Introduction

How many times have you heard someone describe a property market as “too hot” or “overheated”? It’s usually bandied about for a bit of marketing exposure by attention-deficient wanna-be experts. There’s actually no such thing as a market that’s “too hot”.

Don’t get me wrong, there are definitely markets that investors should be fearful of. But not hot markets. It’s actually cold markets that should shiver investor spines.

Clarifying the cliché

OK, perhaps we should drop the clichés and talk in precise economic terms. What are commentators referring to when they say a market is too hot? It’s obviously not the air temperature, right? So, what is it?

When I hear the term used, it invariably gets qualified further by a statement like: “buyers are paying too much”. But how much is too much?

There’s no such thing as too hot

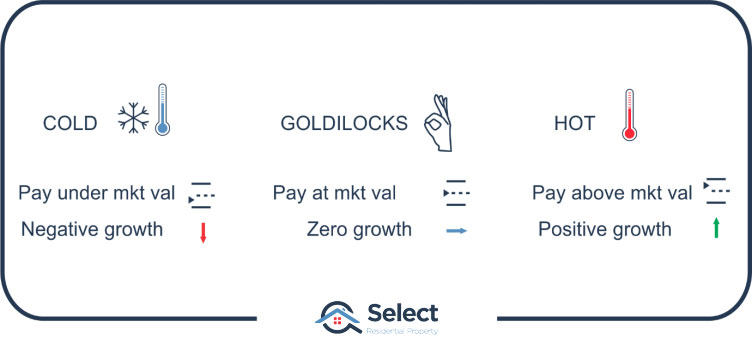

Most would argue paying anything above fair market value is paying “too much”. But think about it this way:

“If nobody pays “too” much, i.e. above market value, then prices never rise”

A market experiencing capital growth is one in which the majority of buyers are paying above market value – effectively paying what the experts suggest is “too” much.

The only markets in which capital growth can possibly occur are those “overheated” markets. Unless you own a property in an “overheated” market, you’ll never get any capital growth.

Supply & Demand

Whenever I use the word “hot” to describe a property market, I’m always thinking of demand exceeding supply. That imbalance can force prices up; it can move stock quickly; it makes buyers competitive; auctions hectic; open inspections busy. That to me is a “hot” market – one in which demand exceeds supply.

Prices rise when demand exceeds supply. It’s a fundamental law of economics and not something to be fearful of. Rather, investors should capitalise on this knowledge.

When supply and demand are balanced, prices are generally flat. That may be good for Goldie-locks, but it’s not good for property investors. We want hot markets.

Demand cannot exceed supply by “too much”. If it did, we’d have a concept called, “too much capital growth” or “too much profit”. Investors might gain “too much equity” leading to “too much wealth” and “too much financial independence and security”.

Is there a point when demand can exceed supply by “too” much? What happens in this case? Does the law of supply and demand suddenly invert? No. There’s no such thing. It’s rubbish.

The greater the degree by which demand exceeds supply, the greater the pressure there is on prices to rise. It’s as simple as that. You want to invest in “hot” markets. Call them “overheated”. Call them “too hot”. Just don’t buy in cold markets, or even lukewarm ones.

Conclusion

Many people think that if demand exceeds supply, this is a hot market and therefore one to avoid, as if they were too late. Wrong.

You want to avoid cold markets. That’s when you’re too late. Head towards the light, the heat, where demand exceeds supply. Cold markets are capital growth wastelands.

There’s no such thing as “too hot”.

By the way, if you want more along these lines, check out this presentation in the same series:

With property, be greedy when others are