Introduction

This month’s newsletter takes a quick look at how regional markets have performed recently compared to the big smoke in each state.

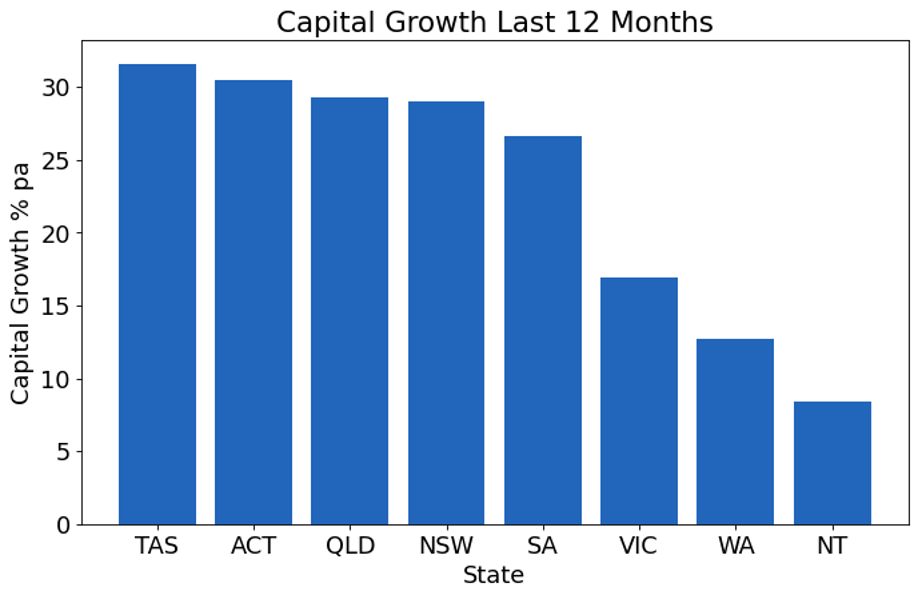

National Growth Rate

Looking at nearly 13,000 suburbs across all of Australia with house sales data in both January 2021 and 2022

National Median House Growth Rate was 26.7%

Breaking it down by state, we can see that there was some growth everywhere and pretty exceptional growth in most states.

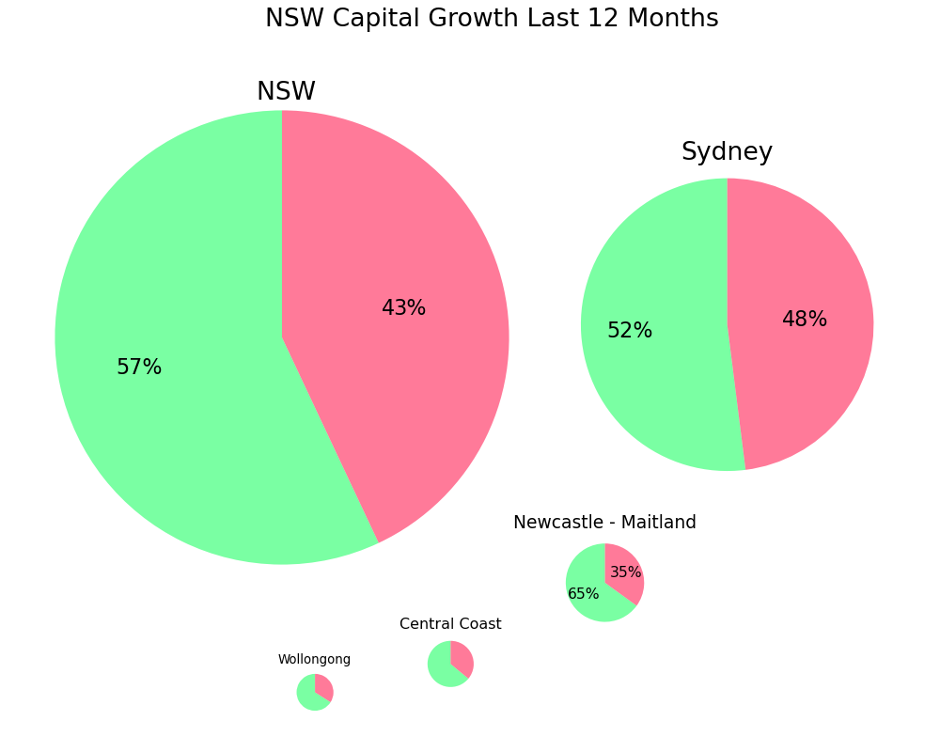

NSW

NSW’s median house growth rate was 29.0% when restricted to the following top 4 significant urban areas:

· Sydney greater metropolitan area

· Newcastle – Maitland area

· Central Coast

· Wollongong

Sydney is the largest urban area in NSW. There are around 700 suburbs in Sydney alone. The top 5 areas of NSW have a total of only 1,072 suburbs.

The size of the pie charts reflects the number of suburbs. Sydney has the lion’s share of suburbs in NSW.

The proportion of green in each pie chart represents the percentage of suburbs in that geography that outperformed the national median growth rate. Roughly half of Sydney’s suburbs outperformed the national growth rate. But in the other major urban centres of NSW, the ratio of outperformers was closer to two thirds.

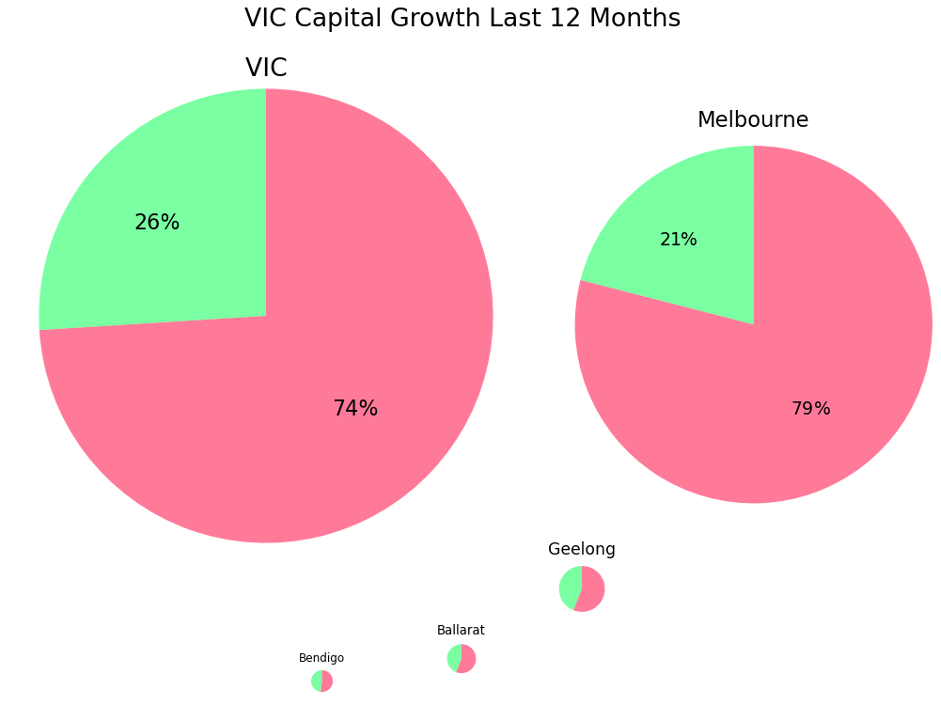

VIC

Victoria had a rough trot over the last year compared to the nation overall. Only 26% of the suburbs in Victoria’s 4 largest urban areas outperformed the national growth rate.

Notice again, that the regional markets of Victoria did much better than Melbourne – literally twice as good. But given Melbourne contains a large portion of Victorian suburb, it weighed down the state’s overall performance compared to the rest of the nation.

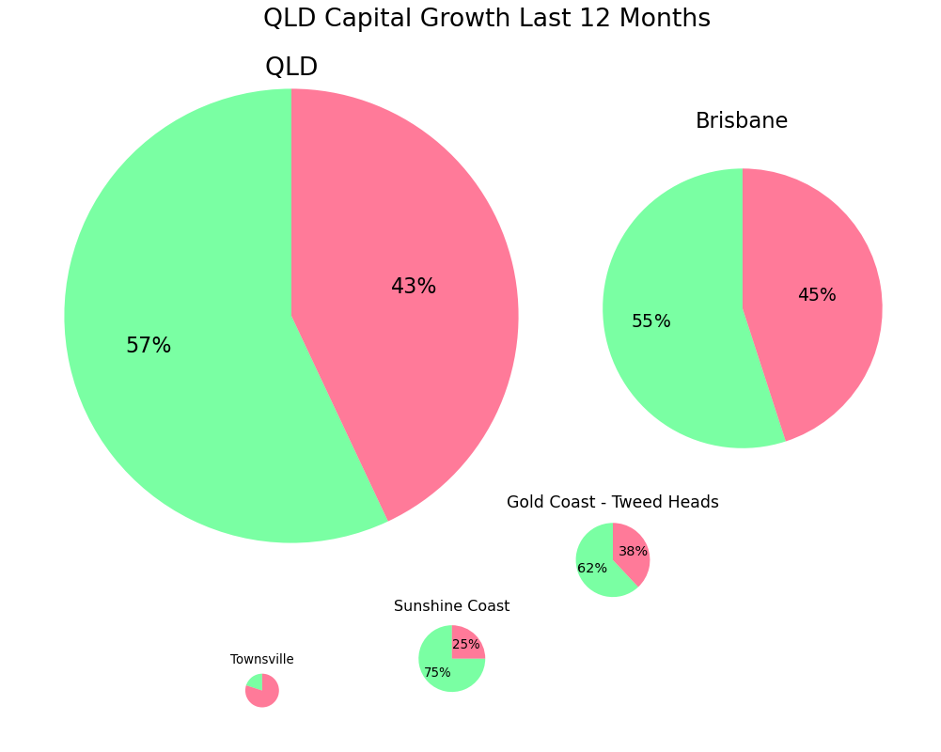

QLD

Note in the following chart that Queensland has less concentration of suburbs in its state capital compared to most other states.

It would have been easy to pick an outperformer in the Sunshine Coast with 3 out of 4 suburbs there beating the national growth rate. You’d be an unlucky investor to not be up by 30% from a year ago.

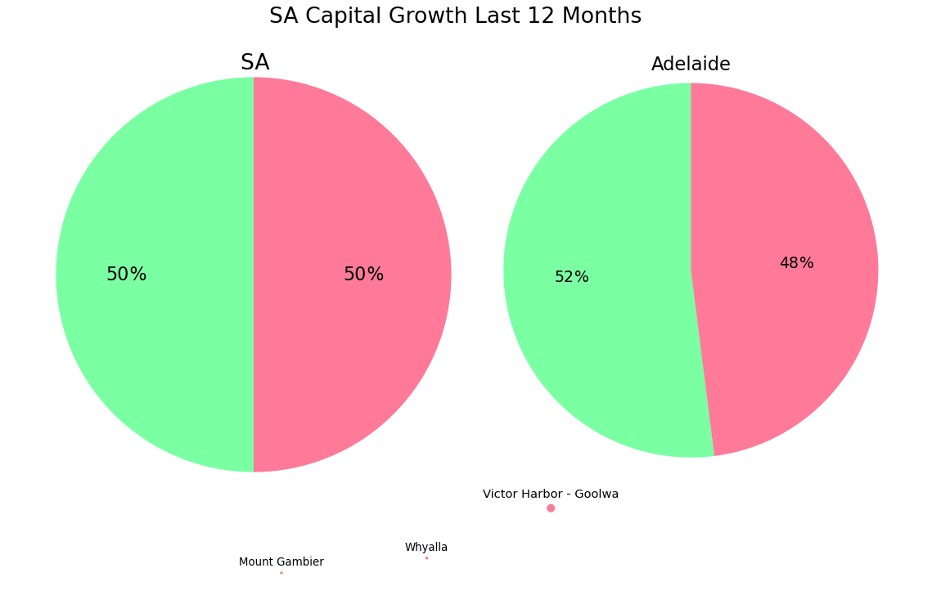

SA

South Australia’s population is predominately in Adelaide.

This is one state in which regional markets did NOT outperform the state capital. It’s hard to see from the pie charts of South Australia’s next 3 largest urban areas after Adelaide since they’re so small. But they are heavily dominated by red.

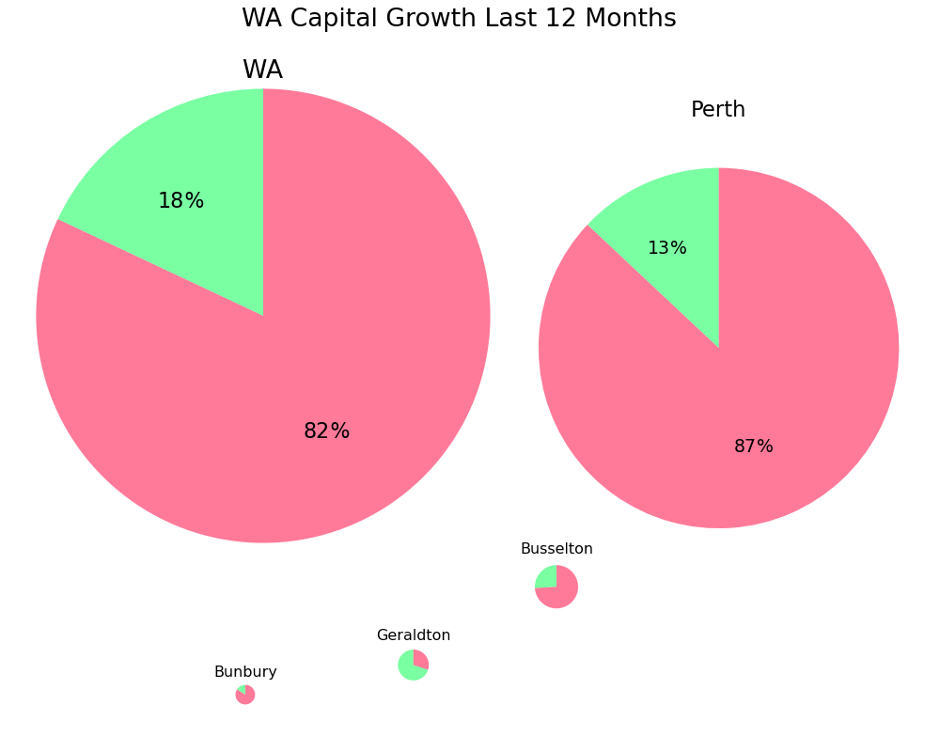

WA

Although there are some signs of life in Perth, most of the city’s suburbs were fairly subdued compared to the rest of the nation.

The regions had better growth than the state capital. Geraldton was the standout, most suburbs there outperformed the national growth rate.

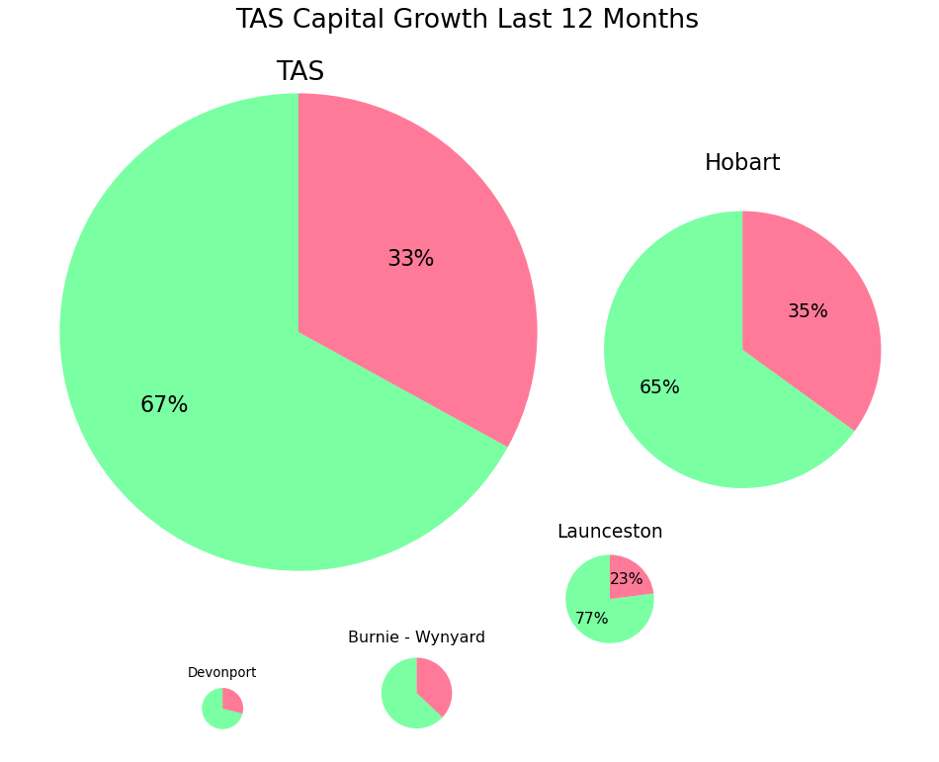

TAS

Tasmania has a far less concentrated population than the mainland states.

The performance was pretty consistent across Tasmania, both the state capital and the regions had excellent growth over the last 12 months.

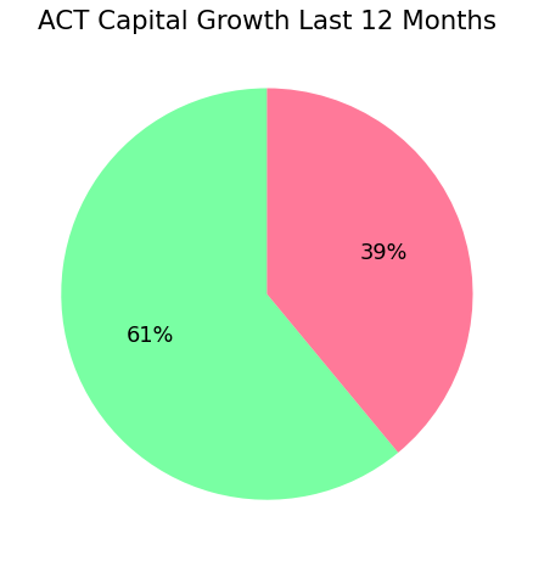

ACT

The ACT doesn’t have any major urban sub-regions we can look at. But the state itself performed favourably compared to the rest of the nation.

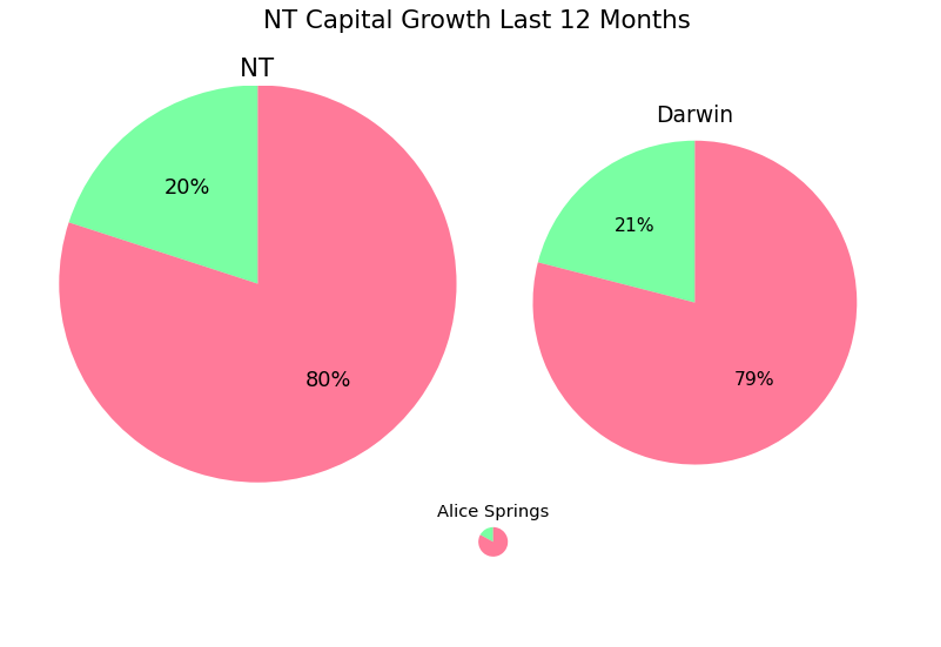

NT

Similar to the ACT, there’s not much in the NT outside of Darwin. And it didn’t perform any better.

CONCLUSION

Regional markets have outperformed their state capital city in every case except South Australia and the Northern Territory.

Note that at any given point in history, regardless of how cracking the national growth rate is, there’s always half the markets ahead of the national median growth rate and half behind it.

There’s bound to be a lot of bragging in the future about the capital growth that was achieved by investors over the last 12 months. Although 27% sounds very impressive, it’s actually pretty ordinary according to the data

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data