Introduction

There are a lot of professionals in the industry who interpret data poorly. Unfortunately, some have high profiles and propagate a fair bit of mistruth. One of these is with respect to demographics. In this presentation I’ll explain why a unit may be a better choice than a house in a suburb full of families.

Which property type to choose

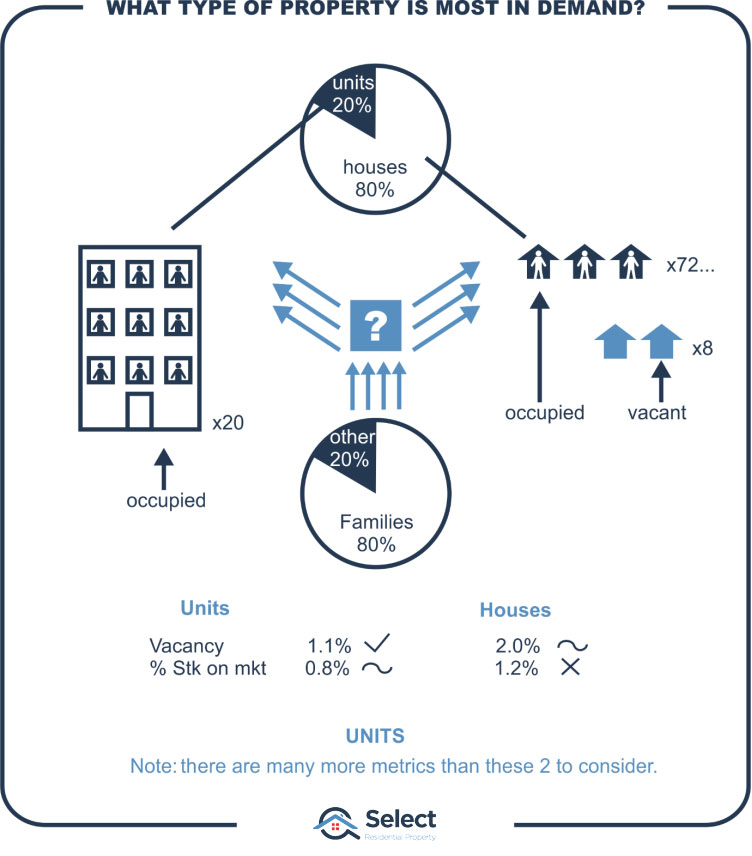

Let’s say you do some research for a certain suburb and you discover that 80% of properties in the suburb are houses. Almost every self-proclaimed expert will tell you, “The demand in this market is obviously for houses. Why would you buy a unit in this market?”

The thing is, that data, 80% houses, doesn’t tell you what you really need to know to find good capital growth properties. It’s borderline useless. But a lot of experts seem to place tremendous importance on it.

Supply & Demand

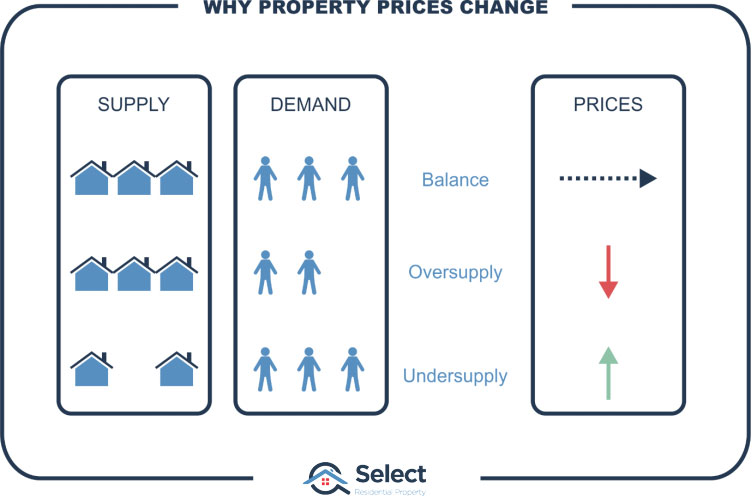

First of all, you need to remember that supply & demand dictate price growth.

If supply and demand for property are in balance, prices don’t change. When supply outweighs demand, prices should fall. But if demand exceeds supply, prices should rise.

What does 80% houses tell you?

Now what does 80% houses and 20% units tell you? The experts will confidently claim it’s telling you about demand. They’ll say the majority of buyers are demanding houses. WRONG!

If 80% of the properties built in the suburb to date have been houses, does that really represent demand? 80% of the properties built in that suburb were houses. In other words, 80% of dwellings developed in that suburb were houses. Or looking at it in a supply and demand context, 80% of properties supplied to that suburb were houses.

What gets built is supply, not demand.

“Supply is the enemy of capital growth”

Don’t interpret supply as demand or you’ll end up in a world of hurt.

Now there’s a very good chance that before deciding to build anything, developers did some research to guess what would be in demand. And for relatively new properties, that might still hold true today. But what if the houses were built 10, 20 or 30 years ago? What if the demographics have changed?

“Demand for a certain type of property can’t be determined by the proportion of that property type in a suburb”

The proportion of houses to units reflects what has been supplied, not what is in demand.

What if there are empty houses?

Imagine a suburb with 100 properties and 80 of them are houses and 20 of them are units. And imagine that 8 of those 80 houses are currently vacant while the remaining 72 are occupied. Let’s also assume that all of the 20 units are occupied.

Now what if only 90% of those houses are occupied and the remaining 10% are vacant or up for sale? Are you sure there’s still strong demand for houses?

And what if units in the same suburb have zero vacancies and zero are for sale? It’s sounding a little different now isn’t it.

What we really need to know

This demographic data merely tells us how many houses there are in proportion to units. It doesn’t really argue a case for demand exceeding supply.

“What we really need to know is what properties are in demand but not supplied”

Families

OK, let’s assume we did a little more demographic research on this suburb and we found out that 80% of the residents are families with 2.3 kids. Now it’s starting to sound a little more like the houses are fully occupied. 80% of properties are houses and 80% of occupants are families. That suggests that demand matches supply one-for-one.

Now does it sound like we can buy a house? Well, maybe. But we still don’t know for sure. We don’t know the break-down of families to dwellings. It’s possible that due to affordability, some families occupied units.

Also, keep in mind that if the remaining 20% of residents that aren’t families occupy the remaining 20% of properties, which are units, then the demand for units looks just as strong as the demand for houses – it’s still one-for-one.

And lastly, even if every house was occupied, it doesn’t mean there is demand for houses. Offer one of those residents a house to live in and they might say, “Thanks but we’ve already got one. We bought it or rented it 2 years ago. We’re quite happy here thanks.”

Now, it’s not illogical to assume that if some people want to live there, others will too. But you can’t gauge how badly others want to live there by the number or proportion of those that currently do.

So again, this demographic data served little purpose because it hasn’t told us about supply & demand.

What data then?

Ok, what data are we looking for to argue the case for houses being more in demand? Well, how about 80% of residents are families with 2.3 kids and only 40% of dwellings are houses. That to me sounds like lots of families are forced into units when they might prefer a house, but houses are undersupplied. It’s a good hint but still inconclusive.

A better metric is comparing the vacancy rates for both houses and units in the same suburb. And similarly, comparing the percentage of property currently available for sale for both houses and units.

There are plenty more metrics than these that are much more useful than demographics.

And to back-up those stats, you could call a local agent and ask them what kind of properties are most in demand from buyers and renters. That will give you more valuable direction than misinterpreting these demographics.

Conclusion

The lessons are:

- Don’t blindly swallow what experts are spewing out

- Think for yourself and challenge what they say

- Be careful how you interpret property data

- And don’t rely on only a handful of metrics, you need a broad view

I hope this presentation opened your eyes to some of the nonsense being spread about. For another example of misinterpreting metrics, check out this presentation: