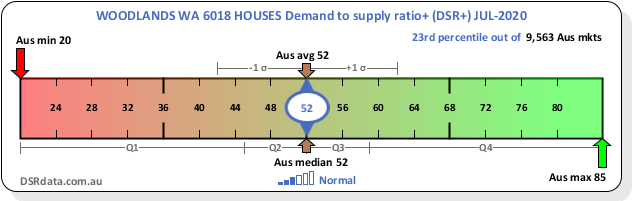

The general property market has been responding well in these pandemic times. Supply and demand have managed to stay roughly in balance. The average demand to supply ratio (DSR+) as at the start of August was 52.

The context ruler above suggests that overall, we shouldn’t see much in the way of price falls. We’d need the average DSR+ to be at least in the 40s for that. But 52 means we shouldn’t expect any growth either.

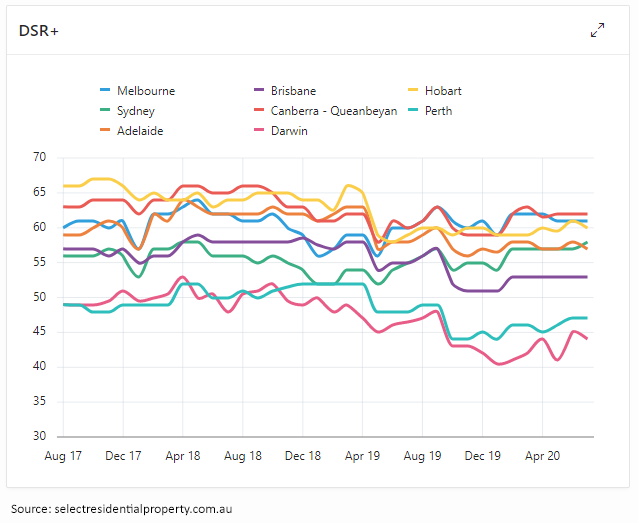

There are still winners and losers of course if we drill down to specific markets. Standout majors are Canberra, Melbourne and Hobart as shown in the following chart.

The chart shows how the DSR has changed for each state capital over the last 3 years. Note the dip in April 2019 prior to the election and sagging demand as the 2019 recession unfolded.

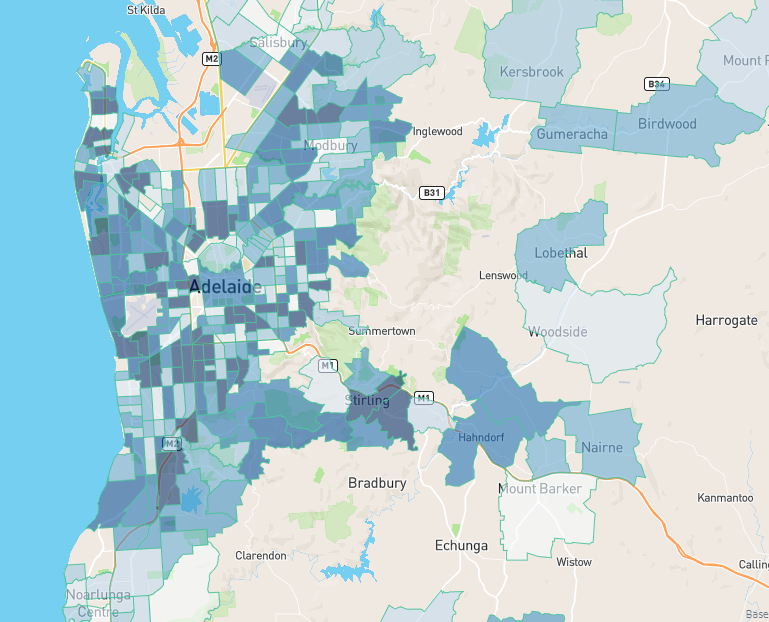

Adelaide misses out on a top 4 spot at city level. But at suburb level it has some of the best opportunities in the country. The following DSR+ heat map shows suburbs with greater growth potential in darker shades.

Properties for sale Australia-wide (supply) have risen this year, but not dramatically. On the demand side, sales have slowed. You’d expect this to lead to oversupply; however, many sellers have withdrawn their properties in anticipation of better conditions in the future. It’s this reaction to conditions that has kept the broader market relatively stable.

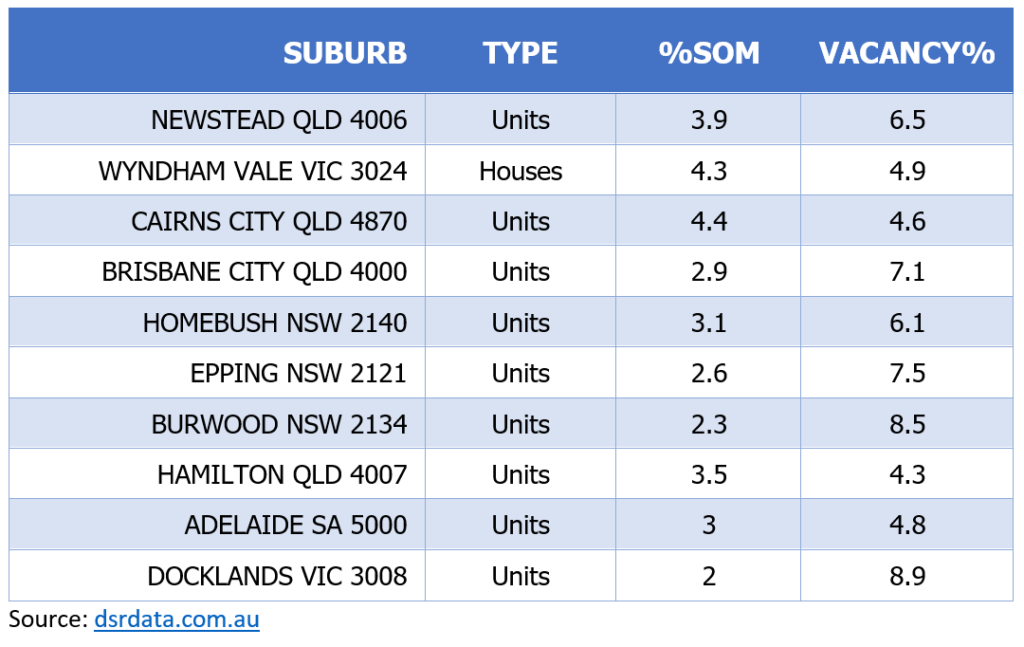

However, some markets have been unable to react well, for example the tourist and student enclaves and investor-dense inner-city high-rise units of Sydney and Melbourne CBDs. Although these have featured in the news, they’re not the only disaster areas.

Some of the worst include:

Each of these has a percentage stock on market and vacancy rate that is at least double what is considered normal. See these links to understand stock on market and vacancy better.

Once again, good investing comes down to picking needles, not spray painting.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data

“Capital growth is the ants pants of property investing.”