Introduction

Every few years I hear a bit of commentary amongst property investment professionals about “adapting to the new phase in the cycle. Everything is different now, you need to be prepared. You need to adapt to the new market dynamics. What worked in the past won’t work now”, statements along those lines.

I label it as marketing B.S. In my opinion it’s simply aimed at getting investors’ attention. I don’t believe there has been any change to the fundamental principle of property investing and I doubt it will ever change.

Circumstances change

There is no need to change to a new strategy in this “phase of the market cycle”.

“An investor’s strategy should change based on their personal circumstances, not on any market cycle nonsense”

If you’re young, you need growth in your assets. If you’re entering retirement or hamstrung by tight cash-flow, you need positively geared properties. Changes in your personal circumstances lead to changes in your strategy, but it’s not changes in the market that trigger changes in your strategy.

If the market you’re currently invested in is showing poor signs of growth, then it might be worth your while selling or at least refinancing to buy elsewhere.

“You don’t have to accept periods of no growth”

But it’s still the same strategy as always: sell if it makes sense.

Why they say it

Why is it then that some experts suggest we need to adapt to a new phase in the market? Well, here’s my best guess.

Imagine there’s an investment professional that only operates in a certain patch, a particular area of a city. And imagine that patch has gone through a change recently; perhaps the latest growth surge has come to an end.

Rather than put their clients in the next growth location, which might be somewhere else in Australia, outside their patch, they put their new clients into the same area and simply manage their clients’ expectations for growth.

Developers’ bitches

Doesn’t sound so good for the investor does it? But it could be worse. There are some investment advisors that don’t even work for investors. They make it look like they do. But really, their true client is the property developer for which they’re doing project marketing

They may earn a commission or some other kind of “kick-back” from the developer for each property they sell from the developer’s stock list.

By the way, there are loads of other cunning means by which they can receive a kick-back other than via a commission. So, asking if they earn a commission from a developer is not enough. You have to ask if there’s any incentive for them to offer the developer’s stock as opposed to any other property in the country. Some project marketing firms are actually set up by the developer to appear independent. And they classify themselves as property investment advisors. So, watch out.

If the location of the developer’s project is obviously not in the best growth location, then they’ll try to suggest that now is the time to “adapt” your strategy – a.k.a. expect no growth.

Keep in mind that supply is the enemy of capital growth. So, any development project supplying new stock to the market isn’t likely to be a good thing for growth in that area anyway.

If you have the slightest inkling of interest in new or off-the-plan properties, please before you sign anything, check out this topic in the series on why you shouldn’t buy new:

Sydney, Perth & Hobart

Back to the main point: you don’t need to adapt to different stages in the property cycle. There’s more than one property market across Australia. All you need to do is change the focus of where you’re investing.

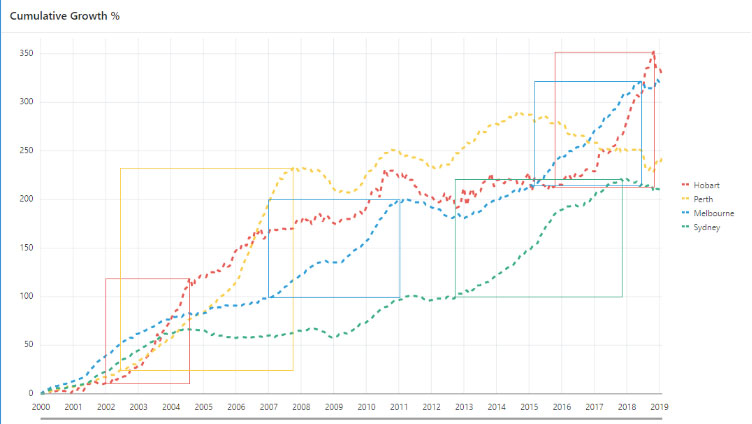

This chart shows that for the last 20 years, there have been opportunities in all but about 3 years. And this is looking at only 4 cities. The chart gets too busy if we include a few more of the popular ones like Brisbane, Adelaide and Canberra. And there are a dozen more regional markets too.

You’ll notice that there are some periods when investors were spoilt for choice. Have a look at the right side of the chart for example. In late 2012 Sydney property prices started booming. Perth was also having some good growth. In 2015, the Sydney boom was still in full flight, but the Perth market started to decline. In the meantime Melbourne had started its boom. Shortly after Sydney started to fade, Hobart started to boom.

And this is just looking at city averages. There are even more extreme cases when you consider individual suburbs within a city. Even when Sydney was fading across 2017, there were still some suburbs outperforming the averages. When Melbourne was coming to the end of its strong run, there were still some suburbs having double-digit growth.

We have tremendous diversity in economies across this country and tremendous diversity in suburbs across cities. What this means is that…

“It is extremely difficult to find a point in our history where there wasn’t a single suburb booming”

Summary

So, if your strategy is to pursue growth, then pursue it anywhere around the country. There’s bound to be a market at the start of its boom phase somewhere. It’s so much easier now days to research suburbs interstate. Lift your sights over the state horizon and jump online to gather all the relevant data. It’s not that hard. The chances are very slim that a hot market is only a short drive from the office of the “expert” trying to get your business.

Have a healthy level of scepticism for anyone trying to sell you anything in property.