Prompt

“How long does the above-average growth of a high Demand to Supply Ratio suburb last”?

I get asked that question often. The answer is, it typically takes about 3 years for supply and demand to rebalance. But it varies tremendously from suburb to suburb.

The next question I get asked, after answering the first, is:

“What should I be looking for to get above average long-term growth”?

Above Average Long-Term Growth

There are more opinions on the drivers of long-term growth than there is data. There are 3 things I have found with solid historical evidence that are also very easy to research

- Do not buy anything new

- Buy a house not a unit

- Buy in a built-up area

The problem with a data-driven approach to long-term drivers is that the information age is relatively new. There’s very little historical property data dating back many decades. Auction clearance rates, vacancy rates, yields, selling times and stock on market don’t go back more than 15 years.

But I have been able to research the 3 things mentioned above over decent timeframes. Here’s what I found…

Don't Buy New

Claiming the depreciation loss against your taxable income helps lessen the impact of a bad thing, but it’s still a bad thing. For more detail on this topic and the historical evidence backing it up, check out this article: “New properties under-perform”.

Buy a House

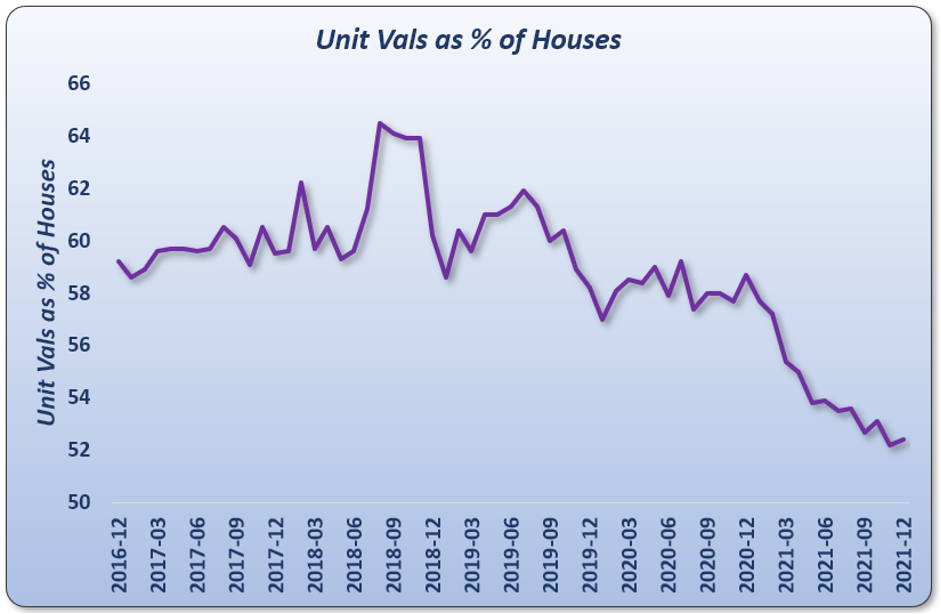

Houses have outperformed units over the long-term.

Buy in Built-up Area

Supply is the enemy of capital growth. House and land packages adjacent to vast tracts of vacant land are to be avoided. Supply can thwart growth in those areas for decades to come.

Have a look on Google maps if you’re not familiar with an area. Switch between satellite and street view. Zoom in and out to get an understanding of how much vacant land there is. It should be pretty obvious when it’s bad…

Why Long Term?

An investor needs to be in the market for a long time to achieve financial freedom. But most of that time, your property is doing nothing. The game-changing periods are actually quite short.

So, I believe investors would be better off focussing on the short-term rather than the long-term because of these reasons:

1. Time evens things out

2. Everything changes

3. Learning cycles are shorter

4. Technology

Time Even Things Out

Looking at decades of historical data for thousands of suburbs around Australia, I’ve noticed that time tends to even growth rates out.

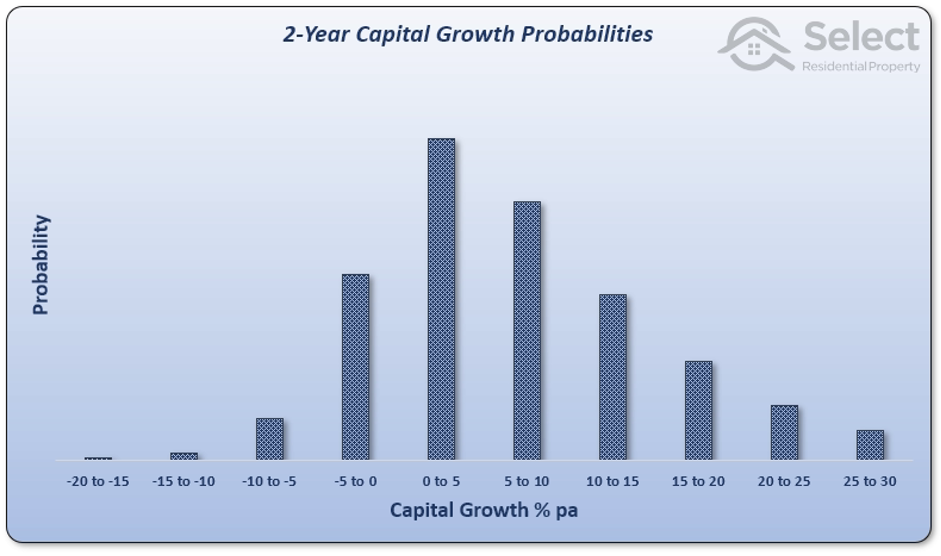

This next chart shows that over any 2-year period in the last 30 years, there’s been quite a diverse range of growth rates.

Most suburbs have grown at around 5 or 6% pa. But the growth rates are quite diverse, that is, spread out.

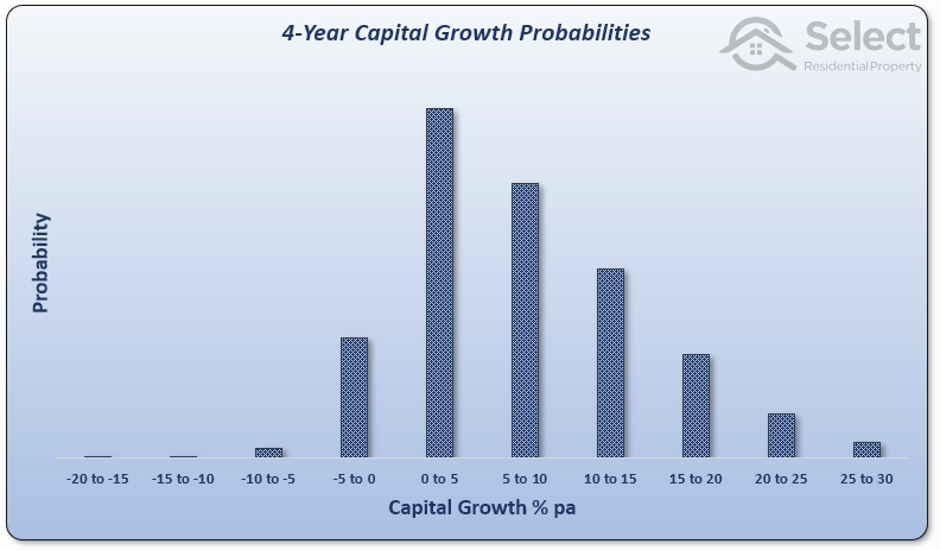

That previous chart was for a 2-year growth period. Here’s the same chart for 4 year growth periods…

Still well spread out, but slightly narrower.

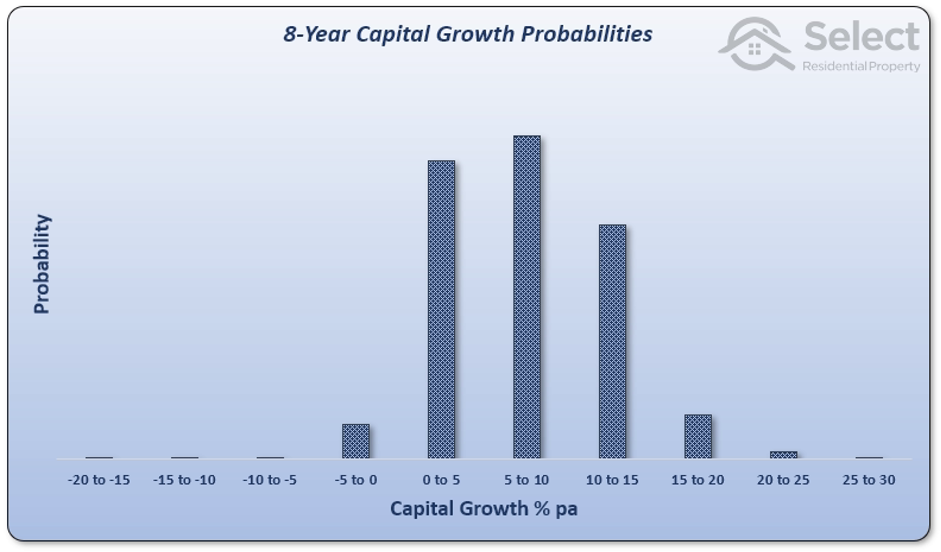

Here it is for 8 years…

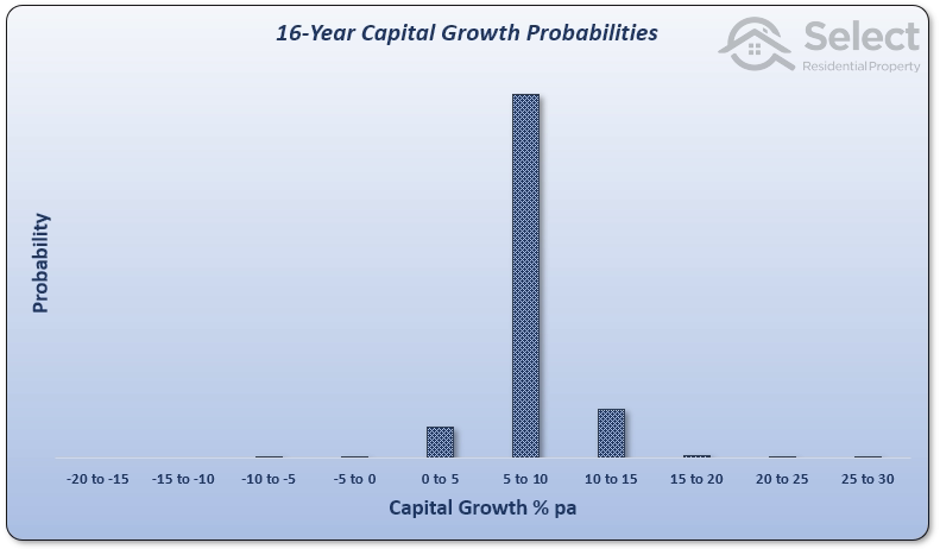

You can see the growth rates narrowing. Here it is for 16 years…

Can you see the trend? It gets even more “singular” over 30 years.

What this means is that the chances of finding an outperforming market get slimmer and slimmer the longer the time-frame.

Everything Changes

If you wait long enough, whatever worked in the past will not work in the future. The longer your plan is, the more chance there is of it coming undone before it’s fruitful.

Short Learning Cycles

How many lessons can you learn if you don’t know you’ve made a mistake until 30 years have passed? Contrast that with a 3-year plan, in which you might have time to recover before retirement age.

Technology

If we can only make predictions a few years in advance, then it makes sense to use what we know rather than guess what we don’t know. It’s extremely difficult to make forecasts decades into the future. Going with what I know makes more sense to me, even if the timeframe is somewhat limited.

Best of Both

If we can only make predictions a few years in advance, then it makes sense to use what we know rather than guess what we don’t know. It’s extremely difficult to make forecasts decades into the future. Going with what I know makes more sense to me, even if the timeframe is somewhat limited.

Commentary by

JEREMY SHEPPARD

Director of Select Residential Property

Founder of DSR Data