from around 2012 to 2017. Here’s a heat map of the 12-month growth leading up to January 2012.

The numbers running up the colour scale on the right are % per annum growth rates. The map shows there was very little growth across Sydney in the prior year. And it had been like this for almost a decade.

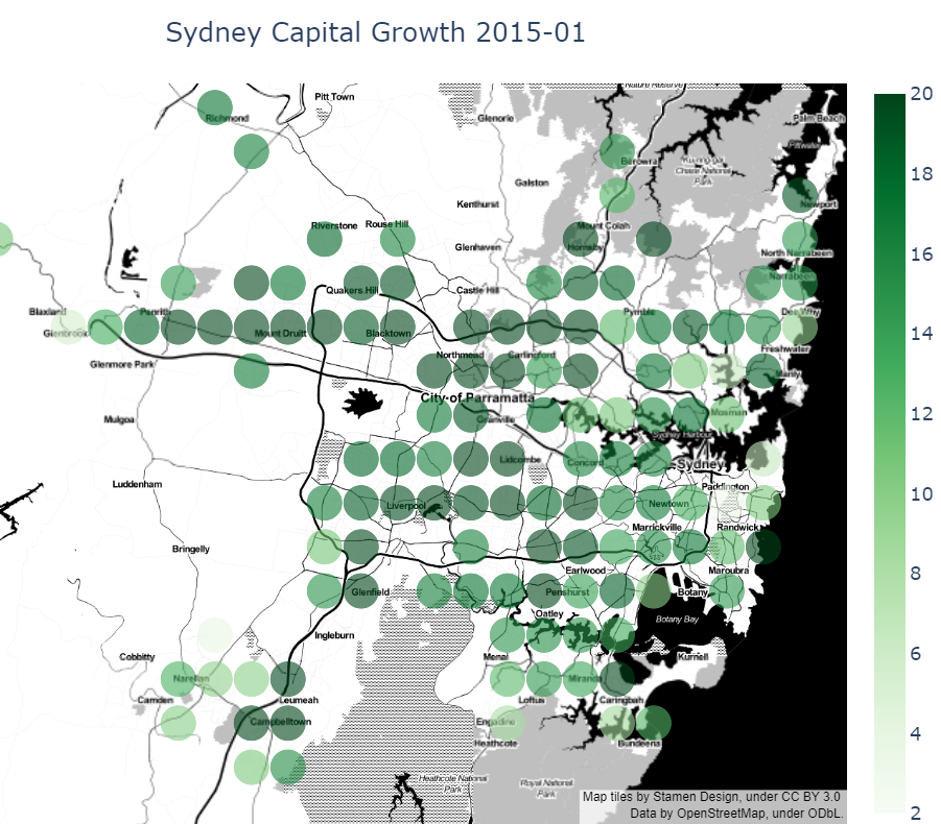

Here’s the same heat map 3 years into the cycle.

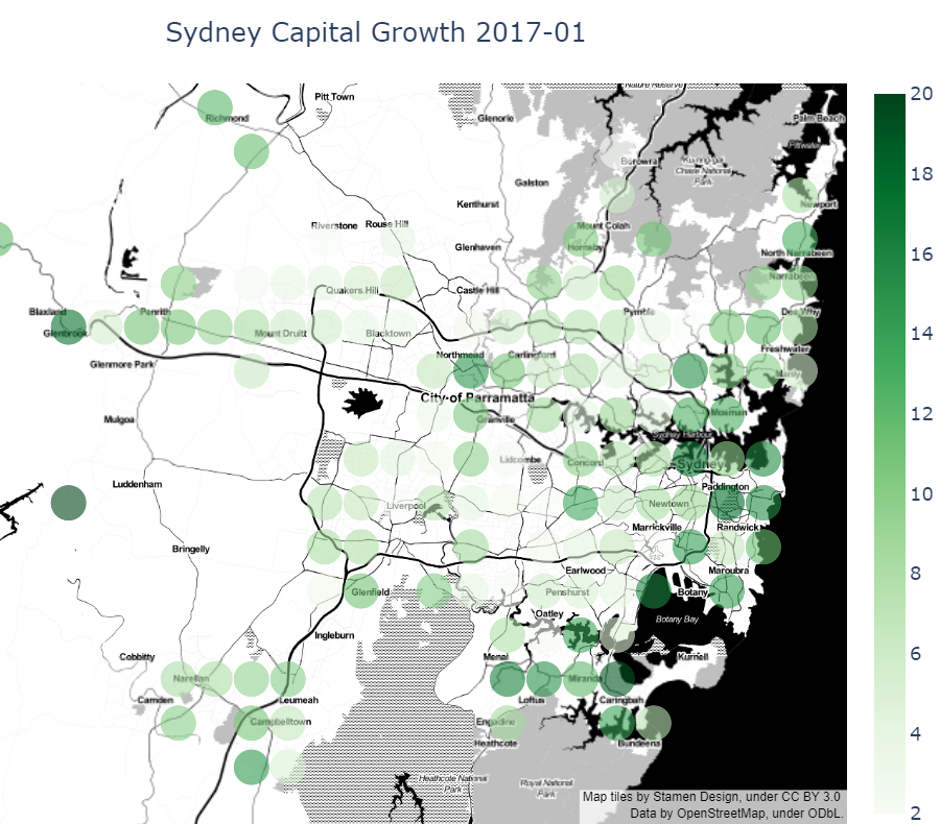

But the growth rate started diminishing in 2016. By the start of 2017, here’s how things looked…

Most of the city had finished its run, but there were still a few spots of growth finishing off the cycle. Note the cluster around the CBD. Normally, we’d expect outer suburbs to dominate the remaining growth.

You can see how the cycle of growth played out in this 15 second video…

A Brisbane Growth Cycle

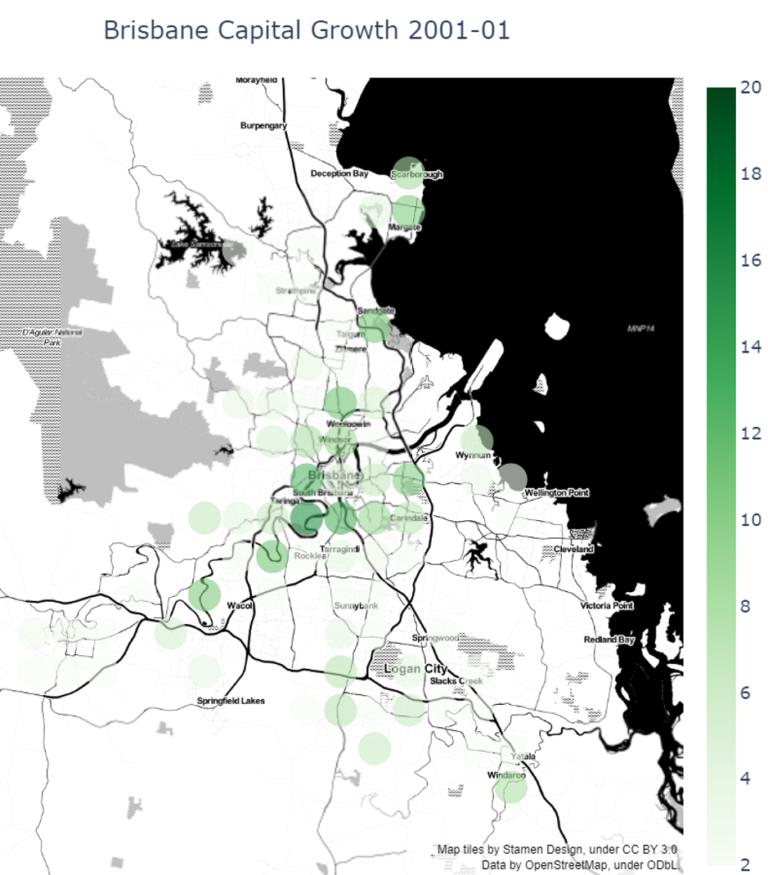

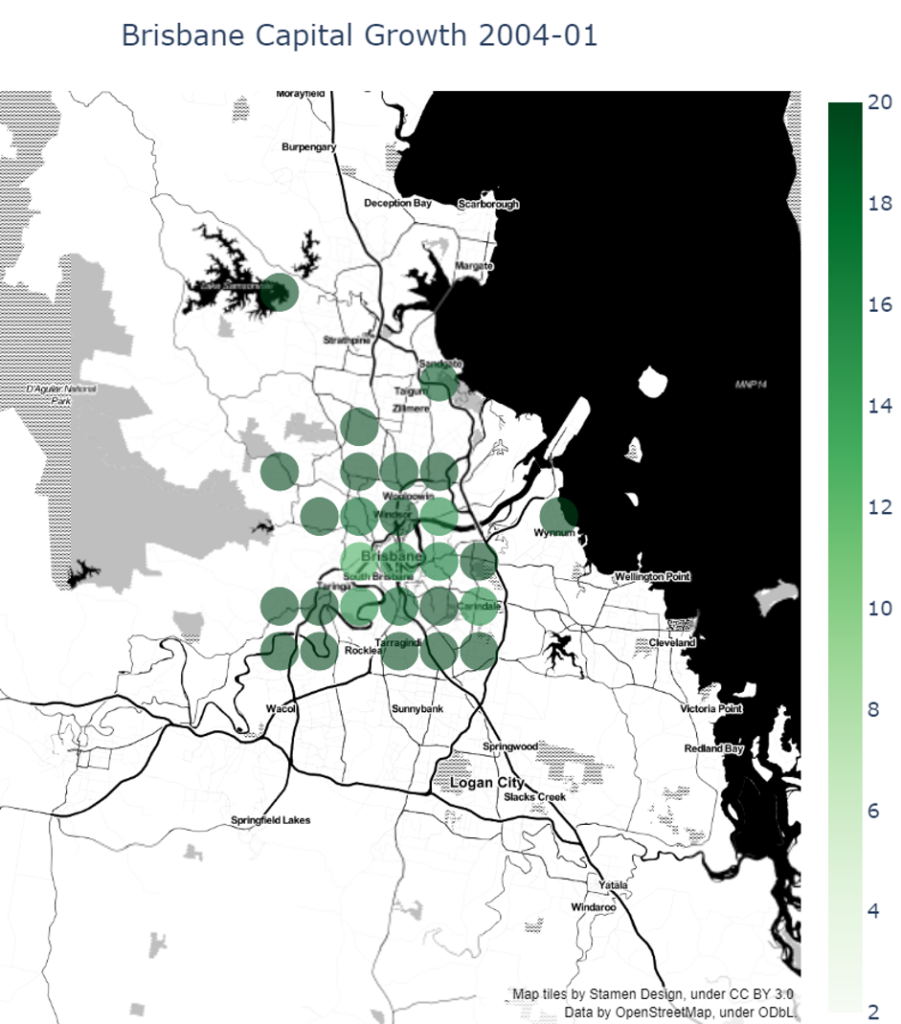

Following is a Brisbane growth cycle from 2001 which went more like Melbourne’s, starting closer to the CBD and spreading outwards.

The big upswing was across 2003.

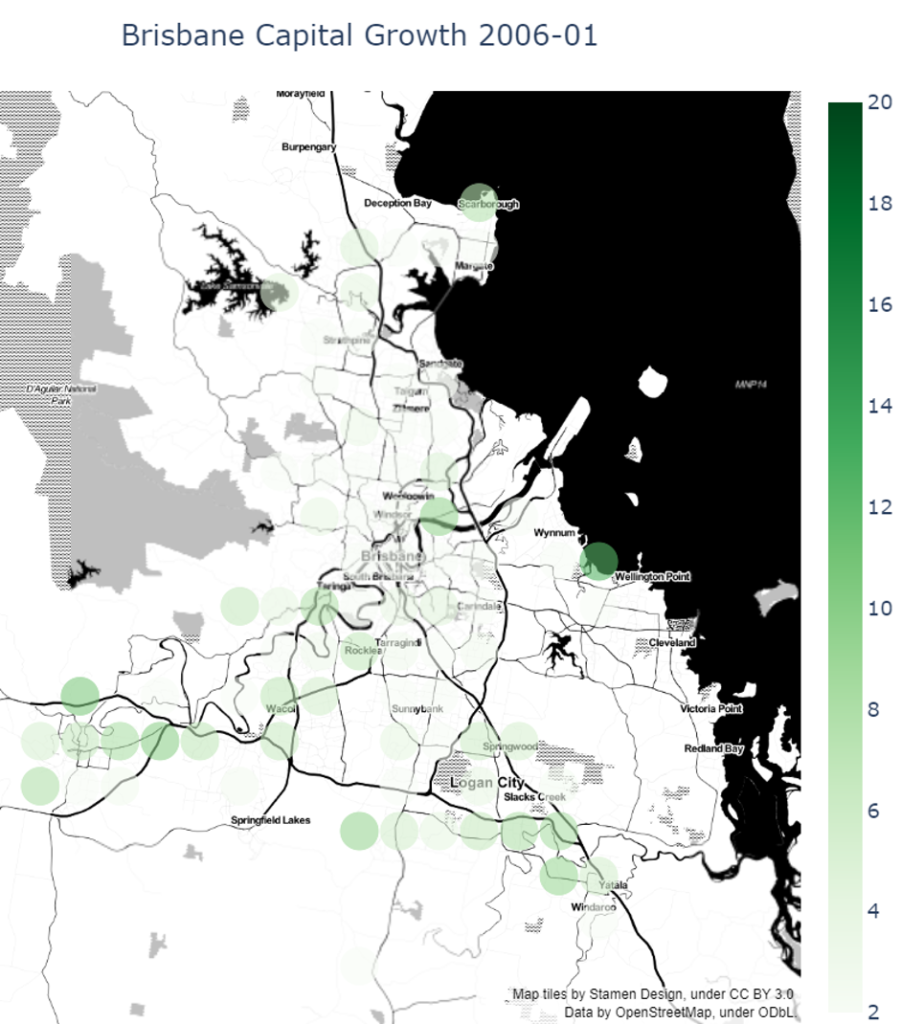

By 2006 the growth had finished in the inner rings and there was only a trickle in the fringes.

Conclusion

The ripple effect doesn’t play out perfectly like the clear-cut symmetrical ripples on a pond. But there’s enough in the data to verify that the effect is real. It makes sense too; buyers get priced out of one market and look for cheaper alternatives. Neighbouring suburbs that haven’t had their growth spurt, look like good value.

In all the examination I’ve done over the last decade of capital growth drivers, I’ve never found one metric I could really “hang my hat on”. I would never base an investment decision on a single metric. Confidence comes when a bunch of metrics are pointing in the same direction. Ripple Effect Potential is only one.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data