Mistake

Many property investors, and even professionals in the industry, think that future growth follows past growth. They believe there’s something inherent in the nature of the property, suburb or city that means it will continue to outperform if it has outperformed in the past.

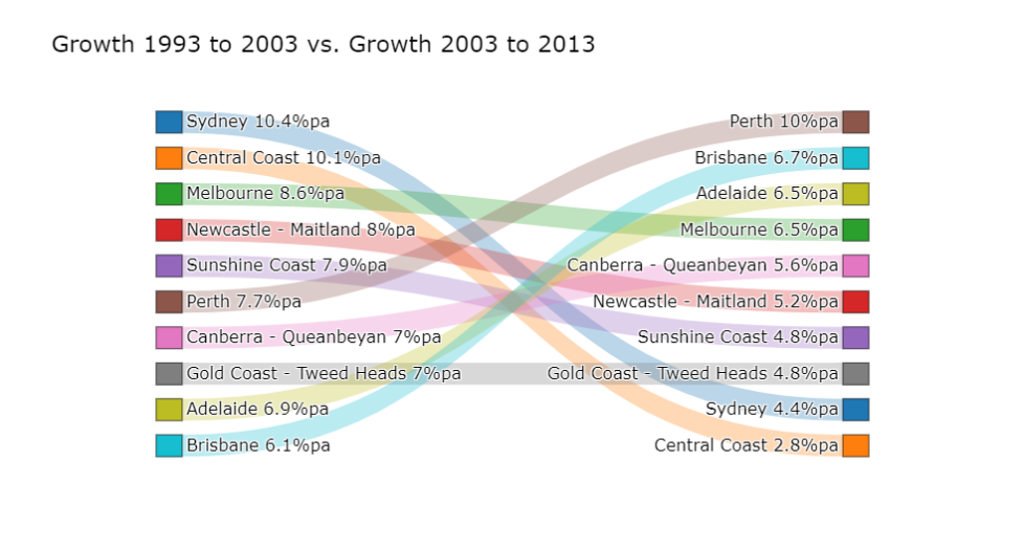

The following chart is what we would see if we believed this theory. It shows 2 growth periods: “past” growth on the left; and “future” growth on the right

The list of property markets shown, are the ten largest significant urban areas (SUAs).

In this theoretical case, Sydney had the best “past” growth at 10% per annum (top left). So, if we believed the theory, we would expect Sydney to have the best “future” growth on the top right.

If future growth follows past growth, we would not expect to see any swapping of positions amongst the SUAs. In other words, the flow-lines from left to right would not cross over one another.

Note that this is a theoretical situation. However, history did not play out this way.

Example 1

Here’s a real case.

Sydney and the Central Coast had the best rate of growth from 1993 to 2003 (top left). But for the 10 years following from 2003 to 2013, they were both at the bottom right.

There’s a significant amount of cross over in this graphic. This suggests that future growth forecasts might be the opposite of past growth.

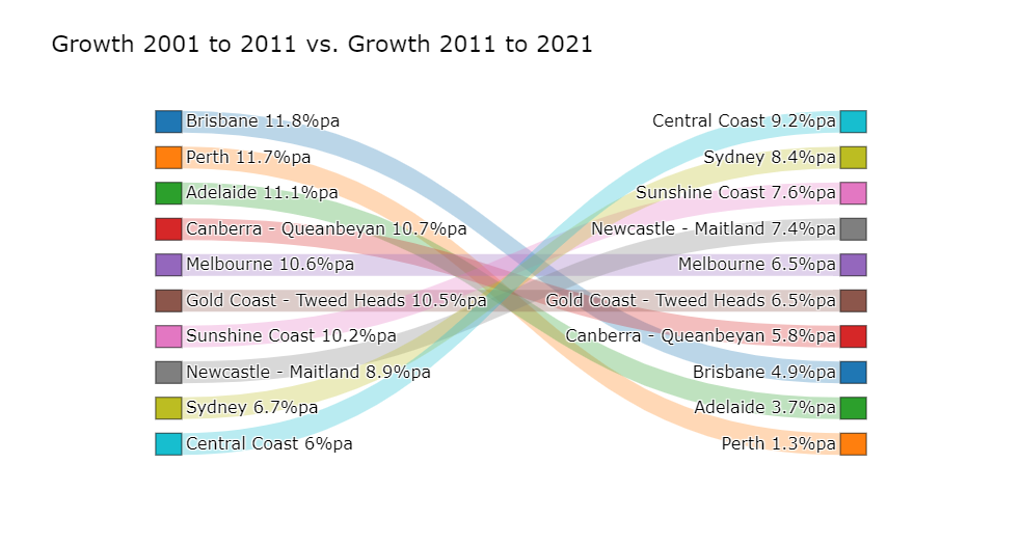

Example 2

This is also for 2 ten-year periods but ending a little more recently.

The top 4 SUAs on the left, were the bottom 4 SUAs on the right. And the bottom 4 on the left, became the top 4 on the right. Lots of cross over.

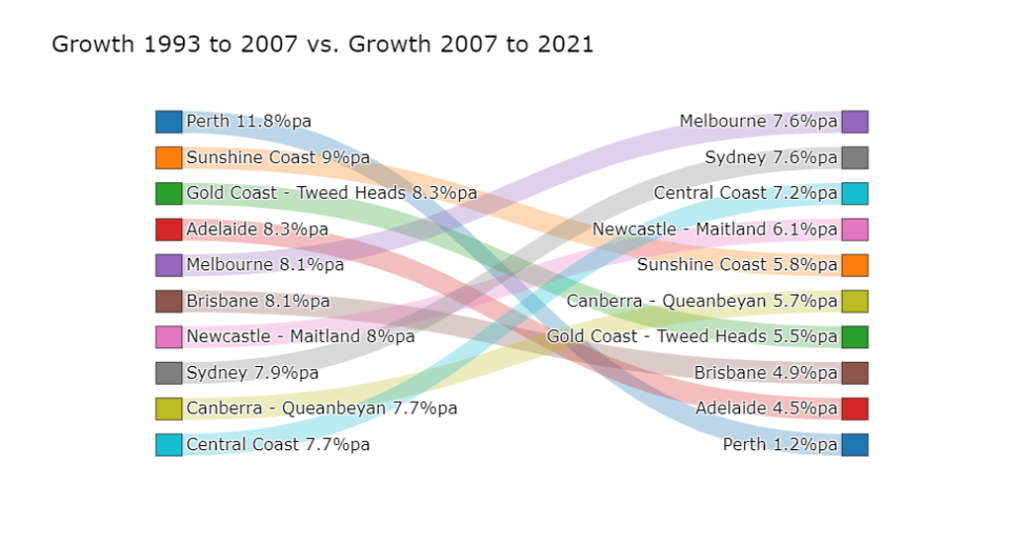

Example 3

This is the last chart and is for a longer timeframe.

Again, you can see there is a lot of cross over – nothing like the theoretical case.

Why?

Why might this phenomenon happen? Imagine property prices in a certain suburb kept climbing faster than everywhere else. Eventually, prices would be so silly, no buyer could justify the expense. That would knock demand out of that market.

Conversely, if prices grew slower than anywhere else, eventually the location would be so cheap compared to other suburbs, that people would flock there. That would bolster demand.

CONCLUSION

Time is the great balancer of growth rates. There’s a tendency over the long-term for properties, suburbs and cities to grow at the same rate. It’s over the short-term that differences in growth rates are significant.

You can use past growth to estimate future growth, but inversely. Seek out suburbs that have experienced low growth over the last 10 to 15 years, not high growth. Given the boom we’ve had recently, that doesn’t make such suburbs easy to find.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data