Growth trumps cash-flow

Capital growth is the ant’s pants of property investing. The most successful investors are the ones who have found great growth locations, not the ones who have found great yield locations.

The equity you get from double-digit growth will make a 7% gross rental yield look virtually inconsequential. It’s not until you do the numbers and forward project that you see just how much better off you’ll be with a growth focus.

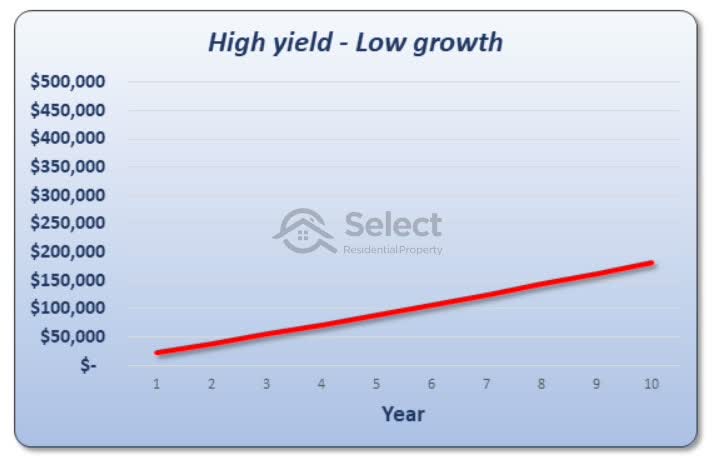

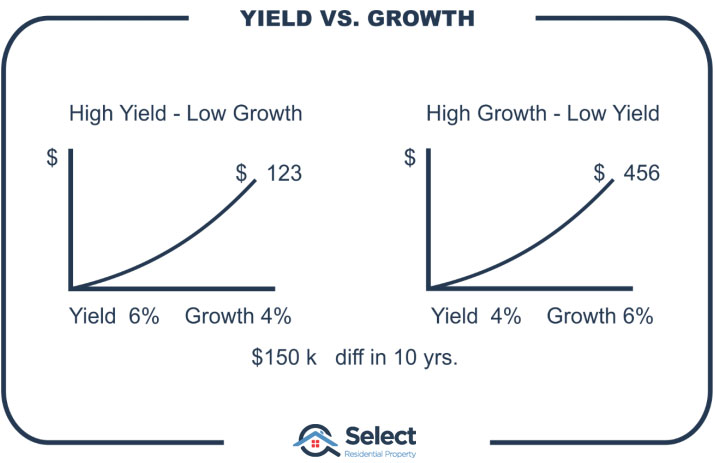

The following chart shows the total wealth created for a theoretical $500,000 property over 10 years with 7% gross rental yield and 3% capital growth per annum.

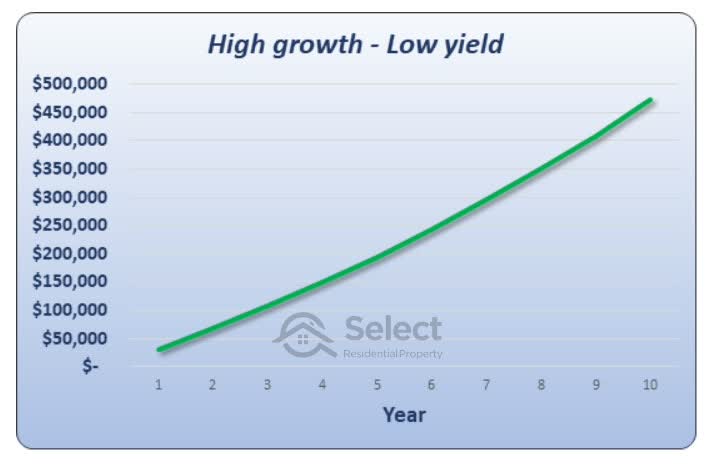

After 10 years there’s about $180,000 of equity and cash-flow combined. Now compare that with the following chart in which the yield is very low (3%) and the growth is much higher (7%).

The total wealth created (equity and cash-flow) is around $473,000.

In just ten years there’s a staggering difference between the two properties’ performance. That’s because of the staggering difference in their growth rates.

Note it’s highly unlikely that such consistent yields and growth rates will be seen over a ten year period. But the idea is simply to compare yield and growth.

Why?

There are a couple of reasons why growth ends up being better than yield:

- More tax is paid on positively geared properties

- Growth also affects rent

Firstly, you pay more tax if you’re property has a high yield. Positively geared properties generate more income from rent than they deliver in expenses. That extra amount of money a positively geared property earns you is taxed. The degree of positivity is diminished because of tax. With a negatively geared property, that loss can be claimed as a tax deduction reducing the degree of its negative influence.

Secondly and much more importantly, rent climbs with capital growth. It might not happen at the same time, but capital growth and rent both change because of the same reasons. Increases in both are caused by demand exceeding supply. What affects property prices, also affects rents. So, with both rent and values climbing at a faster rate, it makes sense that investors are better off chasing growth rather than yield.

My Story

Early in my property investing I chased after yield. I first started buying properties with granny flats to maximise rental income. I also did renovations to force an improvement in both value and rent. I then went in pursuit of high yielding locations around Australia. I bought in: QLD, Tassie, WA and South Australia.

When I couldn’t find yields in Australia that were good enough, I went to New Zealand. I bought 6 houses in NZ with yields all in the double digits. But it still wasn’t good enough, so I went to the USA.

Upon reflection I realised that yield wasn’t the key to creating wealth. In every case it was the capital growth that made the big difference. It didn’t matter how good the yield was, it was always trumped by growth. If I had high yield and low growth, the yield simply didn’t compensate enough. If I had high yield and high growth, the growth always delivered more than the yield did.

“If you’re trying to build wealth through property investing, your top priority should be capital growth”

When is yield OK?

There are occasions when you have to consider yield. If you get good at picking growth locations, you’ll quickly realise you have more equity than you can make use of because of lending serviceability constraints. Serviceability is the investor’s ability to “service” loans. That is, continue to meet payment obligations. A large enough portfolio of negatively geared properties will eventually put you out of lender contention.

When that happens, be sure not to go overboard in your pursuit of cash-flow. Aim for the best growth location that is neutrally geared or just positive – enough to get the next mortgage across the line.

There’s only one case in which it makes sense to go all out on yield and forgo growth altogether…

Retirement

If you’re retiring, you want income and you probably don’t care about asset growth. You’re looking for something to replace your salary.

You might need to sell down part of your portfolio to make it cash-flow positive. You might even consider swapping out growth properties for a set of high yielding ones, possibly commercial. Maybe even consider some high yielding shares instead of property.

Be very careful buying properties in high yielding markets. They’re not usually in set-and-forget locations. They might be in transient locations. Tenants might need to live there for temporary work, but they don’t want to stay there. You don’t want all the tenants to “transient-off” elsewhere. That leads to another misnomer in the industry…

Growth is speculative

I’ve heard plenty of proponents of cash-flow strategies suggest that capital growth is speculative. They believe that rent is more of a sure thing. You can analyse a property’s potential by how much rent it’s currently receiving.

Don’t be fooled by a rental lease. It’s not a sure thing just because it’s the case right now. That tenant could vacate next month along with all of the other transient workers in the area if the economy goes pear-shaped.

Supply and demand affect price growth and yield. Supply and demand effect vacancy rates too. You need to understand supply & demand for the market you’re considering, regardless of the strategy you employ.

Oh, and by the way…

“If your property investment advisor says growth is speculative, they obviously have no idea how to pick growth locations. ‘nough said.”

Growth increases rent

One of the bonuses to capital growth is that it also increases rent. You may not get it happening at the same time or to the same degree, but whatever it was that made a location appealing to buyers, also applies to tenants – they’re humans too.

If there’s demand to live in a location, yet limited properties to buy and limited properties to rent, then both prices and rents will go up.

Growth & Yield

Some people argue that the debate between cash-flow and growth is a moot point because you can find locations with both high growth and high yield. Yes, that is possible. But there are 4 things I’d like to challenge you about that:

- Why do you think growth will come?

- Are yields high because prices have fallen?

- Above average growth doesn’t last

- Above average yield doesn’t last

Firstly, why do you think a certain location is going to have high growth. I wouldn’t need to invest in property to make a fortune if only I had a dollar for every failed hot spot pick I’ve heard of.

Secondly, bear in mind that high yielding locations can quite often rise up from prices stepping down. You don’t want to jump onto that kind of a trend.

Thirdly, above average growth never lasts. So, be sure to keep your eye on those markets after you’ve bought in them. Have a plan to liquidate when growth starts running out of puff.

Finally, just like above average growth, above average yields won’t last forever either. High yields are frequently a symptom of a market nobody really wants to settle in. Why would residents prefer to pay more in rent than they would in mortgage interest? Simple, it’s because they don’t plan to stay long.

The usual cause of a high yield location is a large proportion of transient workers or falling property prices. Neither of those are good for growth.

Alternatives

If cash-flow is a problem for you as an investor you have a few options:

- Sell any negatively geared properties that have ordinary growth prospects;

- Or replace them with properties in markets with higher yields;

- Renovate or add an extra room or granny flat to your properties;

- Wait till rents of your existing properties rise;

- Move spare equity into safe high dividend shares;

- Buy commercial property

Conclusion

In conclusion, prioritise growth. Don’t chase after yields at the expense of growth, unless you’re entering retirement and even then, make sure you’re careful not to pick locations that might have high vacancy rates in the future.

If you’re after high capital growth, check out other presentations in this series. They’re designed to help investors from making mistakes about where, when and what to buy. For example, here’s another monumental misunderstanding investors make about cash-flow: