Introduction

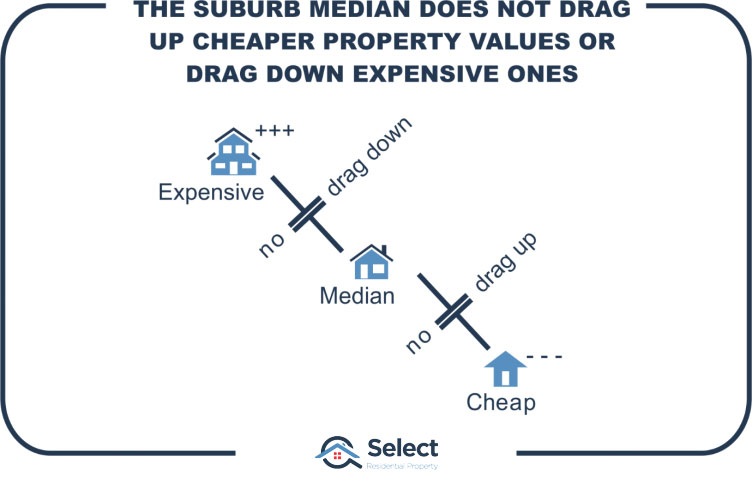

Many property “experts” say you should aim to buy under median value. Their theory is, there will be more properties “dragging up” your property’s value. They say you should have your property compared with more expensive properties, not with cheaper properties. That’s why they advise you to buy under the median. But:

“The median has nothing to do with the valuation of any property”

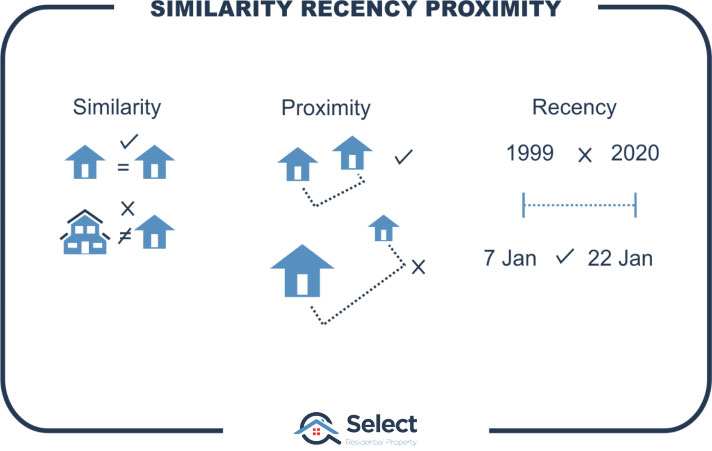

It doesn’t matter what the median for the suburb is. Valuers will compare a property to: nearby properties; that have similar features; that sold recently.

The only thing that will drag the value of a property up is recent sales of similar properties in the vicinity for higher prices.

Aim for cheaper suburbs

There is however an argument for choosing to buy in cheaper suburbs rather than more expensive ones. But that deserves its own topic. See the topic titled:

Expensive markets fall more than cheapies

Valuations

A professional valuer, hired by banks to value a property, will estimate value based on three things.

Professional valuers look at properties nearby. They look for similar ones. And they look for ones that sold recently. Industry professionals call it a Comparable Market Analysis (CMA).

A valuer will ignore a property if it didn’t sell recently. They’ll also ignore a property if it is too far away. And a valuer will definitely ignore a property if it is nothing like the property being valued.

Every property is valued on its merits on an individual case by case basis. If a valuation is less than the median, it’s for good reason. If a property is valued above the median, it’s for good reason. The median doesn’t drag anything up or down.

A valuation will be higher if the property has something special. Maybe it is on a larger block. Perhaps the property is in a quiet street. It might be a beautiful double storey house while other properties in the area are single storey.

A house will be valued at a lower price if it has only 3 bedrooms while other houses have 4, or if it is in bad shape or is on a small block for example.

Buyers don’t go into a suburb expecting to pay the median for any property that is for sale. They expect to pay based on features and condition.

“It is impossible for the median to “drag” values up”

Set up for failure

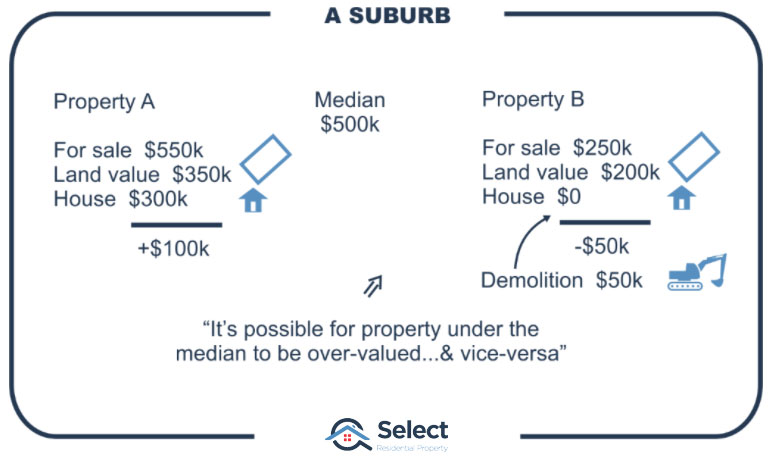

Buying below the median is not intelligent advice. In fact, this is the kind of advice that could set an investor up for failure. They’ll see a property below the median and start thinking its good value for money. But it could be the complete opposite.

There could be all sorts of reasons why a property is under the median. The median itself could be a complete misrepresentation of the typical value of properties in the suburb. Medians are terribly misleading sometimes.

But what each investor is thinking when they hear this advice is that you should seek out cheapies because they’re good value for money. That’s the start of an investment tragedy.

The property could be on a tiny block of land in a new estate on the fringe of suburbia surrounded by loads of developable land. It could be a recipe for over-supply for decades. But if it looks cheap, it could be seen as appealing for investors. Cheap does not mean good value.

If you saw a property for sale in a suburb with a median of $500,000 and this property is listed for sale at $250,000, you might think, “Wow, it’s half the median – half!” But that property could have land value of $200,000 and nothing else. It might cost you $50k to knock it down and remove the asbestos. If you paid $250k for it, you’d be losing $100k – a terrible deal, but half the median.

It’s completely feasible for a property under the median to be over-valued and for a property over the median to be under-valued. Good advice would be to learn how to accurately value properties, not to blindly aim for under the median.

Watch out

The “experts” you don’t need to worry about, are the ones that are barely smart enough to know how to breathe. The ones you’ve got to be wary of are the ones that are dastardly smart. Like those organisations that pretend to have investors’ best interest at heart, but really, they’re just cleverly disguised property developers and project marketers trying to flog off stock.

BTW, as a general rule, don’t buy new. New under-performs established or old property. If you want to learn more about new versus old: firstly, don’t listen to the advice of a property developer. Obviously, it will be biased.

I have nothing to gain whether you buy new or old. But they have everything to lose if you buy old. So, my advice is not biased by financial gain. Let the data educate you about new vs old, check out these other presentations in the same series:

Conclusion

Whether you buy above or below the median has nothing to do with your property’s performance either in the long-term or short-term. What matters is whether there is high demand for your property and low supply of similar properties in the same area.

Don’t blindly swallow the BS from the project marketers. Anyone remotely related to a developer is unlikely to be your confidant. More likely they’re your worst enemy. Happy investing!

I’ve got a couple of other presentations on similar topics you might be interested in. Check these out: