Introduction

This month I’m going to go through the research steps I take to find a suburb worthy of my investment (or my client’s).

General Constraints

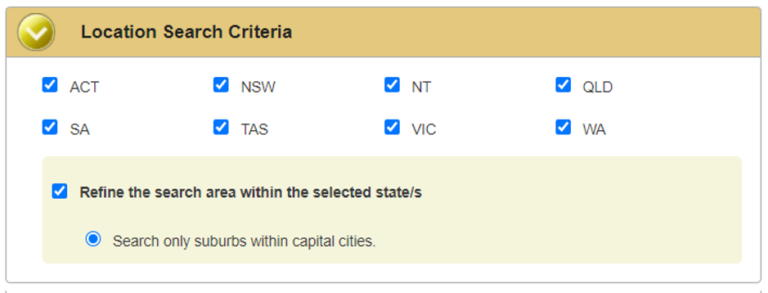

I don’t have much in the way of geographical constraints:

- Australia-wide

- But within state capitals

Normally, I don’t limit to state capitals only. But I’m doing that now for the sake of brevity. Some additional significant urban areas to check include:

- Newcastle

- Wollongong

- Geelong

- Gold Coast – Tweed Heads

- Sunshine Coast

- Toowoomba

- Townsville

- Cairns

- Launceston

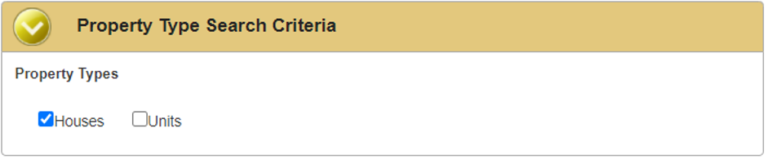

Property Type Constraints

I always choose houses rather than units since units can spring up from anywhere and represent an over-supply risk. Houses, on the other hand, require lots of vacant land for over-supply, which is easy to avoid.

My Budget and Priorities

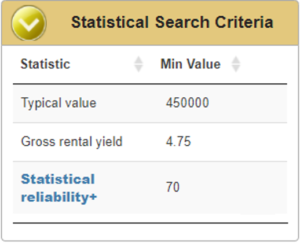

I’m looking for properties with the current numerical constraints:

- Budget of half a mil

- Cash-flow neutral or better yield 4.75%

- Low risk

I calculated the yield required by assuming 1.5% of the property’s value will be needed each year to pay for expenses other than mortgage interest. That’s expenses like: insurance, property management fees, council rates, repairs and maintenance. I also assumed an interest rate of 3.25%.

One of the ways in which I can lower the risk is by eliminating markets where data is limited. To do this I use the “statistical reliability” for a suburb which is a score out of 100. I’ve chosen 70 as my minimum – quite a high standard. 60 is usually good enough.

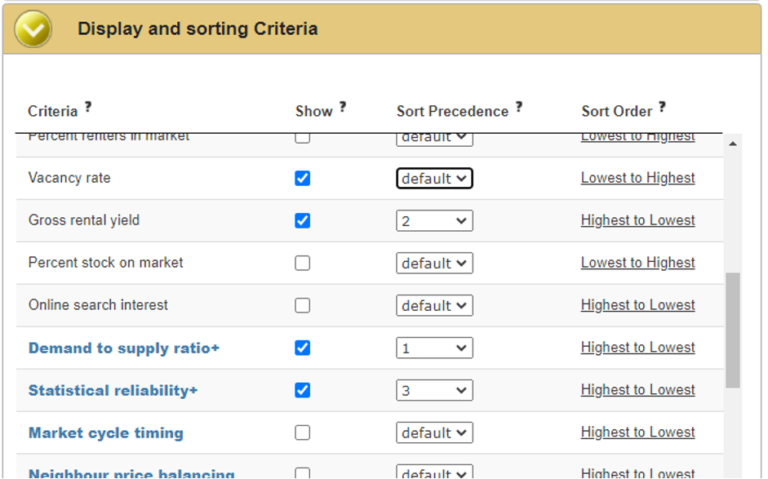

Capital Growth

For growth potential, I’m using the Demand to Supply Ratio (DSR+). It’s a combination of 17 metrics of supply & demand like:

- Auction clearance rates

- Selling times

- Discount rates

- Vacancy

- Ripple effect

- Market cycle timing

- Etc.

You can read the full list here: https://dsrdata.com.au/stats/stats

I’ll sort suburbs that match the criteria firstly by DSR+ and secondly by yield and lastly by reliability. That means if 2 suburbs have the same DSR+, the ordering will further sort between them by yield from highest to lowest. Yield is my second priority.

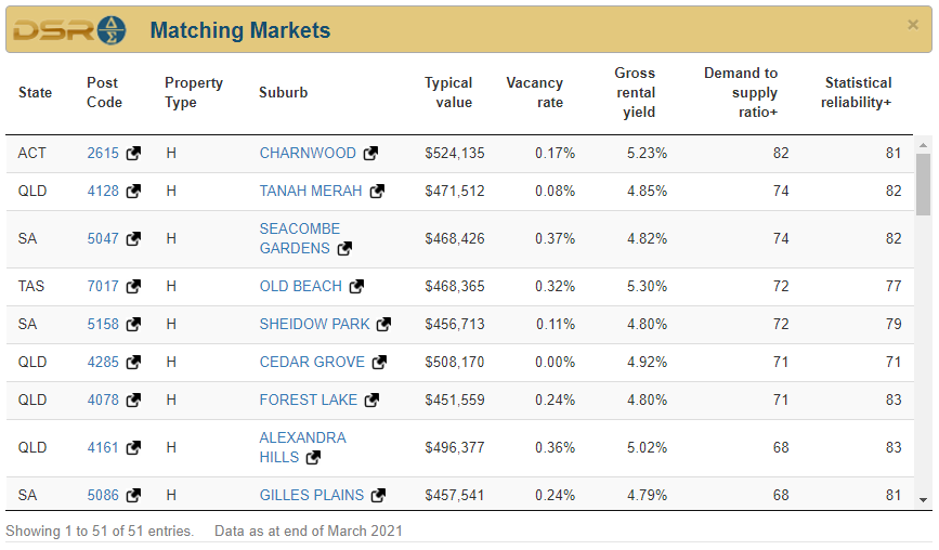

Short-list

Using the criteria above I search for a list of matches anywhere in the country – so long as they meet that criteria.

Charnwood in Canberra is an immediate stand-out. It’s demand to supply ratio is noticeably higher than second placed Tanah Merah.

You’ll also notice that the yield meets my requirement too at 5.2%. However, there’s land tax payable in the ACT. So, I need to factor in a further 0.5% in expenses.

The target yield was 4.75%. Adding another 0.5% raises the requirement to 5.25%. Charnwood’s yield is quoted as 5.23%. They’re pretty rough figures anyway, so it’s close enough.

I’ll have a look at Tanah Merah in Brisbane, and a few of the others too as back-ups to Charnwood

Risk of Infill

The next step is to cross off suburbs if they have any risk of over-supply. Given these are all house markets, the only way over-supply can seriously affect them is if vacant land nearby is developed.

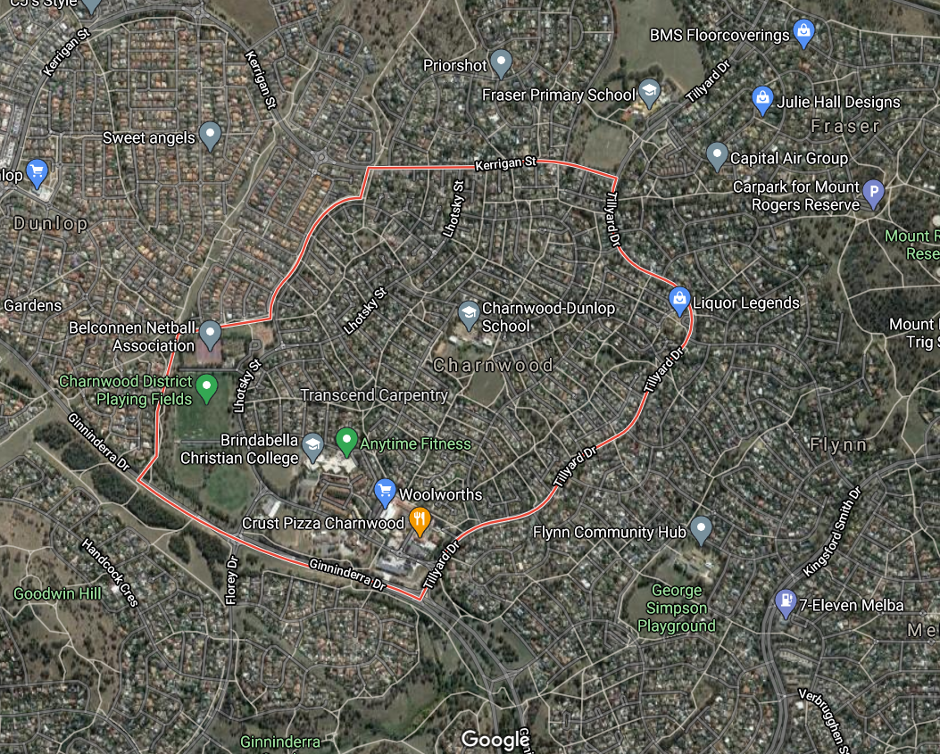

So, I jump on Google maps and switch between street view and satellite view.

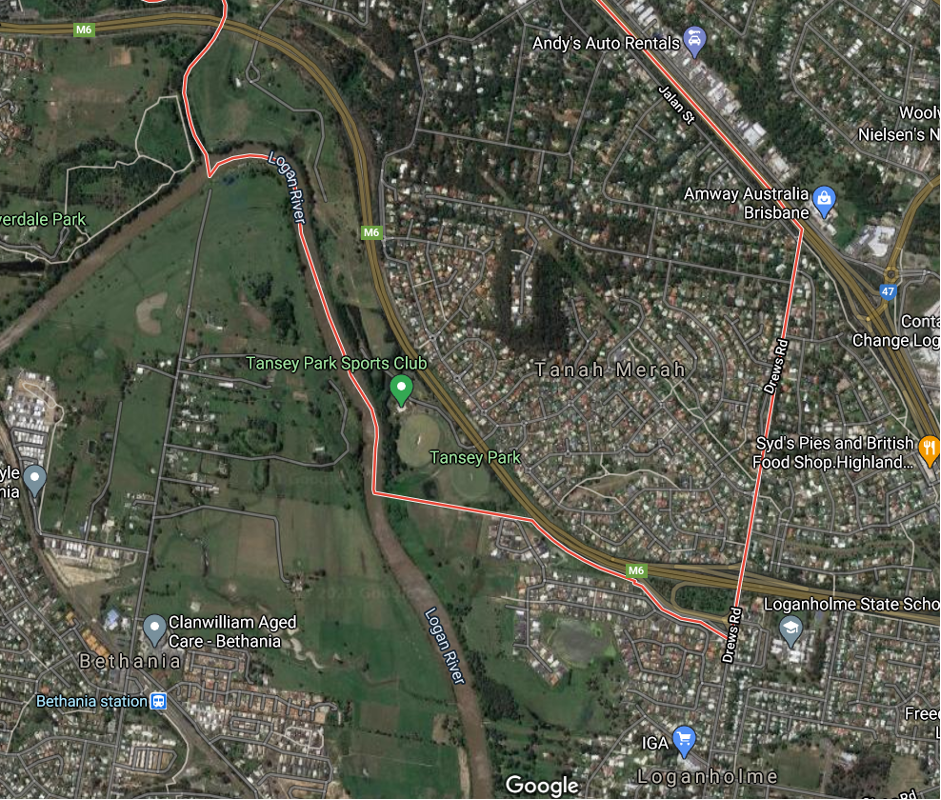

Charnwood is fully built-up already. No risk of over-supply there. But Tanah Merah is a different story

There’s a section to the south-west with development potential. A switch to street view shows it is not a reserve or park, so it could be developed in the future.

There’s nothing being developed right now though, so if my plans were to hold for the short-term it might not be an issue. But erring on the side of caution, I’d cross this off the list.

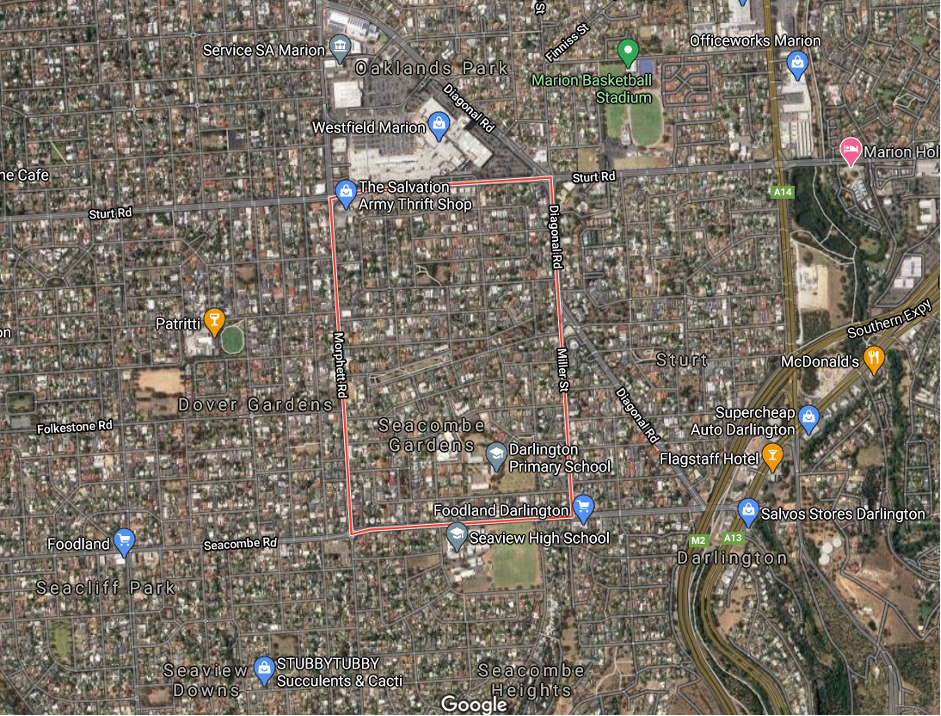

Seacombe Gardens in Adelaide is also fully built-up…

No risk of over-supply there.

Continuing this examination, I’d also probably scrub the remainder of the list. That might be a bit harsh since most of them aren’t really that bad from a risk-of-infill perspective. But since I already have a couple of decent candidates, there’s no need to relax my risk-checking.

Historical Charts

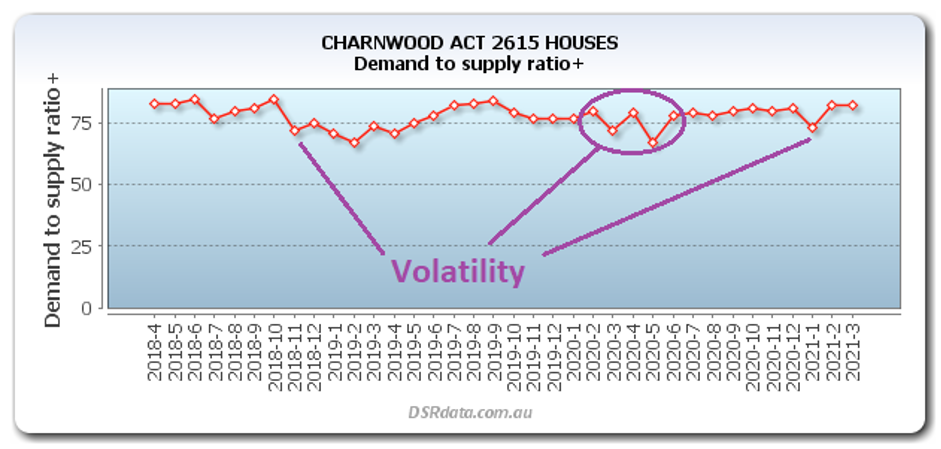

The next thing I look at is the historical charts. I’m checking for volatility.

Volatility is when the curve on the chart bounces around a bit. For some metrics, this is common. But for the DSR+, it’s usually more stable. What would worry me is if the latest month is showing an abnormally high figure. But as you can see the abnormal figure was 2 months ago. And it was down, not up. So, I’m confident demand outweighs supply in Charnwood and by a considerable margin.

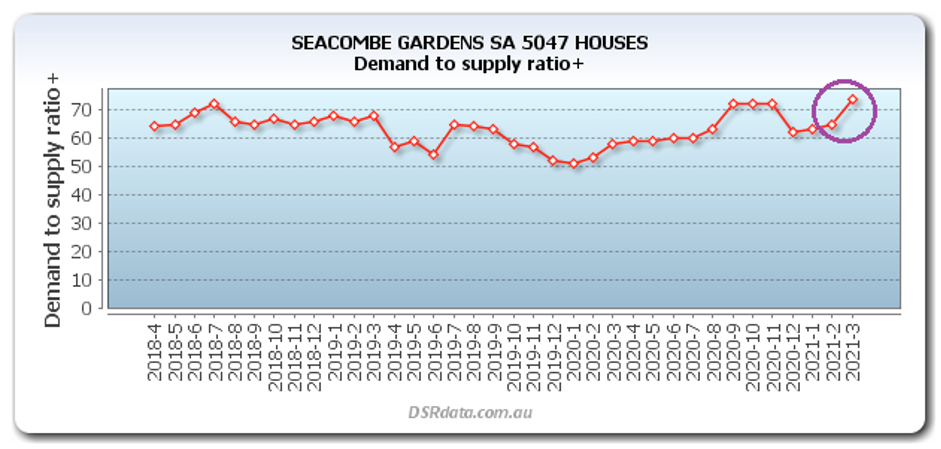

The reverse is true for the second-place getter, Seacombe Gardens…

This suggests that the true demand relative to supply might not be as high as what was reported in the last month.

Recent Price Movement

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

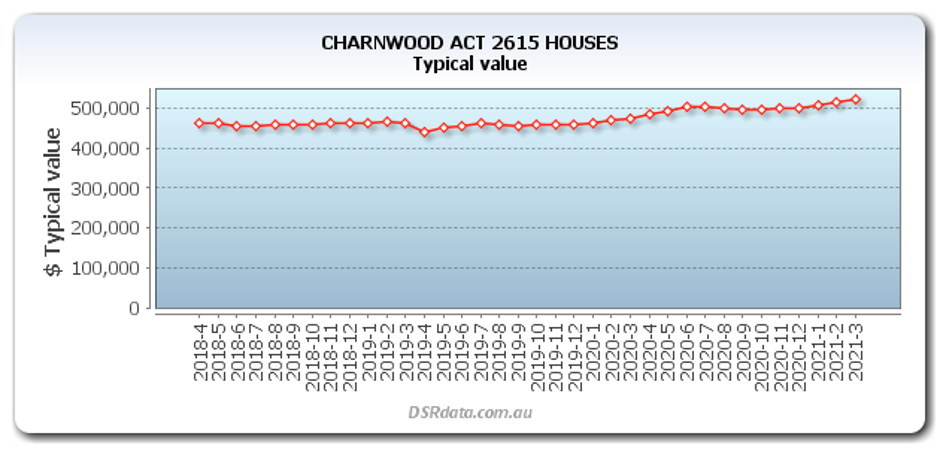

Yes, they have in Charnwood. Tick.

I also check to make sure that prices haven’t risen significantly over the last 3 years. That might mean the market will approach its peak sooner.

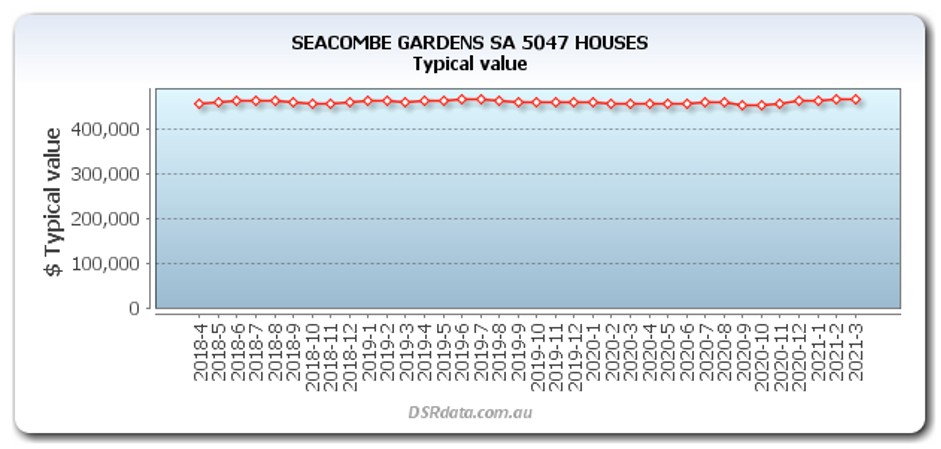

What about Seacombe Gardens?

There’s certainly no risk of buying at the peak in Seacombe Gardens. And prices look to have just started moving. It might not be a bad alternative if I find something negative about Charnwood.

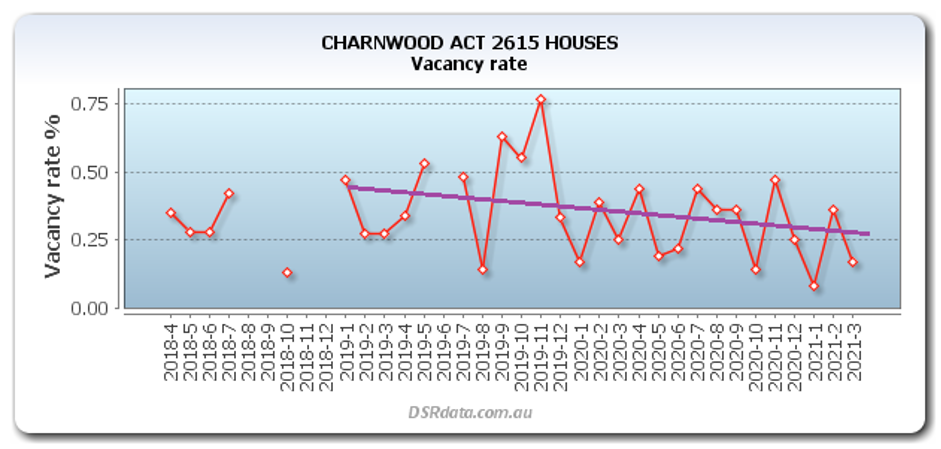

Vacancy

I like to check vacancy rates too. Demand for property might all come from buyers, but I need a tenant. Vacancy rate is a good measure of that demand relative to supply.

This is an extreme case of volatility. Clearly the rental market here is thinly traded. But the vacancy rate is well below 2%. It’s never even gone above 1% for the last 3 years. And the overall trend looks like it’s tighter than that, and heading even lower.

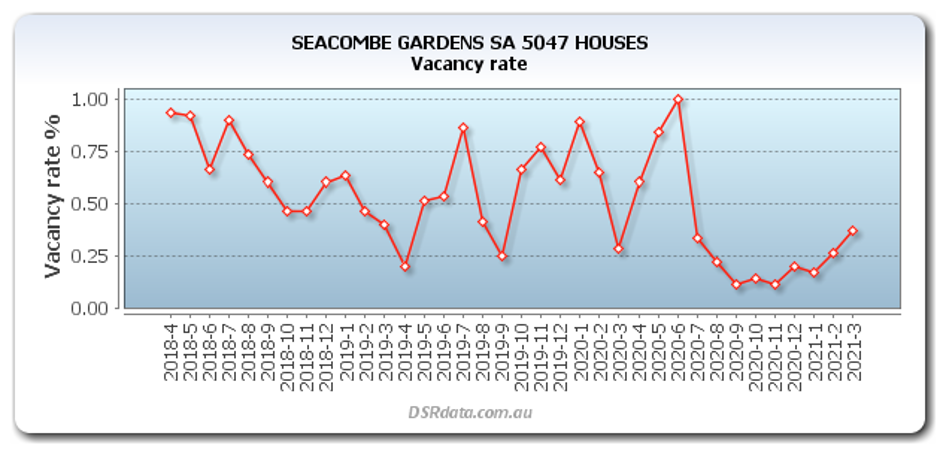

Seacombe Gardens has even more dramatic volatility that looks to have settled recently. Again, vacancy rates are very tight.

Heat Clusters

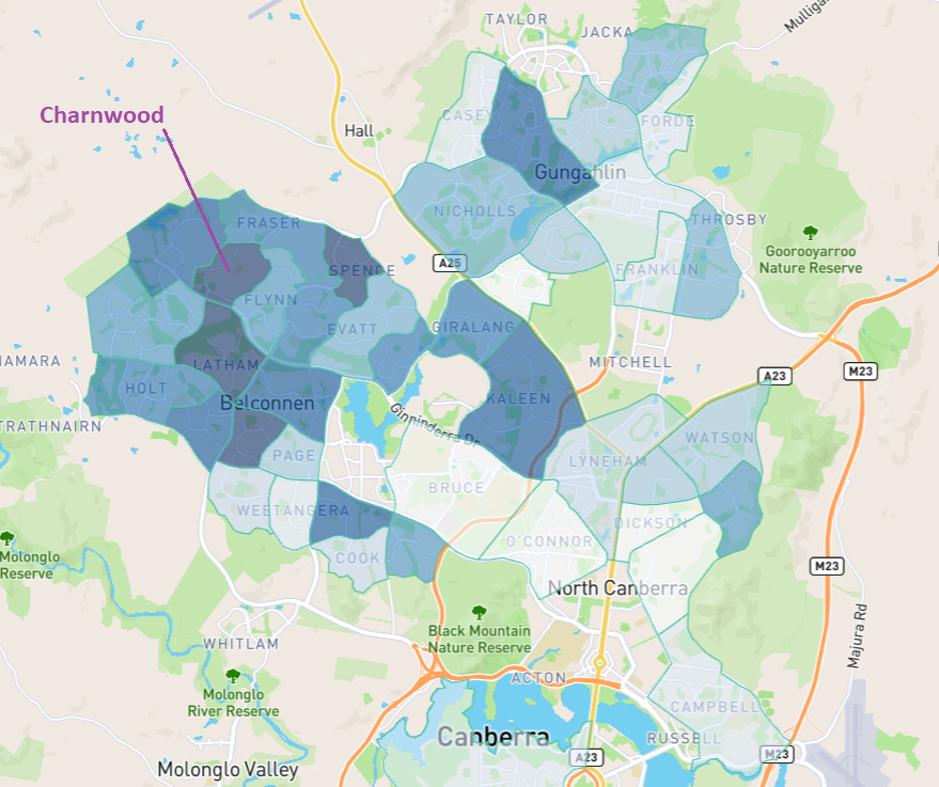

The last thing to check is whether the market is unique or surrounded by other markets that also have considerable “heat”. To do this I check a heat map.

The heat map shows a strong cluster of heat in Belconnen to Canberra’s North West. By “heat” I mean demand exceeding supply. The idea here is that if only one suburb in isolation is hot, buyers can easily escape the heat in neighbouring suburbs. But if the entire area is hot, their only option is to dig deeper into those pockets and pay more.

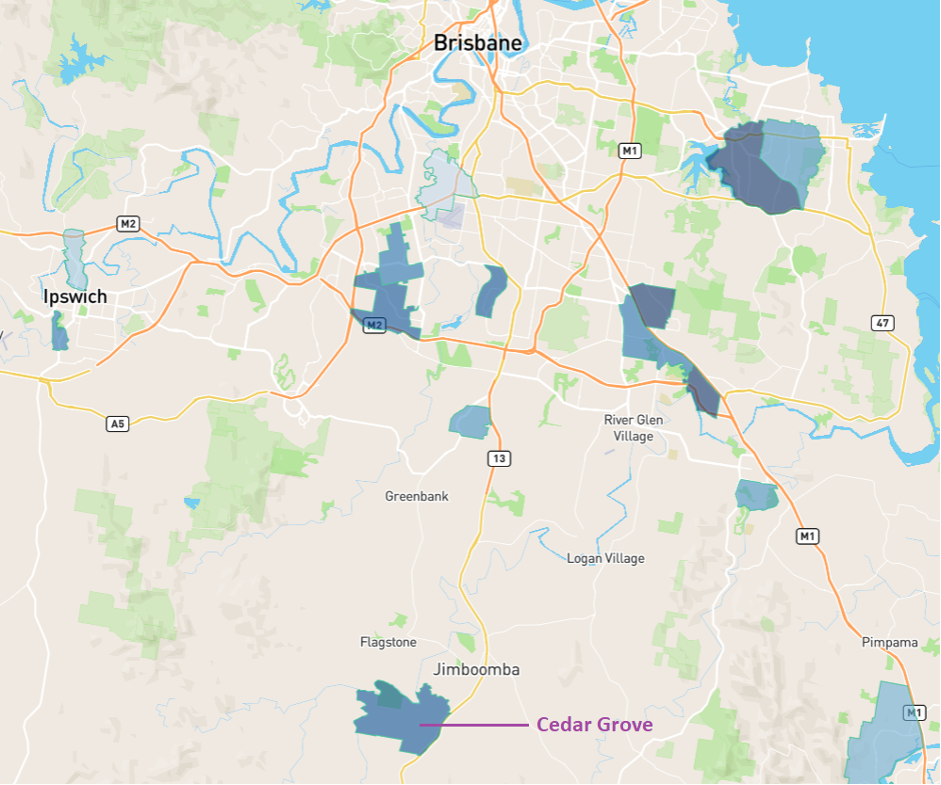

Here’s an example of what I’d call an isolated hot spot – not in a cluster…

Cedar Grove at the bottom of the map has no neighbouring markets of heat.

Infrastructure

I generally don’t bother checking for infrastructure projects. This is best explained here:

https://selectresidentialproperty.com.au/busting/infrastructure-research-is-over-rated/

Conclusion

That’s enough research to snag a pretty good growth deal and avoid risk and meet yield requirements. If you’ve got a budget of half a mil, you might like to check out Charnwood.

Note that in this research I didn’t consider non-state capitals like Newcastle and Geelong. That was merely for brevity. So, Charnwood might not be the best option country-wide for my requirements.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data