Introduction

This newsletter is all about the filtering process required to find suburbs worthy of investing in. For example, what are the best suburbs to invest in Australia with prices between $600,000 to 800,000?

Finding Details

It depends on what we mean by “best”. For this example, I used Market Matcher to filter the entire Australian property market using the following criteria:

Reliable data: Statistical Reliability of 70 out of 100 or higher. Risk is not knowing.

High demand relative to supply: DSR+ of 65 out of 100 or higher. High demand relative to supply leads to capital growth.

Sufficient cash-flow: yield of 4% or higher. I don’t want the mortgage to be a drain.

Secure tenants: vacancy of 1% or lower. Low vacancy rates put pressure on rents to rise.

In addition to the above criteria, I also selected Houses only since they make for better long-term investments compared to units.

And I limited the search to state capitals. I think you can find great property outside state capitals, but I wanted to limit the number of charts, which you’ll see in a sec.

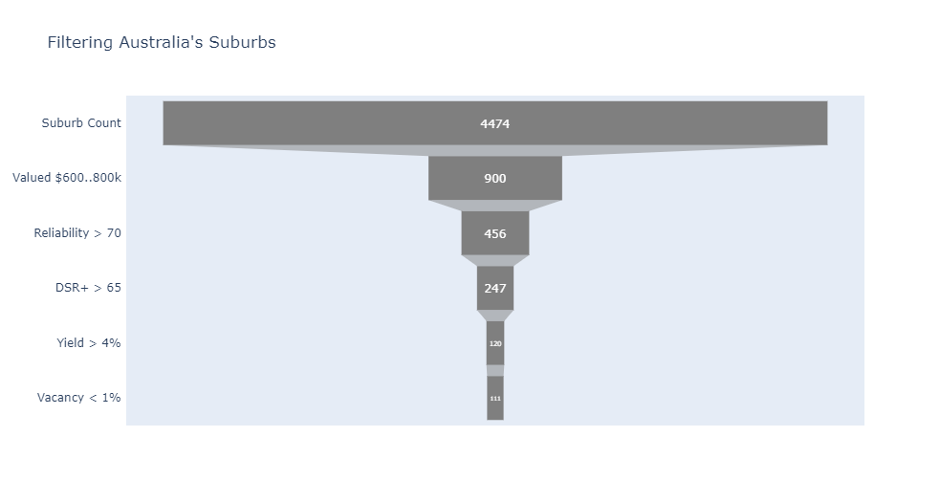

Australia-wide

Here’s how the filtering process went.

This is called a funnel chart. The top of the chart starts with a total count of all suburbs summed from the 8 state capital cities.

The left of the chart shows the filter applied. The next level down shows how many of the suburbs above passed the criteria to the left.

There are nearly four and a half thousand suburbs to choose from in our state capitals. But only 900 had a median house price last month within the target price range. Around 4 in 5 were weeded out with application of the 1st criterium.

Out of those within the target price range, about half had unreliable data and had to be omitted. So, 900 options dropped to 456 with reliable data.

From the remaining 456, only 247 had a demand to supply ratio upwards of 65.

120 of those qualifying the criteria so far, also had a yield of 4%.

And lastly, 111 of those 120 had a vacancy less than 1%.

This filtering process has eliminated 97.5% of the Australian combined state capital property market. And I did it all from my desktop within a couple of minutes. The power of property data.

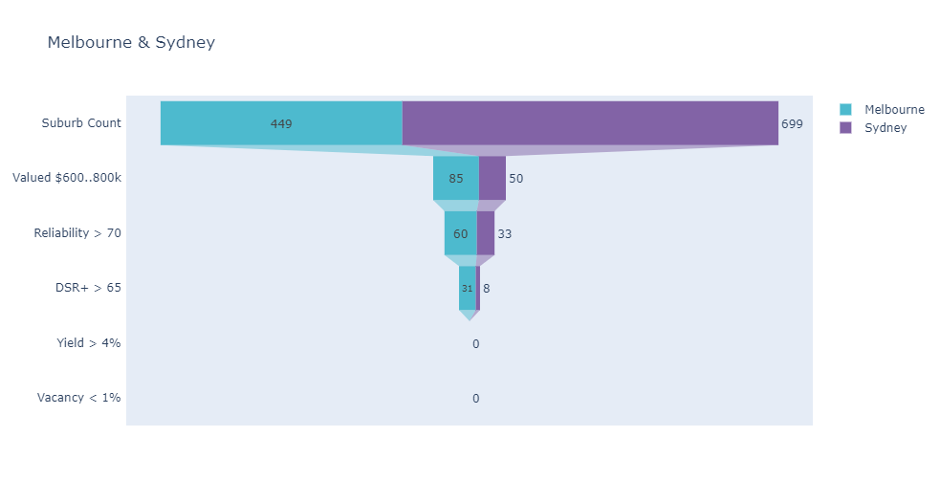

Melbourne & Sydney

None of the suburbs satisfying my search criteria were found in either Melbourne or Sydney. Here’s what happened when I applied the filters to those 2 cities specifically

Understandably, the low price-range filtered quite a few suburbs out right from the start. The chart shows the stopping point in these two cities was yield. No hope of finding what I’m after in those cities.

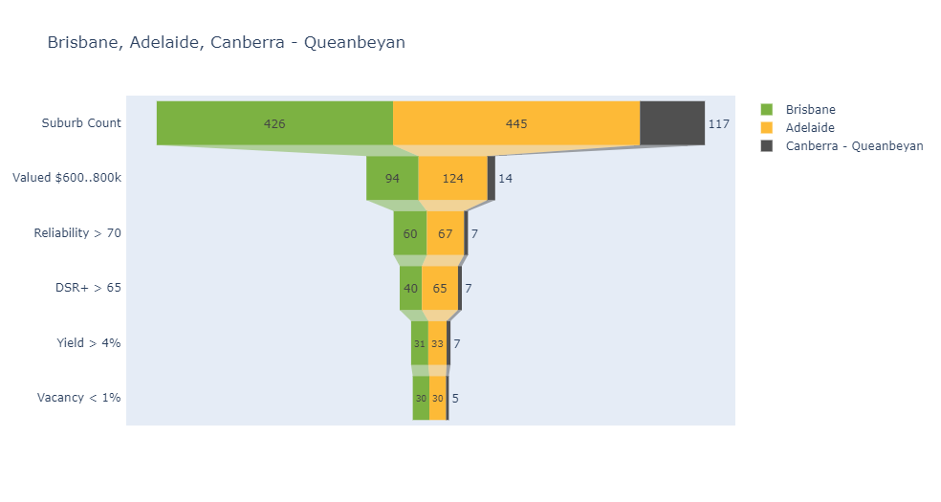

Brisbane, Adelaide & Canberra

Adelaide and Brisbane have very similar investment metrics and the greatest number of suitable markets – both 30.

Note that Canberra is a much smaller market than the others. And this is even after including Queanbeyan.

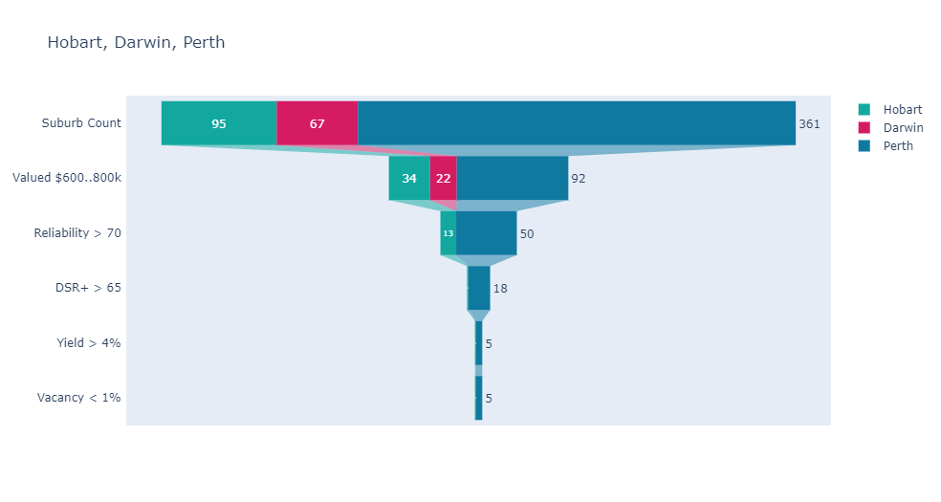

Hobart, Darwin & Perth

Perth is starting to shape up. It’s still nowhere near as hot as the last 3 areas mentioned. But there’s life, especially in the target price range.

Note that Hobart’s good run is coming to an end. And good Darwin data is relatively hard to come by, reliability ended it as an option very early in the process. Overall, slim pickings for investors among these 3 cities.

Concluding Remarks

I know each investor’s criteria are unique to their circumstance. But the purpose of this article was to show how filtering by data puts you in the ballpark.

The enormity of property data allows us a lot of flexibility to sift out gems from the dirt for each investor’s case. The result is a set of suburbs likely to bring decent growth and cash-flow before we’ve even paid the suburb a visit.

And yes, I know anyone with a DSR Data account can do this easily themselves, but not with my pretty funnel charts!

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data