Introduction

Should property investors be worried about rising interest rates? Let’s see if historical data can provide any clues.

RBA Cash Rate

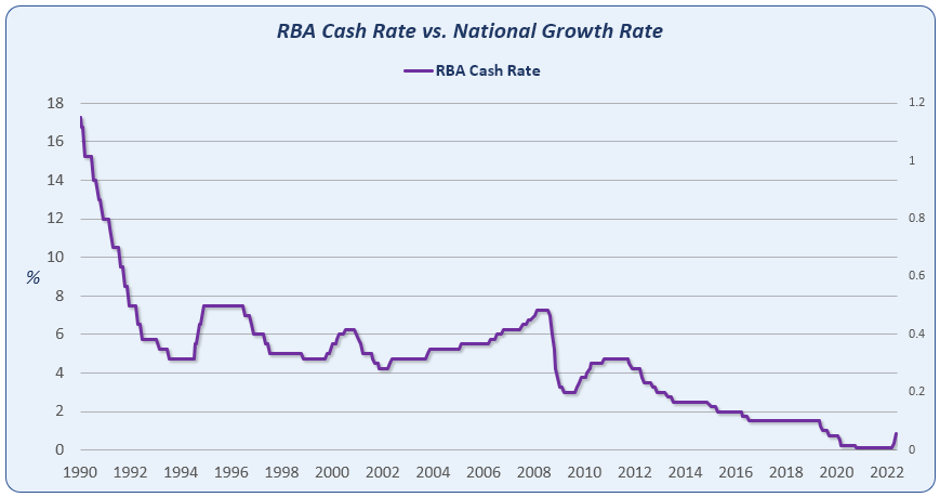

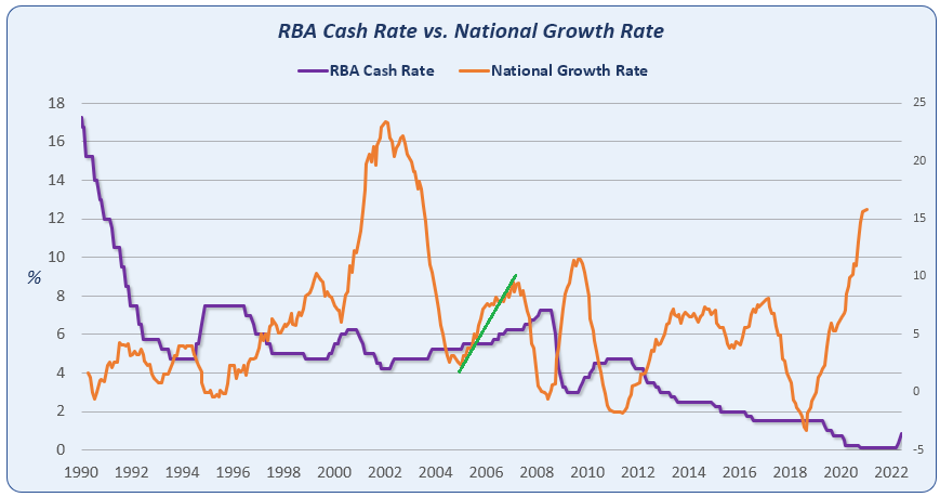

Here’s the history of the RBA cash rate since 1990.

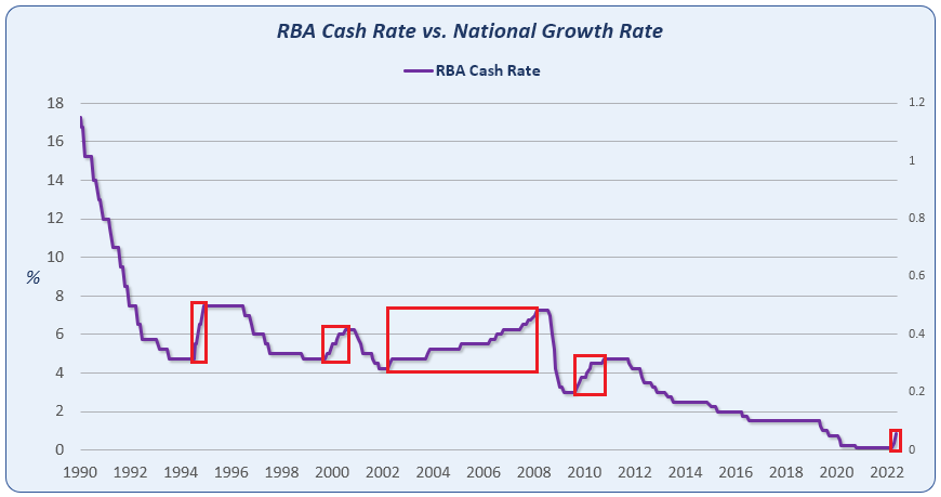

It’s been mostly on a downward trajectory, so unfortunately, we don’t have many historical cases of rising rates to examine. Here they are highlighted.

There are only 5 cases in 31.5 years.

Observations

· Rates have been rising for about 9 of the last 31.5 years

· Interest rates are very low right now compared to the long-term average

· Assuming the period from 1994 to 2012 is “normal”, rates could climb back to 6%

· All past periods of rate rises have been no more than 3% from trough to peak

The key observation is how few historical cases we have to examine. Nobody should start a sentence with,

“Usually when interest rates rise…”

BTW these are RBA rates, banks have their own agenda.

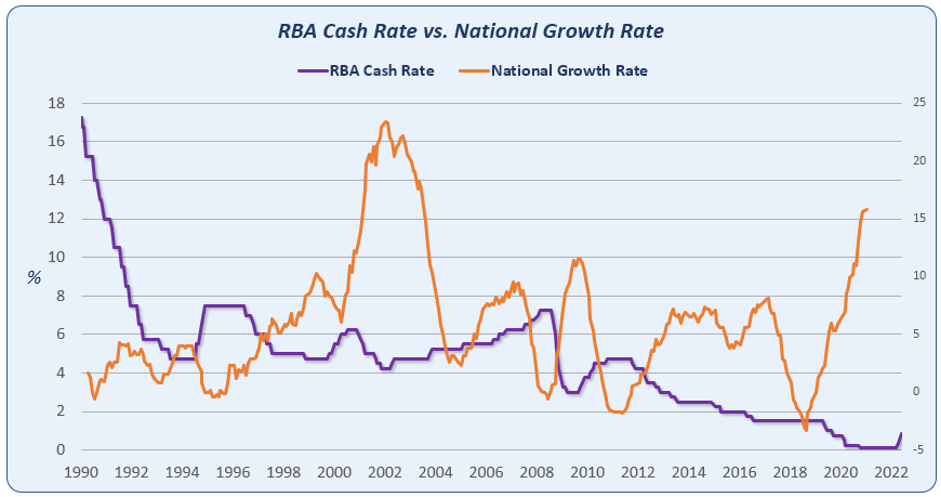

Correlation to Capital Growth

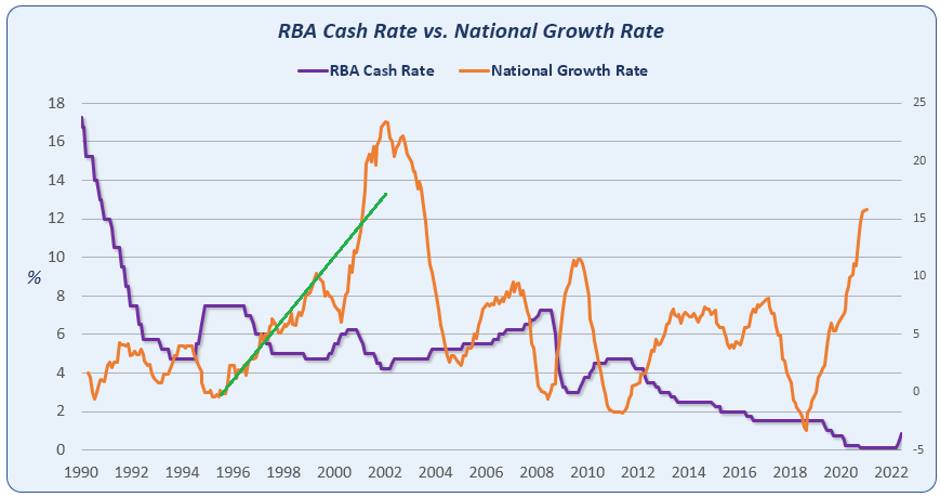

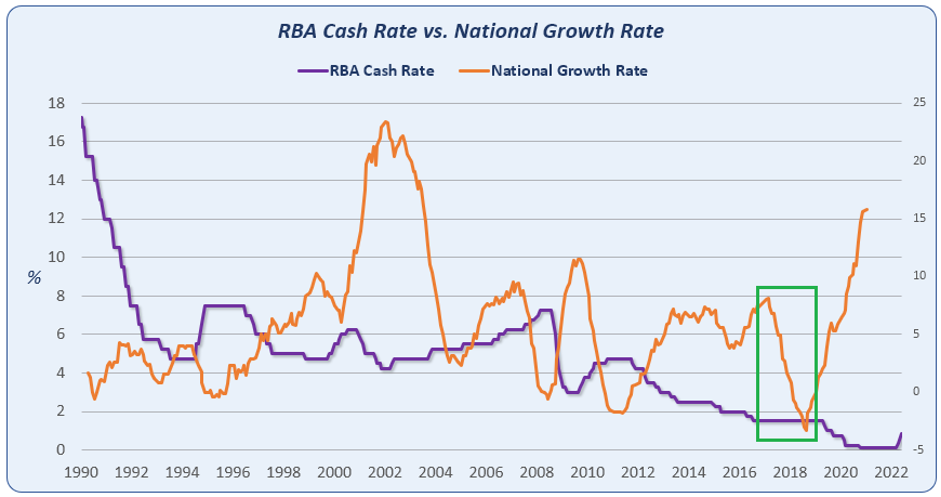

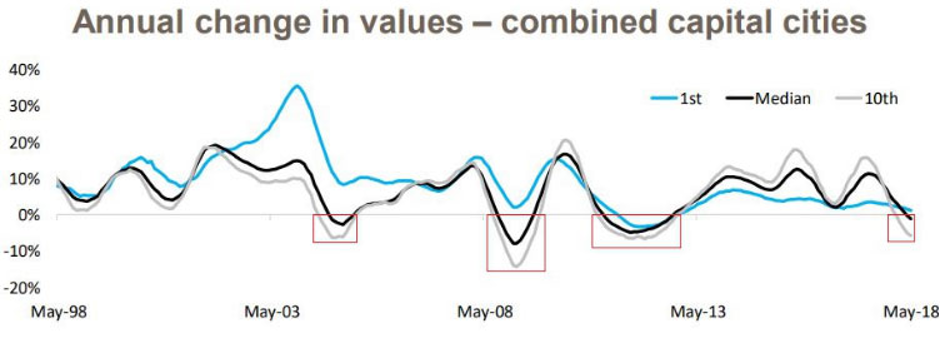

Some parts of this chart make sense and other parts don’t. Take for example the rising rate of growth that started in late 1995. I’ve highlighted it in green below.

And there was a sharp correction of growth rates in 2008 that “preceded” a drop in rates.

And again, from 2017 to 2019 there was a sudden drop in growth rates, but interest rates at that time were unchanged for the longest period on record.

There is definitely “some” relationship between interest rates and capital growth rates. But clearly there are other factors at play.

Other Factors

And remember, people still need a place to sleep at night. Even in high interest rate environments, people still buy houses.

Here are a few other counter-catastrophe arguments…

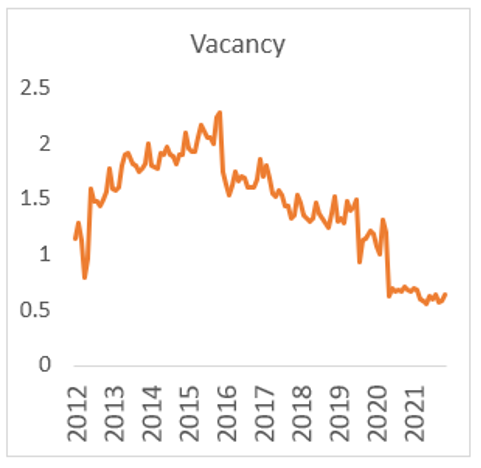

Record Low Vacancies

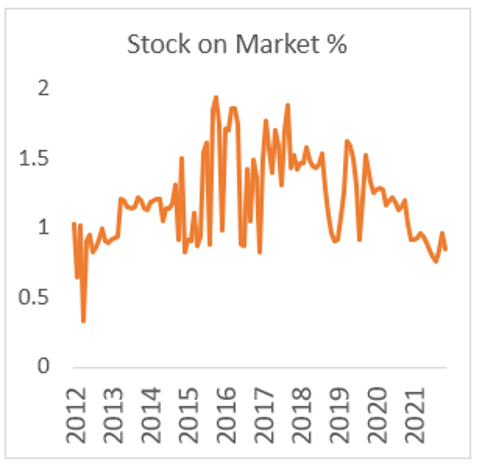

Low Stock Levels

Strong Demand & Supply

Where to Buy?

The markets that have suffered the most during tough times, like rising interest rates, are the prestigious markets. These are in affluent areas of high socio-economic demographics. Core Logic’s historical Decile reports confirm this.

Where to Buy?

Property is very different to the stock market – people can’t take shelter in a share certificate. A massive drop in property prices requires a massive change to how we live. So, any turmoil in property is unlikely to be large or long.

I suspect the market will take a brief breather and then carry on upwards.

A word of caution though: given where we are in the growth cycle, it would be prudent for investors to aim low rather than buy in expensive markets.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

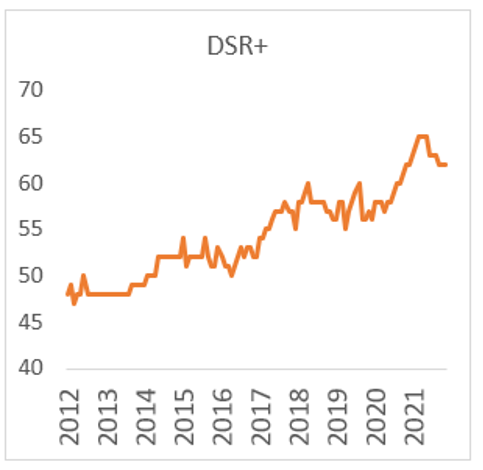

Founder of DSR Data