Introduction

I’ve heard a number of professionals in the industry suggest that you can get too much information. And this can cause “analysis paralysis”.

Expert Advice:

- Too much info

- Have courage

What’s worse, these experts suggest you can cure “analysis paralysis” with a good dose of courage.

Firstly, that’s straight up and down bad advice.

Expert Advice:

- Too much info

- Rubbish

- Have courage

- More rubbish

Fear is a natural response to risk. The right information will alleviate that risk and reduce that fear. But not knowing elevates fear.

Secondly, the real problem is in gathering the right info, interpreting it correctly and recognising noise. It’s not about throwing out data, it’s about collecting as much as possible and processing it intelligently.

In this short presentation I’ll show you:

- What to watch out for

- What to look into

Most importantly, I’ll give you some very simple tips you can follow to avoid buying into an investment disaster area, quite often promoted by self-proclaimed experts.

A typical case

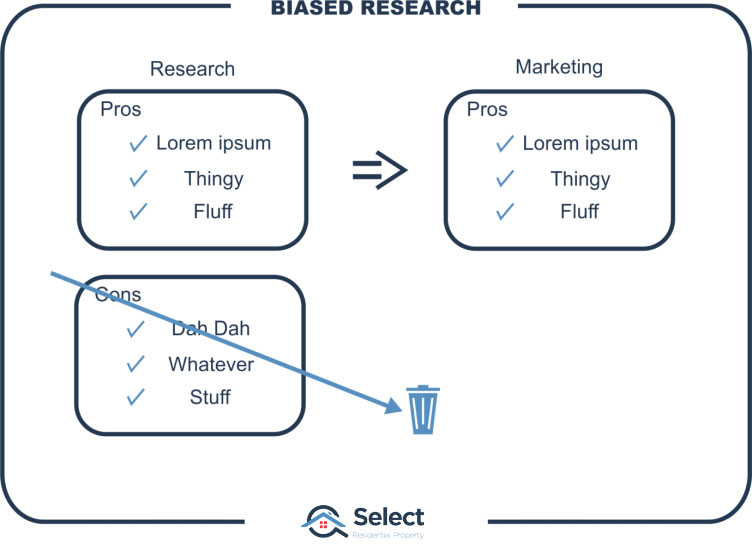

OK, the first thing you need to be aware of is the enormity of property info that is presented as “research”, yet is nothing more than marketing. Quite often it’s a property developer trying to promote a project they’re selling.

They rarely ever cite anything negative about the location. It’s usually heavily biased with only positive info. A balanced view might not get the deal across the line.

So, how do you know what’s legit and what’s sh… sugar … coated unpleasant stuff.

No such thing as information overload

I believe there’s no such thing as information overload. But I will admit there’s a lot of things you can look at. A lot more now days compared to back in 2001 when I first started looking around. And in this information age, it’s only gonna get worse. The good news is you don’t have to absorb all of it.

Although I look at an enormous amount of data now days, I did pretty well in my early investing based on only a handful of key stats and not a lot else. I got into a lot of trouble later on when I started looking at all the wrong things. I still cringe thinking of some of the mistakes I’ve made.

Nearly 2 decades on now, I’ve got a few ideas on what to ignore, what to absorb and how to process it all:

Who you get info from

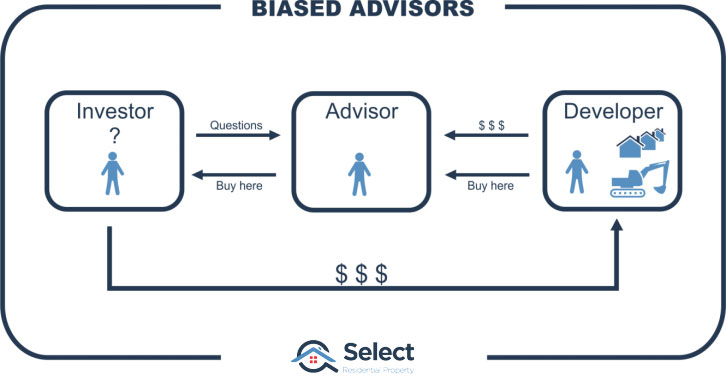

Firstly, who did you get your information from? Don’t trust any source of data that has a vested interest. Big data providers like Core Logic and Price-Finder are fine. The worst offenders would be project marketers and partners of property developers, or even property developers themselves.

And you need to be extra careful here. This group is getting quite cunning.

Some developers disguise themselves as property investment advisors. Or they set up an advisor arm of their development company. Or they may simply partner with a glorified marketing firm that claims to be independent from the developer. But really, they’re in the developer’s hip pocket.

And many come across as the nicest most genuine people you’ve ever met. They truly want to help investors. But they’re completely misguided and biased on what makes for a good investment.

You may think you’ve found an impartial advisor. But if they’re linked financially in any way to a developer, they’re not at all impartial. It can be quite a minefield to negotiate.

Questions to ask your advisor

Start off by asking how your professional gets paid and whether they’re associated with developers in any way.

- How do you get paid?

- Do you partner with property developers?

There are ways in which a business can be structured so it isn’t clear who their real client is. It might not be you. You don’t want your advisor to be paid a commission from a developer or have a shareholding in a development or construction company or get paid to market developer projects or get discounts for bulk-buying from developers or any other kind of cunning kick-back.

- Commission

- Kickback

- Marketing fee

- Shareholding

Commissions paid by developers are so large, businesses can easily afford to put on free webinars and workshops. If it’s free, there could be a bad reason behind it.

How you filter it

Secondly, it comes down to how you filter through all the data. You need to know what to ignore and what to focus on.

“Ignore info that has little to do with supply or demand of property”

Those two aspects alone, supply & demand, will dictate price movement. The more closely your data reflects supply or demand, the more closely you will be examining those two aspects and the more likely you’ll make a good decision.

I’ve seen one case where a project marketer for a developer mentioned that a celebrity likes to go swimming nearby. That’s gossip, not research at all. Hardly a growth driver anyway… well, unless your tenants are the paparazzi!

Some of you may think I’m being a bit tough on developers. But their marketing is so dodgy. And one of the biggest mistakes an investor can make is to buy a new property. They tragically underperform older properties. If you don’t believe me, you have to see this presentation:

Buy new properties not old – WRONG!

It provides comprehensive proof that there simply is no debate about new vs. old. Do not buy new. Just don’t do it.

How you interpret it

How you interpret data is really important. Not knowing the relevance that a particular statistic has to supply & demand can make a really big difference.

Population growth, for example, is a commonly misunderstood topic. It’s frequently interpreted completely the wrong way around. I won’t go into the details now. But if you haven’t seen it yet, check out this topic:

Avoid high population growth suburbs

Another arse-about-face interpretation I see all the time is analysis of past historical growth. Many noobs get this one wrong. There’s a topic that covers that nonsense here:

High property growth history is a red flag

Infrastructure projects can be misleading too. Many of them are way over-hyped. They rarely deliver the kind of growth you’d think. For that one, check out this topic:

Infrastructure research is over-rated

There are loads of simple mistakes that investors and even professionals make. But there’s nothing stopping anyone from learning and getting better.

Avoiding disaster

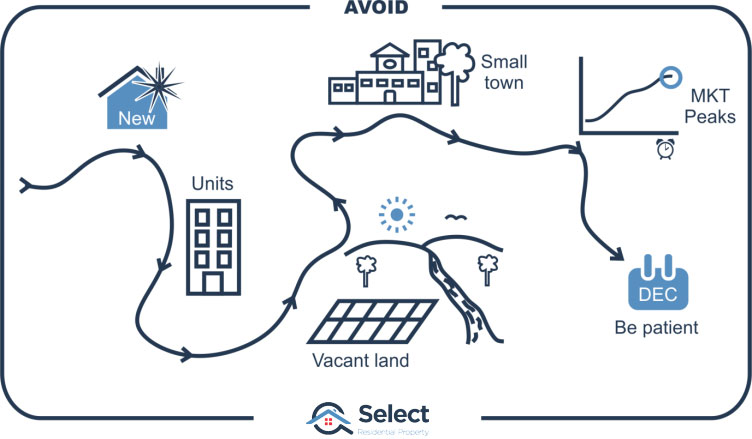

And avoiding a disaster is actually quite easy. It’s a lot harder to get stunning results, but avoiding a tragedy is really quite easy. All you have to do is avoid:

- New

- Units

- Houses near vacant land

- Small towns

- Buying at market peaks

And then be patient.

Don’t buy new

New property underperforms old, and in a major way. There’s no debate, no argument. If you haven’t seen it, be sure to check out that topic I mentioned earlier:

Don’t buy units

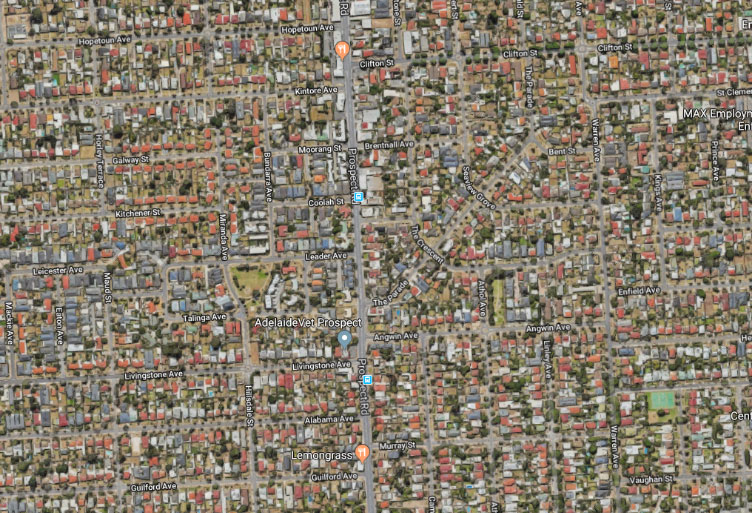

It’s simply too easy for more units to flood the market.

Houses next door can be knocked down and units can go up. Houses across the road can be replaced. Down the street, Around the corner. One block away. Houses can easily be replaced with units creating over-supply.

Instead, buy houses in already built up areas where it’s impossible for new houses to flood the market creating extra supply.

Avoid vacant land

Avoid fringe suburbs next to loads of vacant land that can be developed in the future.

Remember that…

“Supply is the enemy of investors”

You want to avoid markets in which fresh supply can be easily provided adding to the number of existing similar dwellings.

Avoid small towns

You might like to even avoid small cities that might be dependent on only one or two industries, like mining or tourism. Safer options are within the major state capitals with fully diversified economies.

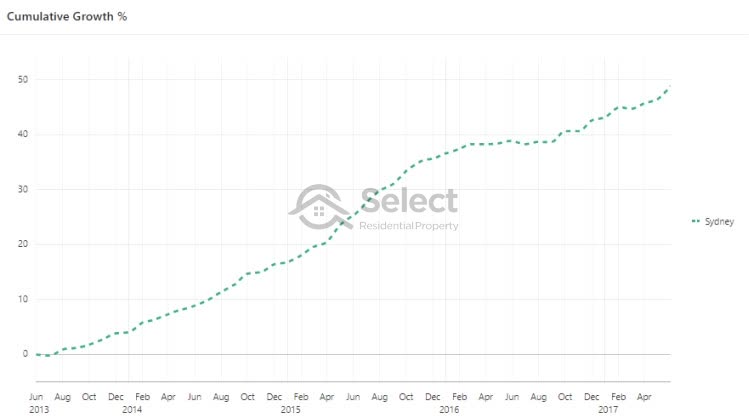

Don’t buy at the peak

Get a growth chart for the last 3 years.

See if the wider market you’re targeting has already had above average growth recently.

And lastly, be patient.

This list of “avoids” won’t get you great growth. It will simply help you avoid disasters. But you may need to wait 10 years or so to get a good cycle of growth, especially if you didn’t time your entry. So, be patient.

Follow that list and you should avoid the disasters. To get ahead and achieve super performance, well that’s a whole new topic. It’s a lot trickier. But for now, you can eliminate your fear relatively easily by simply avoiding these things.

Fear is good

Fear is a natural consequence of not knowing enough about what the future holds. I don’t see it as a negative for investors. It’s a healthy warning signal.

“Confidence comes from having past successes”

But if you’re a new investor, then of course you’re not going to feel confident. Rather than just dive in the deep end, make sure you know enough to be confident. Don’t trust anyone. There are a lot of well-meaning investment professionals who simply don’t know what they’re doing. Your best defence is to:

“Invest in your education before you invest in property”

Then keep looking for more data, the right data. There’ll be a point when you’ve acquired enough knowledge to know what to look for. Then you’ll start feeling more confident you’re making an informed decision.

If you’re still in two minds, a good rule of thumb is…

“When in doubt, chuck it out”

Confidence is bad

Now, on the other side of the coin, there are some people who have a bit too much confidence or are too trusting. Getting excited at the first location you look at, is a sure sign of dangerous over-confidence. Finding what you think is a great property the first weekend you go hunting is another clear indicator you don’t have a balanced view.

“The opportunity of a life-time comes around pretty much every weekend”

If you’re one of these people, you need a healthy sceptic or naysayer in your life. You might need someone negative you can consult to provide a healthy balance. Do enough research to allay their fears.

Conclusion

Property investment dollars are big dollars. It can ruin your financial future if you don’t get it right. Keep hunting down more information to either confirm or deny your initial thoughts. Eventually, you’ll settle on something.

For the vast majority of suburbs and properties that you research, your response is bound to be, “meh”. In which case, move on. There are thousands of suburbs to choose from. And yes, it can be hard work – financial independence is. I hope this presentation has helped.