Introduction

For decades it’s been said that “rent money is dead money”. Some of the follow up catch-cries include:

- Why would you waste all that money when you’ll have nothing to show for it?

- Why would you pay all that money so your landlord can pay off their mortgage?

The idea has been to own your home rather than rent it. But that doesn’t make sense from a financial perspective. It is actually far more likely that:

“Home mortgage money is dead money, not rent money”

It is more beneficial from a financial perspective to rent where you live than to own.

The Problem

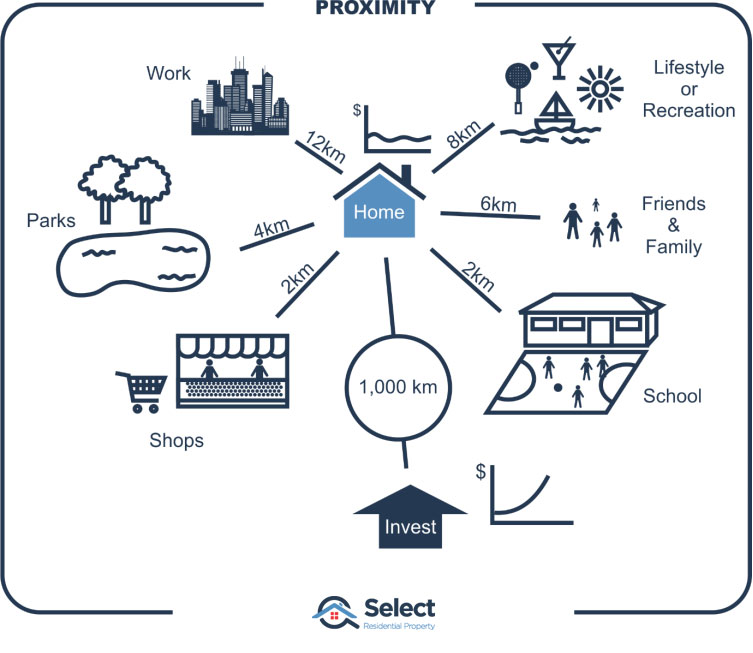

The problem with owning your home is that it’s highly unlikely it’s the best asset your money could buy at any point in time. Out of the thousands of suburbs around Australia, what chances are there that the suburb you want or need to live in, is also the best suburb for your investment dollars?

And once that property market falls out of favour, perhaps goes through a slump, will you offload it like any other underperforming asset? Or will you be tempted to hang onto it since you live in it?

Tax

What’s more, there are numerous tax benefits for investors that home owners cannot claim:

- Mortgage interest

- Depreciation

- Repairs and maintenance

- Insurance

- Council rates

These all make owning a rental property tax efficient compared to owning your home.

Rent vesting

Owning an investment property while renting where you live is called “rent-vesting” because you’re renting while you’re investing.

I first started rent-vesting in 2004. I had 6 investment properties back then, but I didn’t own my principle place of residence. I realised that it was better to own in a growing market and rent close to work, family & friends.

Also, I prefer living in a unit because of the ease of maintenance. But houses make for better investments.

I was able to claim a tax deduction on all the expenses these investment houses incurred which was very tax efficient. But more importantly, they grew in value at a faster rate than the value of the unit I was living in.

Also, the yield on the houses I owned as investment properties was actually better than the yield my landlord was getting, even though it was a unit.

Not all roses

But rent-vesting isn’t all smiles and roses. Occasionally, as a renter you’ll get a notice to vacate. I’ve only had one in my life at this time. And although it was a nuisance, it was the easiest move I’ve ever had. I found another apartment in the same unit complex, same floor even! Moving was relatively easy. I used a shopping trolley to cart my stuff down the hallway. I didn’t need boxes or a removal van, just some mates to help with big furniture.

There are some other problems with rent-vesting though – you can’t renovate to taste. Not a problem for me, since I have no taste. But you might be a bit more particular about the state of your digs.

Anyway, from a financial angle, rent-vesting has great advantages.

How good is it?

But just how good is it? Well, the difference in growth over the next 5 years between a carefully chosen investment property and the value of the property I’m renting as a tenant, could literally be hundreds of thousands of dollars.

Some markets will be flat while others are booming. I don’t need to live in the booming suburbs, I just need to invest there.

But that period of accelerated growth doesn’t last forever. I’ll offload if I don’t think future growth prospects are as good as I can get elsewhere. It’s easier to sell an investment property than it is to move.

And a good investment location has got nothing to do with where I work or where my family and friends live. I don’t want those things to bias my decision of whether to sell or hold. I’m free to objectively and ruthlessly assess a location based purely on supply and demand.

Conclusion

OK, so, rent money is not dead money. On the contrary, home mortgage money is dead money because it’s unlikely to be the best investment you could own for your money.

If you’re struggling to get into the property market, especially because you’re in pricey spots like Sydney, you can own an investment property elsewhere in the country for half the price. And depending on your timing, you could end up with twice the growth.

Owning your own home is actually holding you back financially.

“Home may be where the heart is, but you should own where the ROI is”